Bank Of Korea Holds Rates Steady, But Hints At October Cut

Image Source: Pixabay

The BoK seeks clearer evidence of easing in housing prices

The Bank of Korea left rates unchanged, taking a wait-and-see approach as near-term growth improved amid supportive fiscal policy and reduced tariff-related uncertainties. While there has been a moderation in housing prices and household debt, the BoK noted concerns that housing prices still remain elevated.

The majority of board members agreed to continue monitoring trends in the housing market and watch the yield gap with the US while holding rates today. However, one dissenting member argued that household debt growth has stabilised meaningfully and that the likelihood of a Federal Reserve rate cut in September has increased. Thus, he argued that a preemptive rate cut could support further growth. Three-month forward guidance also pivoted toward a more dovish stance, with five out of six members open to a rate cut.

Quarterly macro-outlook

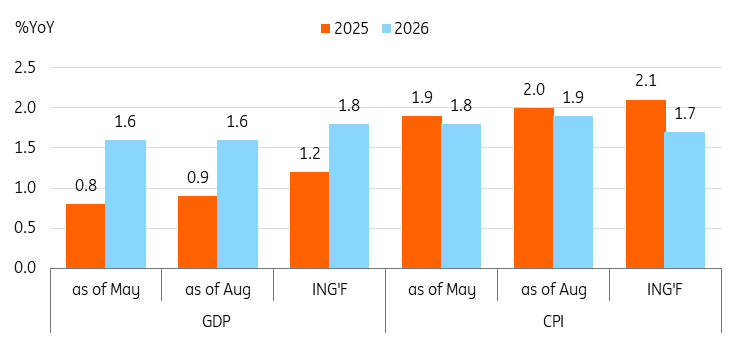

The BoK raised its 2025 GDP growth forecast to 0.9% year on year (from 0.8%), while maintaining the 2026 projection at 1.6%. The inflation outlook for 2025 and 2026 was adjusted upward to 2.0% (from 1.8%) and 1.9% (from 1.8%), respectively.

The BoK expects a recovery in private consumption, but notes that tariffs may negatively affect exports with a delay. Also, construction conditions turned out to be weaker than expected, weighing on overall growth in the second half. This led to a cautious stance on short-term growth. For 2026, the BoK suggests that impact of fiscal policy may turn negative, though the government’s budget plan hasn’t yet been released. However, growth is expected to reach near-potential levels by the end of 2026, amid a continued recovery in private consumption.

BoK revised up its GDP outlook for 2025 only marginally so

Source: CEIC

BoK watch

Inflation below 2% and a cautious growth outlook should support further easing measures. We continue to expect a 25 bp cut in October, followed by another in the third quarter of 2026. The timing of rate cuts in 2026 could move to the first half if the Fed eases faster or financial stability improves more than expected.

More By This Author:

Rates Spark: The Lisa Cook Affair And The CurveRates Spark: Eurozone Bond Spreads Face A Jittery Autumn

Rates Spark: The Bottoming Out Of The 2Y Bund

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more