Bank Of England Survey Bolsters Calls For 2024 Rate Cuts

Image Source: Pexels

The Bank of England is reluctant to endorse the notion of 2024 rate cuts. But its latest survey of CFOs suggests that inflationary pressures continue to ease. We expect easing to begin from the summer, albeit perhaps more gradually than markets currently expect

Financial markets are near-enough pricing six rate cuts from the Bank of England this year. Policymakers are highly reticent to endorse that, though the latest data from the Bank’s own Decision Maker Panel survey indicates that investors are right to be thinking about a series of cuts this year. The survey of Chief Financial Officers (CFOs) continues to suggest that inflationary pressures are easing noticeably.

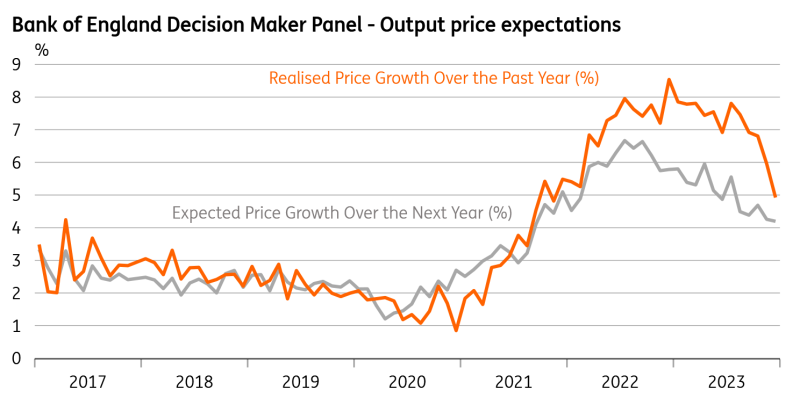

Expected price growth among corporates has slipped further to 4.2%, down from a high of almost 7% in mid-2022. BoE hawks would – and have – argued that firms have been consistently revising down expected price growth but up until now, this hasn’t translated into less aggressive actual price growth. In other words, firms have been saying one thing and doing another. But that seems to be changing – “realized” price growth among corporates is starting to fall rapidly. The latest reading of 5.9% is down from 7.5% in August.

Expected vs. realized price growth

Another way of looking at this, CPI expectations among corporates have also continued to fall in line with actual inflation.

So far, so good. But the issue for the BoE is that wage growth is proving stickier. Expected wage growth over the next year has stabilized above 5% and realized is still up at 7%. Both have been roughly stable for the best part of nine months now.

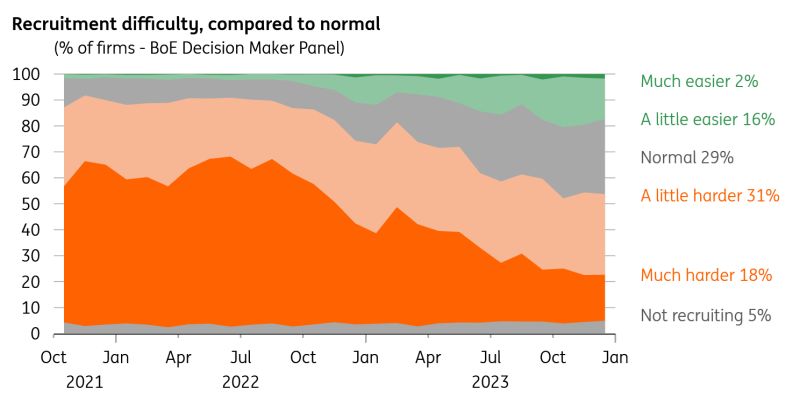

That does at least suggest that the official data on private-sector wage growth can continue to fall gradually from its current 7.3% level. And with vacancies falling quickly, and hiring difficulties having eased considerably since 2022, we think this measure of pay growth can reach the 4-5% area by summer.

Recruitment difficulties are easing, according to the BoE survey

But for the time being, wage growth is still too high for the BoE’s liking. We also think services inflation will remain sticky around 6% for the next two to three months, before falling more noticeably by the summer.

Markets are pricing the first rate cut from the Bank of England in May, which feels a bit early. We also think when rate cuts do begin – potentially in August – they will be a little more gradual than markets are currently pricing. We expect 100 basis points of cuts this year, though much depends on how quickly services inflation and wage growth turn a corner.

More By This Author:

FX Daily: Mixed Fed Minutes Leave Dollar Momentum IntactAsia Morning Bites For Thrusday, January 4

The Commodities Feed: The Middle East Tensions Grow

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more