Bank Of England To Use June Meeting To Lay The Ground For A Summer Rate Cut

Image Source: Pexels

Six things to watch out for at the Bank of England’s June meeting.

Will the Bank of England cut rates on Thursday?

Markets overwhelmingly think the answer to this question is no. The swaps curve is pricing barely a 5% chance of a rate cut. Much of that is down to the latest inflation data, but clearly the timing of the 4 July election is a factor, too. Investors reckon the Bank is highly unlikely to cut interest rates in an election campaign.

We wouldn’t be so sure of that. We don’t expect a rate cut, but markets are under-pricing the chances. The good news for the Bank is that the issue of rate cuts has avoided becoming politicised in a way that it might do in the US presidential election campaign later this year, even if other areas of BoE policy (related to reserve remuneration) are coming under scrutiny.

Our takeaway from the last meeting in May was that June’s decision would be on a knife-edge, and that calculation probably hasn’t changed as much as markets might think. Governor Andrew Bailey, we felt, sounded like he would have voted for a rate cut in May had his committee been more on board with it. Still, our base case is a pause this month.

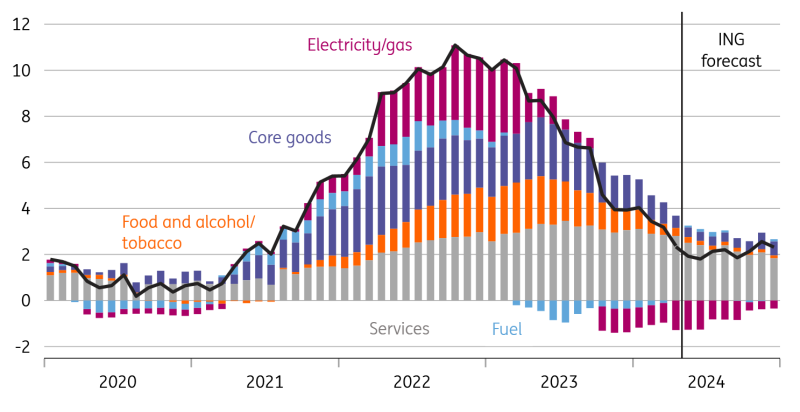

What will the Bank have to say on the latest services inflation data?

The BoE, much like the European Central Bank, has been telling us that it is becoming more confident in its forecasting ability. Governor Bailey has cheered the fact that inflation surprises have been much more minimal over recent months. That view took a bit of a hit when April’s services inflation – overwhelmingly what is driving policy decisions right now – came in almost half a percentage point above the Bank’s May forecast.

Our view is that this is likely to have been a one-off. We saw something very similar in April last year, where one-off annual price hikes across the sector – most notably in rents – drove services inflation well above forecasts. It was enough to convince many investors that the UK had a much worse inflation problem than elsewhere. Ultimately that wasn’t the case, and we think it would be a mistake to reach the same conclusion again now. It’s going to be interesting to see if the BoE agrees on Thursday.

Fortunately for the Bank, the data available for May and June is likely to be more predictable. On top of that, we think services inflation will be close to a percentage point lower in June’s data available ahead of August’s policy meeting.

Contributions to UK headline inflation (YoY%)

Macrobond, ING calculations

Will more committee members vote for a rate cut?

We reckon we’ll see two of the nine committee members voting for a rate cut on Thursday, which would be a mirror image of May’s decision. That may be hard to square against the idea that the committee is very close to cutting rates. But the key thing to remember is that the five internal committee members, who hold the key to the first cut, tend to move as a pack.

When Deputy Governor Dave Ramsden voted for a rate cut last month, that was just the sixth time an internal committee member has voted against the majority since the start of the rate hike cycle in 2021 – that’s out of a total of 105 individual member votes.

In other words, we could easily get another 7-2 vote in favour of keeping rates on hold this month, only to see a sizable majority swing behind a rate cut in August. That would be entirely consistent with history.

