Australian Dollar Rises As Employment Data Boosts RBA Outlook

Image Source: Unsplash

The Australian Dollar advances against the US Dollar (USD) on Thursday, following the seasonally adjusted employment data from Australia, which strengthens expectations of tighter monetary policy from the Reserve Bank of Australia (RBA)

The Australian Bureau of Statistics (ABS) released the Australian Employment Change, which arrived at 65.2K in December, swinging from 28.7K jobs losses (revised from 21.3K jobs losses) in November, compared with the consensus forecast of 30K. Meanwhile, the Unemployment Rate declined to 4.1% from 4.3% prior, against the market consensus of 4.4%.

Sean Crick, head of labour statistics at the ABS, said that this month saw more people aged 15–24 move into employment, contributing to the increase in overall employment and the decline in the unemployment rate.

The International Monetary Fund (IMF) has urged the RBA to remain cautious, highlighting that inflation has stayed above the Bank’s 2%–3% target band for a prolonged period, even though headline CPI eased more quickly than anticipated in November.

US Dollar gains after Trump backs off European tariff threat

- The US Dollar Index (DXY), which measures the value of the US Dollar against six major currencies, is holding ground after registering modest gains in the previous session and trading around 98.80 at the time of writing.

- The Greenback gained ground after Bloomberg reported on Wednesday that US President Donald Trump said he would step back from imposing tariffs on goods from European nations opposing his effort to take possession of Greenland. He said earlier there is “no going back” on his ambitions regarding Greenland, alongside earlier threats to impose new 10% tariffs on eight European Union (EU) countries.

- President Trump also said that the United States and the North Atlantic Treaty Organization (NATO) had “formed the framework of a future deal regarding Greenland.” However, he did not outline the parameters of the so-called framework, and it remained unclear what the agreement would entail.

- US labor market data has pushed back expectations for further Federal Reserve (Fed) rate cuts until June. Fed officials have signaled little urgency to ease policy further until there is clearer evidence that inflation is sustainably moving toward the 2% target. Morgan Stanley analysts revised their 2026 outlook, now forecasting one rate cut in June followed by another in September, compared with their previous expectation of cuts in January and April.

- The People’s Bank of China (PBOC), China's central bank, announced on Tuesday that it would leave its Loan Prime Rates (LPRs) unchanged. The one-year and five-year LPRs were at 3.00% and 3.50%, respectively. It is essential to note that any changes in the Chinese economy could impact the Australian Dollar, as both countries are close trading partners.

- China’s Industrial Production rose 5.2% year-over-year YoY in December, accelerating from 4.8% in November, supported by resilient export-driven manufacturing activity. Meanwhile, Retail Sales rose 0.9% YoY, undershooting forecasts of 1.2% and November’s 1.3%.

- Australia’s TD-MI Inflation Gauge, released on Monday, rose to 3.5% year-over-year (YoY) in December, up from 3.2% previously. On a monthly basis, inflation surged 1.0% month-over-month (MoM) in December 2025, the fastest pace since December 2023 and a sharp acceleration from 0.3% in the prior two months.

- RBA policymakers acknowledged that inflation has eased significantly from its 2022 peak, though recent data suggests renewed upward momentum. Headline CPI slowed to 3.4% YoY in November, the lowest reading since August, but remains above the RBA’s 2–3% target band. Meanwhile, trimmed mean CPI edged down to 3.2% from October’s eight-month high of 3.3%.

- The RBA assessed that inflation risks have modestly tilted to the upside, while downside risks, particularly from global conditions, have diminished. Board members expect only one additional rate cut this year, with underlying inflation projected to remain above 3% in the near term before easing to around 2.6% by 2027.

Australian Dollar tests 0.6800 barrier near upper ascending channel boundary

The AUD/USD pair is trading around 0.6790 on Thursday. Daily chart analysis indicates that the pair is rising within the ascending channel pattern, indicating the persistent bullish bias. Moreover, the nine-day Exponential Moving Average (EMA) rises above the 50-day EMA, with spot holding above both and reinforcing a bullish tone. This alignment keeps upside pressure in place. The 14-day Relative Strength Index (RSI) at 69.93 sits near overbought, signaling stretched momentum.

The AUD/USD pair is testing the immediate resistance at the psychological level of 0.6800, followed by the upper boundary of the ascending channel around 0.6810. Further advances above the channel would expose the 0.6942, the highest level since February 2023.

On the downside, the primary support lies at the nine-day EMA at 0.6732. A break below the short-term average would weaken the price momentum to target the lower ascending channel boundary at 0.6680, followed by the 50-day EMA of 0.6656.

AUD/USD: Daily Chart

Australian Dollar Price Today

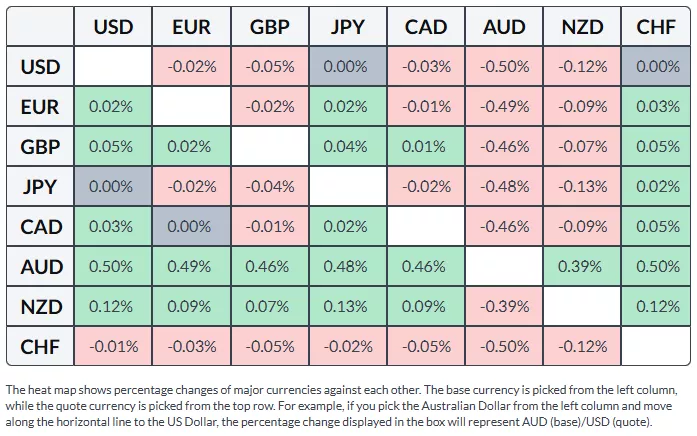

The table below shows the percentage change of the Australian Dollar (AUD) against the listed major currencies today. The Australian Dollar was the strongest against the US Dollar.

More By This Author:

Australian Dollar Gains As Westpac Leading Economic Index Rises In DecemberDow Jones Futures Slump Due To US-Greenland Dispute, EU Trade Risks

US Dollar Index Holds Near 99.50 As Jobless Claims Bolster Fed Pause