Australian Dollar Remains Stronger Due Improving US-China Trade Relations

Image Source: Unsplash

Australian Dollar (AUD) edges higher against the US Dollar (USD) on Wednesday, after recovering its daily losses. The AUD/USD pair gains ground after China’s Finance Ministry announced that it will lift some tariffs on US agricultural products starting November 10. The ministry also said that the 24% tariffs on certain US goods will be suspended for one year, while the 10% tariffs will remain in place.

China's RatingDog Services Purchasing Managers' Index (PMI) fell to 52.6 in October from 52.9 in September. The data matched the market forecast of 52.6 in the reported period. Any change in the Chinese economy could impact the AUD as China is a major trading partner for Australia.

The AUD faced challenges against its peers following the release of the S&P Global Australia Services PMI, which climbed to 52.5 in October from 52.4 in September, signaling continued growth in services activity and extending the expansion streak to 21 months. Meanwhile, Composite PMI came in at 52.1, down from 52.4 prior.

The downside of the AUD/USD pair could be restrained, as the Aussie Dollar could receive support from positive developments in the US-China trade talks. US President Donald Trump announced a cut to fentanyl-related tariffs on imports from China, lowering the rate from 20% to 10%, and the continued freeze of some of his reciprocal levies on Chinese goods. The moves will go into effect on November 10, per Bloomberg.

US Dollar edges lower due to ongoing US government impasse

- The US Dollar Index (DXY), which measures the value of the US Dollar (USD) against six major currencies, is remaining steady and trading around 100.20 at the time of writing. The Greenback moves little as traders adopt caution amid the ongoing US government shutdown.

- The US government impasse has now entered its sixth week and is poised to become the longest federal funding lapse in US history after the Senate once again failed to pass a short-term funding bill. The most recent attempt to resolve the standoff, Republican-backed temporary legislation, was rejected by the Senate for the 14th time on Tuesday.

- However, the US Dollar received support from the cautious sentiment surrounding the US Federal Reserve (Fed) policy stance for December. Fed funds futures traders are now pricing in a 69% chance of a cut in December, down from 90% a week ago, according to the CME FedWatch Tool.

- Fed Chair Jerome Powell said last week during the post-meeting press conference that another rate cut in December is far from certain. Powell also cautioned that policymakers may need to take a wait-and-see approach until official data reporting resumes.

- The White House announced on Tuesday that China will suspend extra export controls on rare earths and end probes into US semiconductor firms, in exchange for the US pausing some tariffs and canceling a planned 100% levy on Chinese exports.

- China’s Premier Li Qiang said on Wednesday that some unilateral and protectionist actions have seriously disrupted the global economic order. Li added that China will keep its focus on economic growth, aiming for high-quality development and stronger domestic demand. He also mentioned that the government plans to roll out more targeted and effective policies to support steady economic expansion.

- China's RatingDog Manufacturing Purchasing Managers' Index (PMI) declined to 50.6 in October from 51.2 in September. The market forecast was for a 50.9 print. It is important to note that any shift in China’s economic conditions could also affect the Australian dollar (AUD), given the close trade ties between China and Australia.

- The Reserve Bank of Australia (RBA) decided to maintain the Official Cash Rate (OCR) at 3.6% in the November policy meeting on Tuesday. RBA Governor Michele Bullock said in her post-meeting press conference that policymakers had not discussed rate cuts and emphasized that annual core inflation remaining above 3% is undesirable. Bullock noted that the effects of previous rate cuts are still filtering through the economy. She added that policymakers discussed maintaining a cautious approach regarding the policy outlook.

- Melbourne Institute reported on Monday that the TD-MI Inflation Gauge rose 0.3% month-on-month (MoM) in October, easing slightly from a 0.4% gain in September but marking the second consecutive monthly increase. Meanwhile, the annual Inflation Gauge rose 3.1%, edging higher from the previous 3.0%.

- Australian Bureau of Statistics (ABS) released Building Permits data, which rose 12.0% MoM, after falling 3.6% in August and beating market expectations of a 5.5% growth. ANZ Job Advertisements fell 2.2% month-on-month in October, following a revised 3.5% drop in the previous month. This marked the fourth straight monthly decline.

Australian Dollar trades near 0.6500 after rebounding from lower rectangle boundary

The AUD/USD pair is trading around 0.6490 on Wednesday. Technical analysis of the daily chart indicates that the pair is in a consolidation phase, trading sideways within a rectangle pattern. The pair remains below the nine-day Exponential Moving Average (EMA), signaling a weakening of short-term price momentum.

The primary support appears at the lower boundary of the rectangle around 0.6460, followed by the five-month low of 0.6414, which was recorded on August 21. Further support lies at the six-month low at 0.6372.

On the upside, the immediate barrier lies at the psychological level of 0.6500, followed by the nine-day Exponential Moving Average (EMA) of 0.6522. A break above the latter could improve the short-term price momentum and support the AUD/USD pair to explore the region around the rectangle’s upper boundary, around 0.6630. Further advances would signal a bullish bias and support the pair in exploring the region around the 13-month high of 0.6707, recorded on September 17.

AUD/USD: Daily Chart

Australian Dollar Price Today

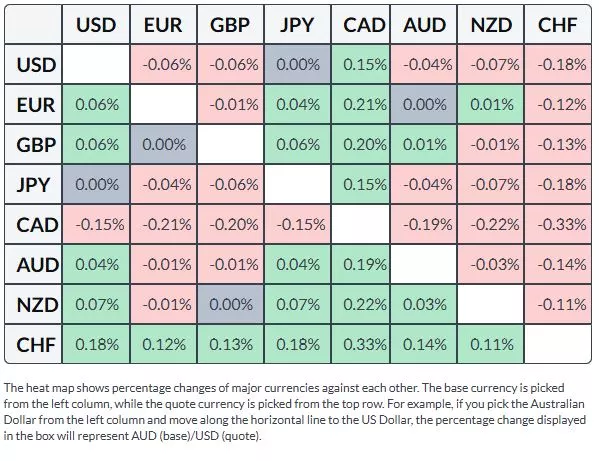

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the Canadian Dollar.

More By This Author:

EUR/USD Holds Gains Near 1.1500 Due To Cautious Tone Over ECB Policy OutlookAustralian Dollar Declines As 10-Year Bond Yield Rises On Inflation Fear

USD/CAD Price Forecast: Tests 1.4000 Barrier After Breaking Above Nine-Day EMA

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not ...

more