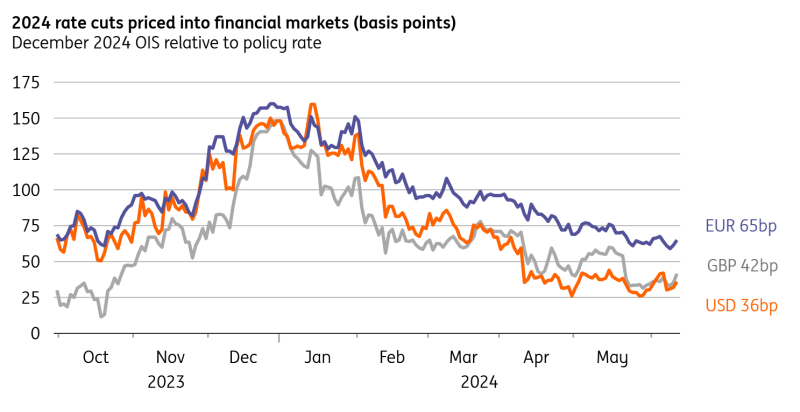

Will the Bank push back harder against market pricing?

The BoE is usually more reluctant than other central banks to pre-commit. Intriguingly though, Governor Bailey said in May’s press conference that it could cut rates “possibly more so than currently priced in market rates”. That statement was heavily caveated, but it sounded like a rare and deliberate signal from the BoE to investors.

There won’t be another press conference after Thursday’s meeting, and the Bank’s ability to communicate outside of the post-meeting statement is curtailed by rules surrounding the forthcoming election.

But watch out for any changes in the forward guidance. The Bank has for several months said that rates need to stay restrictive for “an extended period”. Policymakers have made it clear that this statement can still be true after the first few rate cuts. But words matter and we think the Bank might want to at least water down that sentence ahead of the first rate cut. Doing so next week would be a clear sign that an August rate cut is more likely than markets are pricing (currently 50%).

With the latest US data coming in more favourable for Fed cuts, market expectations for an August BoE rate cut should be lifted. Over the past couple of months global yields have in large part been driven by Fed cut expectations, which were consistently pushed back following hot inflation numbers. We still need more good US inflation numbers to comfort markets that a cut is incoming, but the momentum is now heading in the right direction.

We’ll also be watching for statements in the days following the UK election, when officials are again allowed to make public comments. If an August rate cut is indeed likely, and that’s our base case, then we suspect the likes of Governor Bailey and others might want to steer investors in that direction.

How 2024 rate cut expectations have changed

Macrobond, ING calculations

Will the BoE address the observed pressure in money markets?

Liquidity conditions seem to have tightened significantly since May. We see that the funding costs of banks have been on the rise and use of the Short Term Repo facility of the BoE is increasing rapidly. As the Bank is unwinding its bond portfolio, liquidity conditions are expected to tighten, but the tightening seems to be happening a lot earlier and faster than previously anticipated. With the BoE intending to review the trajectory of quantitative tightening in September we’ll be listening to whether the Bank is concerned about these recent developments and whether this can affect September’s decision.

What about sterling?

Trade-weighted sterling has recently risen to levels last seen in July 2016, when the Brexit tsunami hit. Relatively high yields within the G10 space have helped sterling this year, but most recently lifting the pound has been the travails of the euro – which has a 41% weight in the trade-weighted index.

It looks like a difficult month for the euro – what with France potentially being placed under the Excessive Deficit Procedure on 19 June – and then potentially electing a more right-wing government early next month set on a collision course with Brussels.

Yet our call is that the repricing of the BoE cycle will be the dominant theme for sterling this summer. The combination of softer UK May CPI released on 19 June and then a more dovish MPC statement should be enough to drive EUR/GBP back above 0.8500. Equally, we see downside risks to GBP/USD in a 1.2600-1.2900 range.

More By This Author:

Poland’s CPI inflation trends higher in May amid strong services price growthThe Bank Of Japan Maintains Its Policy Rate Settings And JGB Purchases

FX Daily: French Political Risk Takes Its Toll On The Euro

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more