Bank Of Japan Surprises The Market With Yield Curve Control Tweak

The Bank of Japan in Tokyo

The BoJ surprised the market with YCC adjustment

Stronger-than-expected inflationary pressure has finally moved the BoJ to tweak its YCC policy, and financial markets seem busy digesting the news. We argued that the BoJ could shorten its target yield from the 10Y to 5Y tenor at this meeting, but the BoJ decided to keep the official cap of the 10Y JGB at 0.5%, while allowing more flexibility with the new, so-called strict cap, and raise the trading band to +/- 1.0%. What a confusing statement! They could have simply changed the upper limit of the 10Y JGB from 0.5% to 1.0%.

Conducting YCC with greater flexibilty

Bank of Japan

Honne vs Tatemae

Our interpretation is this. We believe that the BoJ was forced to alter its YCC policy in light of higher-than-expected inflation and market pressures but at the same time, the BoJ also needs to manage market expectations for future monetary policy changes and avoid a sudden hike in market rates. So, by keeping the 10Y limit at 0.5%, the BoJ seems to want to be considered as dovish as possible.

The BoJ would also probably like to see how the market reacts to the change and how far the 10Y JGB can go. The market really can test 1.0% or settle somewhere between 0.5%/1.0%. Today’s decision can also help anchor 20Y and 30Y so that they don't float too much. The BoJ is concerned that rising market rates could hurt the investment recovery and overall growth.

Inflation outlook revised up only for FY2023

The BoJ released its latest quarterly macro-outlook report and upgraded its overall assessment of the economy. More meaningfully, the BoJ revised up its core inflation outlook for FY 2023 from 2.5 to 3.2% but kept the outlook for FY 2024 and FY 2025 at 1.7% and 1.8%, respectively. Again, it is also a sign that the BoJ appears to be buying time until it is confident of achieving its sustainable inflation target.

Actually, we have seen this kind of tactic in April when the BoJ removed its forward guidance from its statement. To prevent the market from getting too far ahead, the Bank of Japan simultaneously proposed a policy review that would take more than a year.

Net-net a small yen positive

USD/JPY has seen a wild ride on today's BoJ communication. An initial 1% spike on the BoJ seemingly keeping the YCC unchanged - the 10-year JGB yield target is still 0% with a +/- 0.5% band - but then selling off 2% to 138.00 when the market realised that today's adjustments of 'greater flexibility and 'nimble' purchasing effectively raised the hard cap in the 10-year JGB yield to 1.00%. In terms of the JGB market, we have seen 10-year JGB yields rise - just 11bp - to 0.55% - with the 10-year tenor hit harder than the 30yr (+7bp) and 5-year (+4bp). For reference, the JGB forward market has not got overly excited. 10-year JGB yields are priced at 0.60% in three months, 0.64% in six months and are not priced above 1.00% until three years' time.

We would have probably seen bigger market moves if the CPI forecasts had been raised substantially. As it is, the FY24 and FY25 forecasts remain below 2.00% and in effect justify ongoing easing from the Bank of Japan. This suggests today's YCC adjustment could have been more technical in nature. However, the market is now going to have to take on board the greater flexibility in the BoJ's policy-making - raising expectations of some follow-up move at the 31 October meeting when new CPI forecasts are released.

We are bearish on USD/JPY in the second half - though largely on the back of the dollar story. Based on today's developments we see no reason to change our forecasts for 135 and 130 for the end of September and end of December, respectively.

Tokyo inflation suggests the nation's core inflation hasn't peaked yet

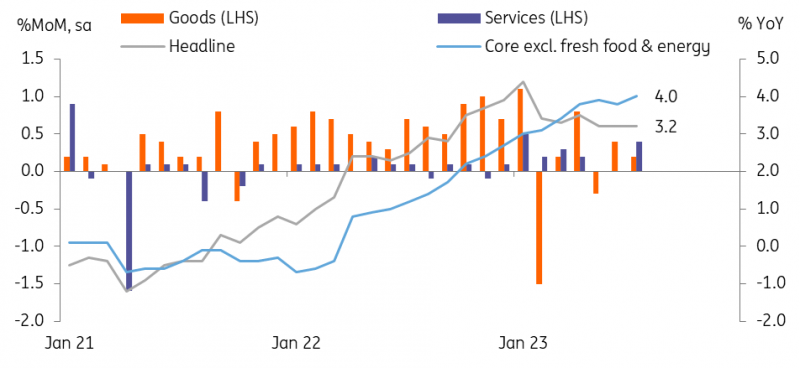

Headline inflation stayed at 3.2% year-on-year in July for three consecutive months (vs 2.9% market consensus), while more surprisingly, core inflation, excluding fresh food and energy, reaccelerated to 4.0% (vs 3.8% in June and 3.7% market consensus), the highest level since April 1982. Inflationary pressure is broadening with the exception of a drop in utility prices (-10.8%) on the back of the energy subsidy programme. Monthly growth also advanced 0.3% month-on-month (seasonally-adjusted) in July (vs 0.2% in June) with both goods and services prices up by 0.2% and 0.4%, respectively. Going forward, headline inflation is expected to slow mainly due to falling global commodity prices and base effects, but core inflation will likely remain high for a considerable time.

Core inflation reaccelerated to 4.0% in July

(Click on image to enlarge)

CEIC

More By This Author:

Eurozone Economic Sentiment Indicator Confirms Weak Start To Third Quarter

FX Daily: Diverging G3 Trends Dominate

Goldilocks GDP Feeds The US Soft Landing Narrative

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more