Australian Dollar Price Outlook: Aussie Drops Into Downtrend Support

The Australian Dollar is down nearly 2% off the monthly highs against the US Dollar with the decline testing the first major daily support zone early in the week. These are the updated targets and invalidation levels that matter on the AUD/USD charts.

AUSTRALIAN DOLLAR PRICE CHART – AUD/USD DAILY

(Click on image to enlarge)

Chart Prepared by Michael Boutros, Technical Strategist; AUD/USD on Tradingview

Technical Outlook: In my last Australian Dollar Price Outlook we noted that Aussie was testing near-term uptrend support while highlighting that, “Weakness beyond 6815 would suggest a larger correction is underway.” A downside break post-FOMC last week fueled a steeper decline in price with AUD/USD now testing key daily support at 6759/67 – a region defined by the 61.8% retracement of the September advance and the monthly low-day close.

A break/close below this threshold is needed to keep the short-bias viable with such a scenario targeting the monthly open / pitchfork support at 6724. Key daily resistance now 6827 with a breach above the monthly high-day close at 6866 needed to suggest a more significant low was registered this month.

AUSTRALIAN DOLLAR PRICE CHART – AUD/USD 120MIN

(Click on image to enlarge)

Chart Prepared by Michael Boutros, Technical Strategist; AUD/USD on Tradingview

Notes: A closer low at Aussie price action sees AUD/USD continuing to trade within the confines of a near-term descending pitchfork formation extending off monthly highs with the lower parallel catching support on Friday. The weekly opening-range is taking shape just above key support at 6759/67 and we’re looking for the break for guidance. Shorts are at risk near-term while above this threshold.

Interim resistance stands at the median-line backed by the trendline confluence near 6800 and 6810- both areas of interest of possible topside exhaustion IF reached. Ultimately a breach above 6828 is needed to validate a larger breakout. A break lower from here targets 6745 backed by the monthly open at 6724- look for a bigger reaction there IF reached.

Bottom line: Aussie is testing key near-term support here at 6760/67 with the weekly opening-range taking shape just above. From a trading standpoint, a good spot to reduce short-exposure / lower protective stops. Look for possible downside exhaustion near-term while above the lower parallel – ultimately a larger recovery in price may offer more favorable short entries with the risk weighted to the downside while within this formation. Review my latest Australian Dollar Weekly Price Outlook for a closer look at the longer-term AUD/USD technical trading levels.

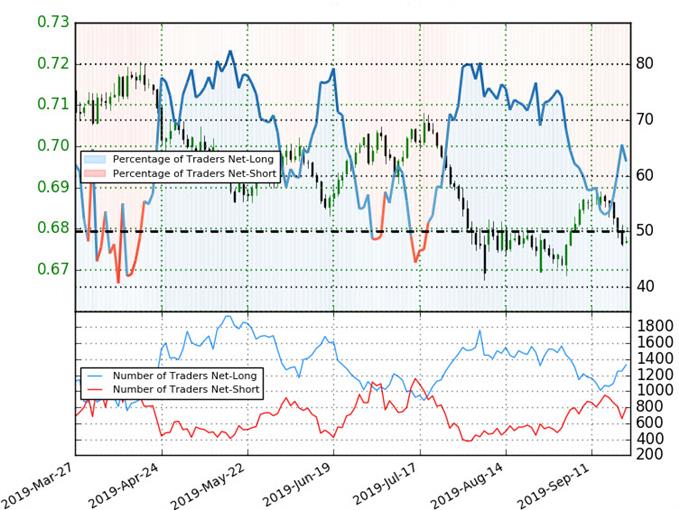

AUSTRALIAN DOLLAR TRADER SENTIMENT – AUD/USD PRICE CHART

(Click on image to enlarge)

- A summary of IG Client Sentiment shows traders are net-long AUD/USD - the ratio stands at +1.67 (62.6% of traders are long) – bearish reading

- Traders have remained net-long since July 19th; price has moved 2.8% lower since then

- Long positions are 5.6% higher than yesterday and 29.0% higher from last week

- Short positions are4.9% higher than yesterday and 15.9% lower from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests AUD/USD prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current positioning and recent changes gives us a stronger AUD/USD-bearish contrarian trading bias from a sentiment standpoint.