Australian Dollar Struggles As Trump Administration Plans To Blacklist Chinese Chipmakers

Image Source: Unsplash

- The Australian Dollar faces headwinds as the Trump administration moves to add several Chinese chipmakers to its export blacklist.

- The AUD remains under pressure despite a strong Australian labor market report showing solid job gains in April.

- The US Dollar continues to trade within a narrow range, as recent US economic data has sent mixed signals to the market.

The Australian Dollar (AUD) extends its decline against the US Dollar (USD) for a third consecutive session on Friday. The AUD remains under pressure, possibly due to reports that the Trump administration is planning to add several Chinese chipmakers to its export blacklist, known as the "entity list." Given the close trade relationship between Australia and China, any disruption in the Chinese market can significantly impact the Aussie Dollar.

According to the Financial Times, Trump administration officials expressed concern late Thursday that imposing export controls on key Chinese firms at this stage could undermine the recently reached trade agreement between China and the US during talks in Geneva over the weekend.

The AUD struggles despite a strong Australian labor market report, which reported robust job growth in April. The AUD/USD pair struggled even as the Greenback weakened following economic data that fueled speculation the Federal Reserve (Fed) could resume interest rate cuts in the coming months.

The risk-sensitive AUD/USD pair also failed to benefit from easing global trade tensions. A senior adviser to Iran’s supreme leader, Ali Shamkhani, stated on Wednesday that Iran is ready to sign a nuclear deal with US President Donald Trump. Additionally, the US and China reached a preliminary agreement, under which the US will reduce tariffs on Chinese goods from 145% to 30%, while China will lower its tariffs on US imports from 125% to 10%.

Australian Dollar struggles despite a weaker US Dollar amid improved risk sentiment

- The US Dollar Index (DXY), which tracks the Greenback against a basket of six major currencies, is trading lower at around 100.60 at the time of writing. US economic data this week has delivered mixed signals—highlighting the economy’s resilience while also indicating a slowdown in growth momentum, which has kept the dollar confined to a narrow trading range.

- The US Producer Price Index (PPI) rose 2.4% year-over-year in April, easing from the 2.7% increase in March and falling short of the market expectation of 2.5%. Core PPI, which excludes food and energy, climbed 3.1% annually, down from the previous 4%. On a monthly basis, headline PPI dropped 0.5%, while core PPI fell 0.4%.

- US Initial Jobless Claims for the week ending May 10 stood at 229,000, unchanged from the revised figure for the previous week, and in line with expectations, according to the US Department of Labor (DOL). Continuing Jobless Claims rose by 9,000 to reach 1.881 million for the week ending May 3.

- US Consumer Price Index (CPI) rose by 2.3% year-over-year in April, slightly below the 2.4% increase recorded in March and market expectations of 2.4%. Core CPI—which excludes food and energy—also climbed 2.8% annually, matching both the previous figure and forecasts. On a monthly basis, both headline CPI and core CPI rose by 0.2% in April.

- US President Donald Trump told Fox News that he is working to gain greater access to China, describing the relationship as excellent and expressing willingness to negotiate directly with President Xi on a potential deal.

- According to the Australian Bureau of Statistics (ABS), employment surged by 89,000 in April, significantly higher than the 36,400 increase in March and far above the forecasted 20,000. Meanwhile, the Unemployment Rate remained unchanged at 4.1%.

- Australia's seasonally adjusted Wage Price Index rose by 3.4% year-over-year in Q1 2025, up from a 3.2% increase in Q1 2024 and surpassing market forecasts of a 3.2% gain. This marks a recovery from the prior quarter, which recorded the slowest wage growth since Q3 2022. On a quarterly basis, the index climbed 0.9% in Q1, surpassing the projected 0.8% rise.

- Australian Prime Minister Anthony Albanese was sworn in for a second term on Tuesday after a decisive election victory. Key cabinet positions—including treasurer, foreign affairs, defense, and trade—remain unchanged. Albanese is scheduled to attend the inauguration Mass of Pope Leo XIV in Rome on Sunday, where he will also meet with leaders such as European Commission President Ursula von der Leyen to discuss trade relations.

- Easing global trade tensions have prompted investors to dial back expectations for aggressive interest rate cuts in Australia. Markets now project the Reserve Bank of Australia (RBA) to reduce the cash rate to approximately 3.1% by year-end, a revision from earlier forecasts of 2.85%. Nevertheless, the RBA is still widely expected to proceed with a 25 basis point cut at its upcoming policy meeting.

Australian Dollar finds support around 0.6400 after breaking below nine-day EMA

AUD/USD is hovering around 0.6410 on Friday. Technical analysis on the daily chart indicates a bearish bias, as the pair is trading below the nine-day Exponential Moving Average (EMA). However, the 14-day Relative Strength Index (RSI) remains above the 50 level, signaling that some bullish momentum persists despite the downside pressure.

Immediate support lies at the psychological level of 0.6400, followed by the 50-day EMA around 0.6355. A decisive break below these levels could deteriorate the short- to medium-term outlook and pave the way for a deeper slide toward 0.5914 — a low last seen in March 2020.

On the upside, resistance is seen at the nine-day EMA near 0.6417. A break above this could lead the pair to retest the six-month high of 0.6515, recorded on December 2, 2024. A sustained rally beyond that point may target the seven-month high of 0.6687 from November 2024.

AUD/USD: Daily Chart

Australian Dollar PRICE Today

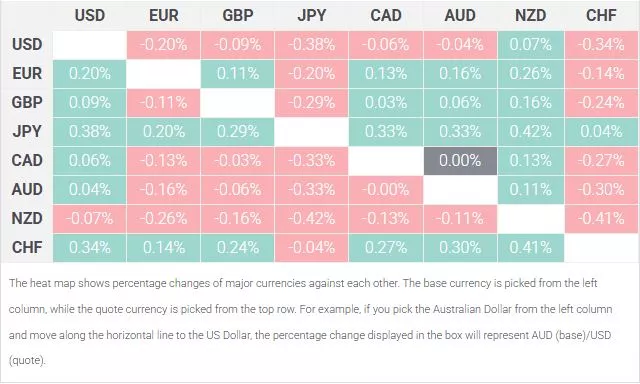

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the New Zealand Dollar.

More By This Author:

AUD/JPY Slips Toward 93.50 Due To Optimism Over Potential US-Japan Trade AgreementSilver Price Forecast: XAG/USD Breaks Below $32.00 With Developing Bearish Bias

Australian Dollar Remains Stronger As US Dollar Depreciates Ahead Of Retail Sales, PPI

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not ...

more