Australian Dollar Struggles As US Dollar Gains Ahead Of Michigan Consumer Sentiment Data

Image Source: Unsplash

Australian Dollar (AUD) declines against the US Dollar (USD) on Friday, extending its losses for the second successive session. The AUD/USD pair loses ground as China's Trade Balance arrived at CNY640.4 billion for October, narrowing from the previous figure of CNY645.47 billion.

China's Exports fell 0.8% year-over-year (YoY) in October against 8.4% in September. Meanwhile, imports rose 1.4% YoY in the reported period vs. 7.5% recorded previously.

In US Dollar (USD) terms, China’s Trade Surplus expanded less than expected in October. Trade Balance arrived at +90.07B versus +95.60B expected and +90.45 prior.

The AUD could receive support as Washington moves to suspend penalties on China’s shipbuilding sector, easing trade tensions between the world’s two largest economies. The Office of the United States (US) Trade Representative announced that it is seeking public input on a one-year suspension of tariffs on Chinese imports.

China’s Finance Ministry announced on Wednesday that it will lift some tariffs on US agricultural products starting November 10. The ministry also said that the 24% tariff on certain US goods will be suspended for one year, while the 10% tariff will remain in place. Any change in the Chinese economy could impact the AUD as China is a major trading partner for Australia.

Australia’s Trade Surplus widened to 3,938 million month-over-month (MoM) in September, exceeding the 3,850 million expected and 1,111 million (revised from 1,825 million) in the previous reading. Exports rose by 7.9% MoM in September, swinging from a previous decline of 8.7% (revised from -7.8%). Meanwhile, Imports rose by 1.1% MoM, compared to a previous rise of 3.3% (revised from 3.2%).

US Dollar gains on a technical upward correction

- The US Dollar Index (DXY), which measures the value of the US Dollar against six major currencies, is rebounding after losing nearly 0.5% in the previous session and trading around 99.80 at the time of writing. Traders will likely observe the preliminary Michigan Consumer Sentiment Index data on Friday, while the US government shutdown is restricting official data releases like Nonfarm Payrolls (NFP) and Unemployment Rate.

- The US Dollar faced challenges as the Challenger Job Cuts report prompted the Federal Reserve (Fed) to lower interest rates at its December meeting. Challenger, Grey & Christmas on Thursday, announced that companies cut over 153,000 jobs in October, marking the biggest reduction for the month in more than 20 years.

- ADP Employment Change in the US climbed by 42,000 in October, compared to the 29,000 decrease (revised from -32,000) seen in September. This figure came in better than the estimations of 25,000. US ISM Services PMI climbed to 52.4 in October, from 50.0 prior and exceeding analysts’ forecasts of 50.8.

- US government shutdown extends further, hitting a record with still no solution in sight. The Senate is not currently set to vote on a House-passed measure to reopen the government on Thursday, after it failed to advance for the 14th time on Tuesday.

- St. Louis Fed President Alberto Musalem said late Thursday that inflation risks remain tilted to the upside. Musalem noted that while tariffs are currently adding upward pressure to prices, their impact is expected to diminish next year. He added that longer-term inflation expectations remain well anchored. The US economy has shown resilience despite ongoing uncertainty, with the labor market softening recently but still hovering near full employment, he added.

- Fed Chair Jerome Powell signaled a more cautious approach, waiting for more data, which is complicated by the US government shutdown. Powell said that another rate cut in December is far from certain. However, Fed Governor Stephen Miran suggested that another rate cut could be appropriate in December.

- China's RatingDog Services Purchasing Managers' Index (PMI) fell to 52.6 in October from 52.9 in September. The data matched the market forecast of 52.6 in the reported period. Manufacturing PMI declined to 50.6 in October from 51.2 in September. The market forecast was for a 50.9 print. It is important to note that any shift in China’s economic conditions could also affect the Australian dollar (AUD), given the close trade ties between China and Australia.

- The S&P Global Australia Services PMI climbed to 52.5 in October from 52.4 in September, signaling continued growth in services activity and extending the expansion streak to 21 months. Meanwhile, Composite PMI came in at 52.1, down from 52.4 prior.

- The Reserve Bank of Australia (RBA) decided to maintain the Official Cash Rate (OCR) at 3.6% in the November policy meeting on Tuesday. RBA Governor Michele Bullock said in her post-meeting press conference that policymakers had not discussed rate cuts and emphasized that annual core inflation remaining above 3% is undesirable. Bullock noted that the effects of previous rate cuts are still filtering through the economy. She added that policymakers discussed maintaining a cautious approach regarding the policy outlook.

Australian Dollar breaks below 0.6500 to target lower rectangle boundary

AUD/USD is trading around 0.6470 on Friday. Technical analysis of the daily chart shows the pair consolidating within a rectangle pattern, trading sideways. It remains below the nine-day Exponential Moving Average (EMA), indicating a weaker short-term momentum.

The AUD/USD pair may test the lower boundary of the rectangle around 0.6460, followed by the five-month low of 0.6414, which was recorded on August 21. Further support lies at the six-month low at 0.6372.

On the upside, the initial barrier lies at the nine-day Exponential Moving Average (EMA) of 0.6508, followed by the 50-day EMA at 0.6535. A break above these levels would improve the short- and medium-term price momentum and support the AUD/USD pair to explore the region around the rectangle’s upper boundary around 0.6630. Further advances would support the pair to approach the 13-month high of 0.6707, recorded on September 17.

AUD/USD: Daily Chart

Australian Dollar Price Today

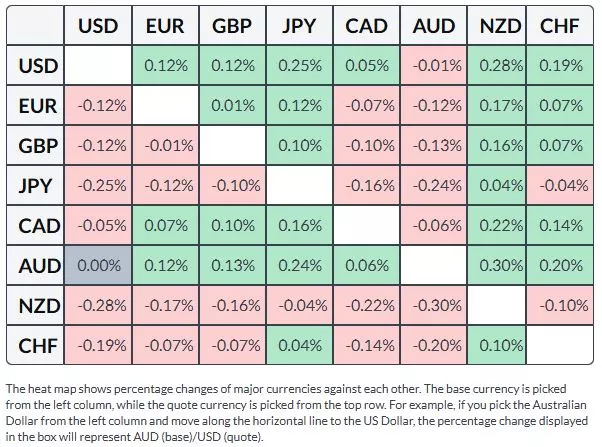

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the weakest against the US Dollar.

More By This Author:

Australian Dollar Holds Gains As US Dollar Declines On Fading Fed Rate Cut BetsAustralian Dollar Remains Stronger Due Improving US-China Trade Relations

EUR/USD Holds Gains Near 1.1500 Due To Cautious Tone Over ECB Policy Outlook

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not ...

more