Australian Dollar Stays Calm As Traders Adopt Caution Ahead Of US PCE

Image Source: Unsplash

- The Australian Dollar holds ground after China's PMI was released on Friday.

- The AUD could appreciate due to the hawkish sentiment surrounding the RBA hiking rates.

- The US Dollar rebounds despite the lower US Treasury yields ahead of Core PCE.

The Australian Dollar (AUD) moves sideways after lower-than-expected NBS Purchasing Managers Index (PMI) data was released from China on Friday. Given the close trade relationship between Australia and China, any changes in the Chinese economy can significantly impact the Australian market. However, the AUD/USD pair had gained ground earlier in the day as the US Dollar (USD) struggled due to a slowdown in the US economy.

The AUD also found support as the monthly inflation rate accelerated to 3.6%, raising the possibility that the Reserve Bank of Australia (RBA) might need to hike interest rates again. Investors anticipate that the RBA will maintain high rates for a longer period, with a rate cut not expected until May next year.

The US Dollar Index (DXY), which measures the US Dollar against six major currencies, could receive pressure from a drop in US Treasury yields. This could be attributed to the US Gross Domestic Product (GDP) Annualized growth rate being revised lower to 1.3% from 1.6% for the first quarter. Traders are likely looking ahead to the Federal Reserve's preferred inflation gauge, the Core Personal Consumption Expenditures (PCE) Price Index, which will be released on Friday.

Daily Digest Market Movers: Australian Dollar consolidates after lower China PMI

- China’s NBS Manufacturing Purchasing Managers Index (PMI) fell to 49.5 in May from 50.4 in April, missing the market consensus of an increase to 50.5. Meanwhile, the Non-Manufacturing PMI declined to 51.1 from the previous reading of 51.2, falling short of the estimated 51.5.

- Australia's Private Capital Expenditure increased by 1.0% in Q1, exceeding expectations for a 0.5% rise and surpassing the previous quarter's 0.9% increase.

- As per a Bloomberg report, RBA Assistant Governor Sarah Hunter said at a conference in Sydney on Thursday that “inflationary pressures" are the key issue. “We’re very mindful of that." Hunter also stated that the RBA Board is concerned about inflation remaining above the target range of 1%-3%, suggesting persistent inflationary pressure. Wages growth appears to be near its peak.

- Bloomberg reported on Wednesday that Atlanta Fed President Raphael Bostic stated that the path to 2% inflation is not assured and that the breadth of price gains is still significant.

- Australia’s Monthly Consumer Price Index rose 3.6% year-over-year in April, surpassing the expected reading of 3.4% and the previous reading of 3.5%.

- On Tuesday, Neel Kashkari, President of the Federal Reserve Bank of Minneapolis, suggested that a rate hike might still be possible. Kashkari stated, “I don’t think anybody has taken rate increases off the table,” and expressed uncertainty about the disinflationary process, predicting only two rate cuts, per MSN.

- US Housing Price Index (MoM) for March underperformed, with March's number coming in at 0.1% against 1.2% for February, where 0.5% was expected.

Technical Analysis: Australian Dollar remains above the key level of 0.6600

The Australian Dollar trades around 0.6630 on Friday. An analysis of the daily chart suggests a bullish bias for the AUD/USD pair as it consolidates within the rising wedge. The 14-day Relative Strength Index (RSI) is positioned slightly above the 50 level, confirming a bullish bias.

The AUD/USD pair could target the psychological level of 0.6700, followed by the four-month high of 0.6714 and the upper limit of the rising wedge around 0.6740.

On the downside, the immediate support appears at the psychological level of 0.6600 around the lower boundary of the rising wedge. The next support appears at the 50-day Exponential Moving Average (EMA) at 0.6588. A further decline could exert downward pressure on the AUD/USD pair, potentially driving it toward the throwback support region at 0.6470.

AUD/USD: Daily Chart

Australian Dollar price today

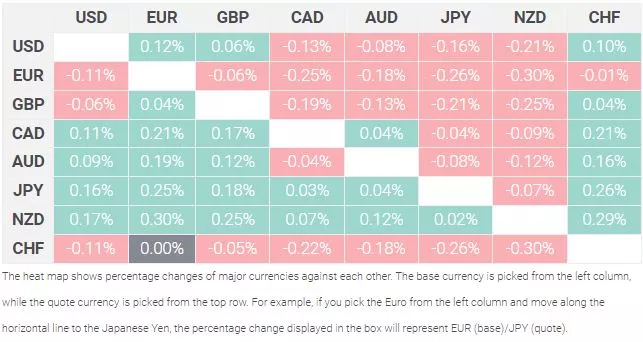

The table below shows the percentage change of the Australian Dollar (AUD) against listed major currencies today. The Australian Dollar was the strongest against the Euro.

More By This Author:

WTI Drops To Near $79.00 Ahead Of Key US Economic ReleasesAustralian Dollar Rebounds As Aussie 10-Year Yields Hit Monthly Highs

USD/CAD Appreciates To Near 1.3650 Due To A Downward Correction In Oil Prices

Disclosure: Information on this article contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes ...

more