Australian Dollar Recovers Losses Amid Improved Consumer Sentiment Index

Image Source: Unsplash

- The Australian Dollar inches higher amid the improved Consumer Sentiment index released on Tuesday.

- Australia's Westpac Consumer Confidence rose by 1.7% MoM in June, marking the highest level since February.

- The US Dollar may limit its downside; strong US business activity data dampened expectations for Fed rate cuts.

The Australian Dollar (AUD) inches higher due to an improvement in Australia's Westpac Consumer Confidence Index, released on Tuesday. Additionally, the AUD/USD pair receives support from the hawkish stance of the Reserve Bank of Australia (RBA). However, investors are likely to be cautious ahead of this week's Australian inflation data.

The RBA Governor Michele Bullock said during her latest press conference that the Board discussed potential rate hikes, dismissing considerations of rate cuts in the near term, as per ABC News. Markets have significantly reduced their expectations for a RBA’s rate cut this year, with an easing not anticipated until April next year.

The US Dollar trades on a softer note ahead of key US economic data due later this week. The revised US Gross Domestic Product (GDP) for the first quarter (Q1) is set to be released on Thursday, followed by the Personal Consumption Expenditure (PCE) Price Index on Friday.

Daily Digest Market Movers: Australian Dollar edges higher due to improved Consumer Sentiment

- Australia's Westpac Consumer Confidence rose by 1.7% month-over-month in June, rebounding from a 0.3% decline the previous month. This marks the first increase in four months and the highest level since February.

- According to the CME FedWatch Tool, investors are pricing in nearly 67.7% odds of a Fed rate cut in September, compared to 61.5% a week earlier.

- On Tuesday, the People's Bank of China injected 300 billion Yuan via seven-day reverse repos, maintaining the reverse repo rate at 1.8%. Any change in the Chinese economy could impact the Australian market, as China and Australia are close trade partners.

- On Friday, the US Composite PMI for June surpassed expectations, rising to 54.6 from May’s reading of 54.5. This figure marked the highest level since April 2022. The Manufacturing PMI increased to a reading of 51.7 from a 51.3 figure, exceeding the forecast of 51.0. Similarly, the Services PMI rose to 55.1 from 54.8 in May, beating the consensus estimate of 53.7.

- As per a Reuters report, Fed Reserve Bank of Minneapolis President Neel Kashkari noted on Thursday that it will probably take a year or two to get inflation back to 2%.

Technical Analysis: Australian Dollar hovers around 0.6650

The Australian Dollar trades around 0.6650 on Tuesday. Analysis of the daily chart shows a neutral bias for the AUD/USD pair as it consolidates within a rectangle formation. The 14-day Relative Strength Index (RSI) is positioned slightly above the 50 level, indicating a potential bullish bias.

The AUD/USD pair may find support around the 50-day Exponential Moving Average (EMA) at 0.6615, with additional support near 0.6585, marking the lower boundary of the rectangle formation.

On the upside, the AUD/USD pair may encounter resistance near the upper boundary of the rectangle formation around 0.6695, aligned with the psychological level of 0.6700. Beyond that, potential resistance levels include the high of 0.6714 observed since January.

AUD/USD: Daily Chart

Australian Dollar price today

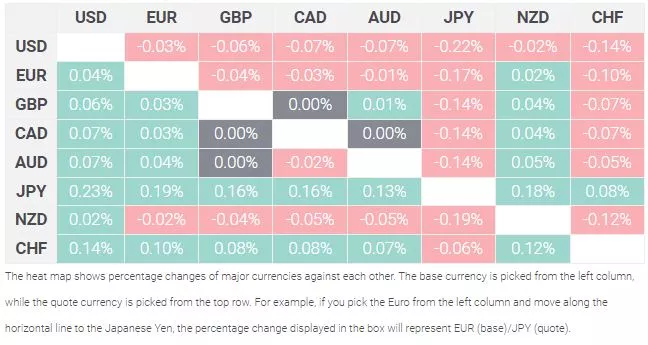

The table below shows the percentage change of the Australian Dollar (AUD) against listed major currencies today. The Australian Dollar was the strongest against the US Dollar.

More By This Author:

USD/CAD Appreciates To Near 1.3700 As Fed Delays The Expected Timing Of The Rate CutEUR/GBP Depreciates To Near 0.8400 Due To Political Uncertainty In Europe

USD/CAD Price Analysis: Hovers Around 1.3750; Grapples To Return To Rising Channel

Disclosure: Information on this article contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes ...

more