Australian Dollar Rises As Inflation Fuels RBA Rate Hike Prospects

Image Source: Unsplash

The Australian Dollar (AUD) advances against the US Dollar (USD) on Friday, extending its gains for the sixth consecutive day. The AUD strengthens against major peers as hotter-than-expected inflation tempers expectations of the Reserve Bank of Australia (RBA) easing and revives the risk of another rate hike. Wednesday’s data showed consumer prices rising for a fourth consecutive month in October, moving further above the RBA’s 2%–3% target band.

The RBA is expected to maintain the Official Cash Rate (OCR) at 3.6% in December as inflation remains above the RBA’s 2–3% target range. RBA officials noted that the unemployment rate has risen slightly, but the job market remains healthy and is expected to continue doing so. The ASX 30-Day Interbank Cash Rate Futures showed, as of November 27, the December 2025 contract trading at 96.41, implying a 6% chance that the RBA will cut the cash rate to 3.35% from 3.60% at its upcoming Board meeting.

Reserve Bank of Australia reported on Friday that Private Sector Credit rose 0.7% MoM in October, beating both the prior reading and expectations of a 0.6% increase. Annual growth edged up to 7.3% from a revised 7.2%.

The AUD/USD pair also draws support as the US Dollar (USD) struggles amid rising odds of Federal Reserve (Fed) rate cut bets in December. Traders are also anticipating three additional rate cuts by the end of 2026 after reports indicated that White House National Economic Council Director Kevin Hassett is the leading candidate for the next Fed chair. Traders see Hassett as aligned with US President Donald Trump’s preference for lower interest rates.

US Dollar struggles amid rising Fed rate cut bets

- The US Dollar Index (DXY), which measures the value of the US Dollar against six major currencies, is facing challenges and trading around 99.50 at the time of writing.

- The CME FedWatch Tool suggests that markets are now pricing in a more than 87% chance that the Fed will cut its benchmark overnight borrowing rate by 25 basis points (bps) at its December meeting, up from the 39% probability that markets priced a week ago.

- The US Department of Labor (DOL) reported on Wednesday that Initial Jobless Claims fell to 216,000 for the week ending November 22, down 6,000 from the previous week’s revised figure. The result was stronger than the market expectation of 225,000. Meanwhile, the 4-week moving average eased by 1,000 to 223,750.

- The US Producer Price Index (PPI) remained steady at 2.7% year-over-year in September, matching expectations and August’s reading and suggesting that inflationary pressures have stabilized. Core PPI eased to 2.6% from 2.9%, undershooting the forecast of 2.7%.

- The US Retail Sales rose by 0.2% month-over-month (MoM) in September, slowing from the 0.6% increase seen in August, indicating more cautious consumer spending. Separately, the Conference Board reported a sharp deterioration in household sentiment, with Consumer Confidence sliding 6.8 points to 88.7 in November from 95.5 in October.

- Fed Governor Christopher Waller told Fox Business on Monday that his primary concern is the weakening labour market, adding that inflation is “not a big problem” given the recent softness in employment. He also said the September payrolls figure will likely be revised lower and warned that concentrated hiring is “not a good sign,” indicating his support for a near-term rate cut.

- The Australian Bureau of Statistics (ABS) released Private Capital Expenditure on Thursday, which rose by 6.4% quarter-over-quarter in the third quarter, accelerating from a 0.2% gain in Q2 and surpassing the 0.5% expected. On Wednesday, ABS reported the first “complete” monthly Consumer Price Index (CPI), which climbed by 3.8% year-over-year (YoY) in October. The reading surpassed the market consensus of a 3.6% rise and a 3.5% increase prior.

- The preliminary reading of Australia's S&P Global Manufacturing Purchasing Managers Index (PMI) came in at 51.6 in November, versus 49.7 prior. Meanwhile, Services PMI rose to 52.7 in November from the previous reading of 52.5, while the Composite PMI increased to 52.6 in November versus 52.1 prior.

- The Reserve Bank of Australia published the Minutes of its November monetary policy meeting last week, indicating that board members signalled a more balanced policy stance, adding that it could keep the cash rate unchanged for longer if incoming data proves stronger than expected.

Australian Dollar tests 0.6550 barrier as short-term bullish momentum strengthens

The AUD/USD pair is trading around 0.6540 on Friday. The technical analysis of the daily chart shows the pair trading within a rectangular consolidation zone, reflecting a neutral bias. The pair has moved above the nine-day Exponential Moving Average (EMA), indicating strengthening short-term bullish momentum.

The AUD/USD pair may target the monthly high of 0.6580, followed by the psychological level of 0.6600. Further advances above this confluence resistance zone would support the pair to explore the region around the rectangle’s upper boundary near 0.6630.

On the downside, the AUD/USD pair could find its initial support at the nine-day EMA at 0.6504, aligned with the psychological level of 0.6500. A break below this crucial support area would prompt the AUD/USD pair to test the lower boundary of the rectangle around 0.6420, aligned with the five-month low of 0.6414, recorded on August 21.

AUD/USD: Daily Chart

Australian Dollar Price Today

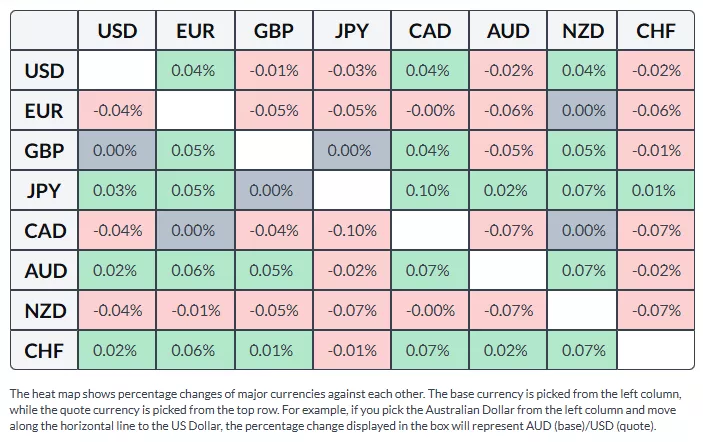

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the Canadian Dollar.

More By This Author:

Australian Dollar Strengthens As US Dollar Dips On Fed Rate Cut OddsAustralian Dollar Gains As CPI Beats Forecasts, Fed Rate Cut Bets Grow

EUR/USD Rises To Near 1.1600 As US Data Boost Fed Rate Cut Bets

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not ...

more