Bank Of Canada Preview: Stretching The ‘Hawkish Hold’ Approach

Slower-than-expected inflation, a clouded growth outlook and higher bond yields mean the BoC is likely to overlook jobs tightness and keep rates on hold on 25 October. There is still all the interest in keeping a higher-for-longer narrative alive, but markets may start to shed some doubts on it. A sustainable decline in USD/CAD looks like a 2024 story to us.

Chance of a hike have dwindled on slower inflation

Market expectations for the upcoming Bank of Canada policy meeting have fluctuated quite a lot since the last policy meeting on 6 September when it left rates on hold at 5%. Back then the BoC signalled it was “prepared to increase the policy interest rate further if needed” and the market was anticipating a 60% chance of a 25bp rate hike at the 25 October meeting in the wake of much hotter-than-expected August inflation and strong jobs numbers.

However, since then the data has been moving in the opposite direction and after the September inflation readings the probability of a hike next week has crashed back down to 17%. This week, September CPI figures showed a faster-than-expected slowdown in all measures of inflation: the core rate came in at 3.8%, the BoC’s preferred 3-month average core rate fell from 4.3% to 3.7%.

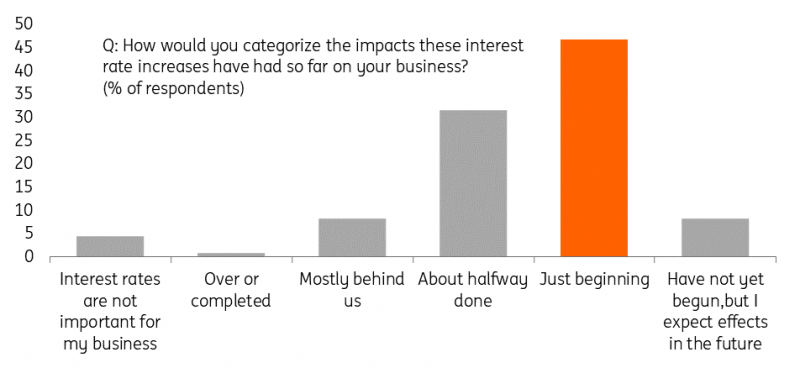

Canadian firms expecting more impact from higher rates

(Click on image to enlarge)

Bank of Canada, ING

Growth concerns persist

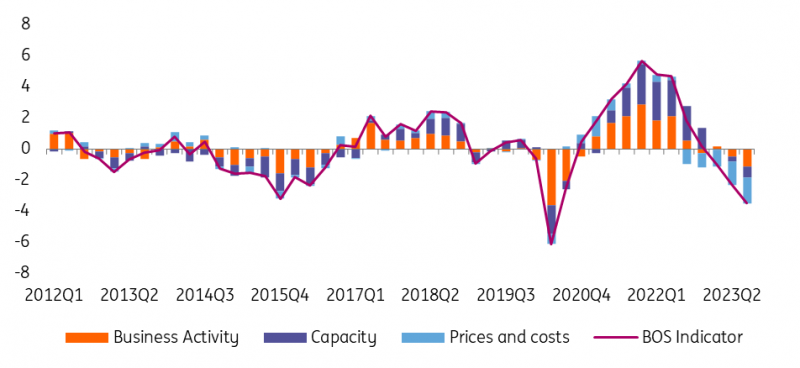

It isn’t only the latest inflation number that has surprised. The economy posted a shock contraction in the second quarter, and since then activity has flat-lined with wildfires, floods and strike action, all acting as a brake on activity in addition to the cumulative effects of policy tightening from the Bank of Canada. The BoC Business Outlook indicator slumped further in the third quarter on the back of weaker demand expectations, as well as a reduced plan for hiring and capex spending.

With an increasing number of households facing mortgage rate resets at much higher borrowing rates, there is a concern that highly indebted households will feel intensifying pain over coming quarters. We have already seen three consecutive monthly declines in home sales and further weakness is likely with affordability looking incredibly stretched.

BoC Business Outlook gauge points south

Bank of Canada, ING

The counterargument: strong jobs market

Canada’s jobs market has surprised even the most optimistic forecasters recently. August and September saw employment rising by a total of over 100k, equally split between part- and full-time hiring, while unemployment remained low at 5.5%.

In a recent speech, the BoC Governor said: ”it’s not so much about where inflation is now, it’s about where inflation’s going to be”, stressing the importance of inflation expectations and wage growth. Wage inflation has been on the upside according to official data, touching 5.3% year-on-year in September after four consecutive months of acceleration. Wage figures in Canada tend, however, to be rather volatile.

