Australian Dollar Pares Recent Losses Due To Technical Correction

Image Source: Unsplash

- Australian Dollar edges higher despite a stable US Dollar ahead of Q2 GDP data.

- RBA Governor Michele Bullock noted that labor market conditions have softened somewhat, with unemployment edging up.

- San Francisco Fed’s Daly said more rate cuts may be needed to restore price stability and support jobs.

The Australian Dollar (AUD) advances against the US Dollar (USD) on Thursday, recovering recent losses from the previous session. The AUD/USD pair gains ground as the Greenback remains steady ahead of the US Gross Domestic Product (GDP) for the second quarter (Q2) due later in the day.

The AUD received support from Australia’s Monthly Consumer Price Index (CPI), which climbed by 3.0% year-over-year in August, following a 2.8% increase reported in July. According to Reuters, prospects for a Reserve Bank of Australia (RBA) rate reduction at its November meeting faded to 50% from almost 70% before the data.

RBA Governor Michele Bullock said earlier this week that labor market conditions have eased slightly, with unemployment ticking higher. Bullock noted that recent rate cuts should support household and business spending, while stressing that the RBA must stay vigilant to changing conditions and be ready to respond if needed.

Australian Dollar gains ground despite a stable US Dollar amid Fed caution

- The US Dollar Index (DXY), which measures the value of the US Dollar against six major currencies, is holding its position and trading around 97.80 at the time of writing.

- San Francisco Fed President Mary Daly said on Wednesday that further rate reductions are likely to be needed, as the central bank works to restore price stability and provide necessary support to the labor market.

- Chicago Fed President Austan Goolsbee broke away from the overarching narrative of consecutive Fed rate cuts heading through the end of the year, widening the narrative gap between Fed incumbents and Donald Trump's newly minted Fed pick, Stephen Miran.

- US S&P Global Composite PMI ticked down to 53.6 from 54.6 in August, pointing to a private sector that seems to be struggling to strengthen further. Manufacturing PMI eased to 52.0 from 53, signalling waning momentum in the sector. The Services PMI slipped to 53.9 from 54.5, suggesting that demand may be easing.

- Fed Chair Jerome Powell said on Tuesday that a weaker labor market is outweighing concerns about stubborn inflation, leading to an interest rate cut at its September meeting last week. However, Powell further stated that he is comfortable with the current policy path, though he indicated the possibility of further cuts should the FOMC see the need to be more accommodative.

- The White House announced that US companies will take control of TikTok’s algorithm, while Americans will occupy six of the seven board seats for its US operations. White House Press Secretary Karoline Leavitt said the agreement could be finalized “in the coming days,” though Beijing has not yet commented.

- The White House announced that Australian Prime Minister Anthony Albanese and US President Donald Trump will hold their first in-person meeting in Washington, D.C. on October 20 to discuss the Aukus nuclear submarine pact.

- Australia’s preliminary S&P Global Composite PMI fell to 52.1 in September, from 55.5 prior, marking the lowest reading in three months. Manufacturing and services both noted slowing growth amid weaker new business inflows and lower goods orders at the fastest pace in eight months. The preliminary S&P Global Services PMI showed a modest slowdown to 52 in September, from 55.8 in August. Meanwhile, the Manufacturing PMI fell to 51.6 from 53.0 previously.

- The Reserve Bank of Australia (RBA) rate cuts. Markets now price just a 20% chance of a September cut, while odds for November stand at 70%, with above-target inflation keeping policymakers cautious.

Australian Dollar remains below 0.6600, nine-day EMA barrier

AUD/USD is trading around 0.6590 on Thursday. Technical analysis on the daily chart shows that the pair is positioned below the nine-day Exponential Moving Average (EMA), suggesting the short-term price momentum is weaker. However, the 14-day Relative Strength Index (RSI) maintains its position slightly above the 50 level, suggesting that bullish bias is still active.

The AUD/USD pair may find its initial support at the 50-day Exponential Moving Average (EMA) at 0.6552, aligned with the psychological level of 0.6550. A break below the support zone would weaken the medium-term price momentum and put downward pressure on the pair to navigate the region around the three-month low at 0.6414, which was recorded on August 21.

On the upside, the initial resistance lies at the nine-day Exponential Moving Average (EMA) of 0.6602. A break above this level would improve the short-term price momentum and lead the AUD/USD pair to approach the 11-month high of 0.6707, recorded on September 17.

AUD/USD: Daily Chart

US Dollar Price Today

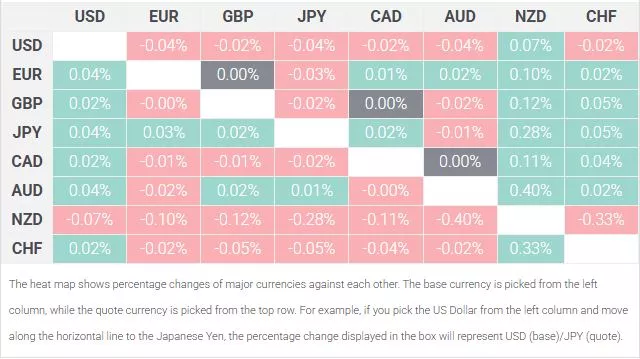

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the New Zealand Dollar.

More By This Author:

Australian Dollar Remains Stronger As CPI Inflation Bolsters RBA CautionUS Dollar Index Price Forecast: Remains Within Confluence Zone Around 97.50 Barrier

Australian Dollar Extends Losses As US Dollar Gains On Steady Fed Outlook

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not ...

more