Bank Of Canada Opts For A ‘Dovish’ 50bp Hike

The market had been split as to whether the Bank of Canada would hike interest rates by 25bp or 50bp. Strong growth, a tight jobs market, and elevated inflation led it to opt for the larger move, but having previously suggested ongoing tightening, the bank is now saying it is merely 'considering' whether additional hikes will be required.

BoC goes for a more aggressive 50bp hike

So we got a 50bp hike from the Bank of Canada – in line with our view, but the market had been more cautious, pricing in only around 33bp ahead of the decision. The accompanying statement acknowledges that growth is "proving more resilient than was expected" with Canada's labor market remaining "tight" and the economy "continuing to operate in excess demand". Nonetheless, there is "growing evidence that tighter monetary policy is restraining domestic demand", citing softer consumer spending growth and a weakening housing market. The bank is expecting that "growth will essentially stall through the end of this year and the first half of next year". As for inflation, it is "still too high", but there are early indications that "price pressures may be losing momentum".

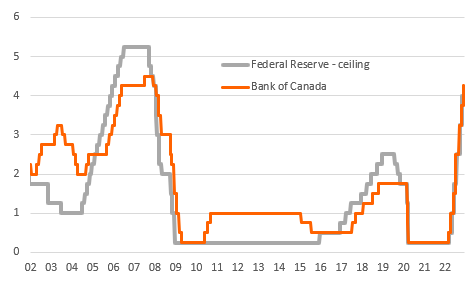

Central bank policy interest rates (%)

Source: Macrobond, ING

A dovish shift suggests further hikes are no longer the default position

As for the outlook, the central bank has hinted that we are now very close to the end of the tightening cycle with the Governing Council "considering whether the policy rate needs to rise further". At the last meeting in October, BoC said "the Governing Council expects that the policy interest rate will need to rise further" – so this is a dovish shift.

We have been penciling in a final 25bp hike early next year for quite some time. The next meeting is 25 January and such a move would take the policy rate to 4.5%. However, the housing market is looking particularly vulnerable, with the mortgage market structure meaning Canadians are more impacted by rising rates than American homeowners, given shorter periods of fixed mortgage rates. The global growth story is weakening, as underlined by today's Chinese trade data, and we are seeing signs in Europe and the US that inflation is moderating. If replicated in Canada, this would argue against that final hike. We will keep that last 25bp in for now but it is a low-conviction call.

FX: Bigger hike doesn’t mean stronger CAD

Despite the larger-than-expected rate hike, USD/CAD has struggled to move below 1.3600, which is due to a) the more dovish tone in the statement around the future path of rate increases; and b) an external environment that remains largely unsupportive for CAD. On the second point, crude prices below $80/bll are undoubtedly weighing on the loonie, especially since they have been accompanied by consecutive days of deteriorating risk sentiment.

The silver lining for CAD from the BoC dovish tilt is that there could be a lower probability of a disorderly fall in house prices, which was a key tail risk for CAD next year. We expect a stabilization in USD/CAD into year-end, but upside risks should continue to prevail unless oil prices rebound. Looking at next year, we continue to favor the loonie over other pro-cyclical currencies, given more limited exposure to China and Europe’s economic woes.

More By This Author:

China Trade Slump In November

FX Daily: Markets Settle Into More Recessionary Trading

Euro Credit Supply: November Saw A Large Window For Issuance