The BoC puts a lot of weight on the BoC Business Outlook survey, and the third quarter issue contained a few notions that partly offset the strong labour market narrative. Firms reported expected wage growth at around 4.3% for the year ahead, a fifth consecutive quarter-on-quarter decline, with a record 60% of respondents expecting increases in labour costs to abate in the next 12 months.

Incidentally, hiring intentions have declined in tandem with collapsing investment plans and are at the lowest since the third quarter of 2020. A key driver of strong employment gains – supply shortages – also appears to be abating: the BoC indicator of labour shortage intensity has dropped to the lowest since 2009.

Is labour ultra-tighteness going to last?

(Click on image to enlarge)

Bank of Canada, ING

*Labour shortages: Does your firm face any shortages of labour that restrict your ability to meet demand? **Intensity of labour shortages (balance of opinions): compared with 12 months ago, are labour shortages generally more intense, less intense or about the same intensity?

Another hawkish hold, but the BoC may well be done

We must add another factor to the equation: higher bond yields. Canadian sovereign yields have jumped in line with the US ones, reaching a peak a 4.24% peak in early October and now trading around 4.10% – over 100bp higher compared to when the BoC last met in September. BoC speakers have not been as vocal as their Fed counterparts about the link between higher market yields and lower chances of another hike, but there are few reasons to believe they strongly oppose such a line of reasoning.

When adding the clouded growth pictures and indications that the extreme tightness in labour market may not last much longer, we see little scope for a surprise rate hike by the BoC on 25 October. However, policymakers still have all the interest to keep the higher-for-longer narrative to keep a floor below Canadian yields and let them do part of the tightening.

Moving ahead, we are of the view that economic weakness will also contribute to inflation continuing to slow to target, meaning no further rate hikes from the Bank of Canada. We see the potential for the BoC having to start to reversing course and bring policy rates towards a more neutral level from the second quarter of 2024 onwards.

Market implications: CAD still struggling to shine

The CAD OIS curve is pricing only 4bp ahead of the October meeting, meaning that a hold is a very well-telegraphed outcome and should not have a major impact per-se. Markets will primarily focus on the content of the monetary policy report: revisions of the inflation and growth projections will be particularly in focus, and there is a risk those may hinder the attempts by Governor Macklem to maintain a hawkish stance.

There are still around 15bp of tightening in the price to a peak, and therefore some downside risks for CAD if new projections show a more benign path for inflation and/or worse growth outlook. Either way, USD/CAD should remain primarily driven by non-Canadian factors: the USD performance on the back of US data releases, geopolitical events and the connected implications for commodity prices and risk sentiment.

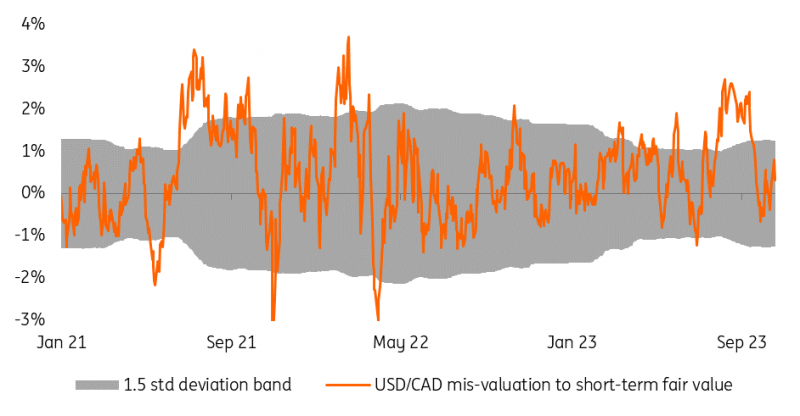

Despite trading around the levels of late August and early September, our short-term fair value model shows that USD/CAD is not overvalued as it was back then – meaning that the move in spot is justified by the rates and equity dynamics and there is no risk premium into the pair. While we still expect a turn lower in the pair on the back of a broad-based USD decline from the first quarter of 2024, we maintain a neutral bias (1.37/1.38) into December, with only some potential downside risks on the back of seasonal USD weakness into year-end.

CAD is no longer cheap

ING

More By This Author:

FX Daily: Peak Optimism Vs. Peak Pessimism

China: Activity Firms Further

Sticky UK Services Inflation Not Enough To Unlock A November Rate Hike

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more