Australian Dollar Pares Losses As US Dollar Declines On Market Caution

Image Source: Unsplash

The Australian Dollar (AUD) recovers its intraday losses but remains in the negative territory against the US Dollar (USD) on Tuesday after registering losses in the previous session. The AUD/USD pair remained subdued after the Reserve Bank of Australia (RBA) published the Minutes of its November monetary policy meeting.

The RBA Meeting Minutes showed that board members signalled a more balanced policy stance, adding that it could keep the cash rate unchanged for longer if incoming data proves stronger than expected.

However, the AUD receives support as stronger domestic employment data reinforced expectations for a cautious stance from the Reserve Bank of Australia (RBA). As of the latest update on November 14, the ASX 30-Day Interbank Cash Rate Futures for December 2025 traded at 96.41, reflecting a 6% probability of a rate cut to 3.35% from 3.60% at the upcoming RBA Board meeting.

US Dollar moves little despite diminishing Fed rate cut likelihood

- The US Dollar Index (DXY), which measures the value of the US Dollar against six major currencies, is edging lower and trading around 99.50 at the time of writing. Traders brace for a backlog of US data following the government's reopening.

- The CME FedWatch Tool suggests that financial markets are now pricing in a 43% chance that the Fed will cut its benchmark overnight borrowing rate by 25 basis points (bps) at its December meeting, down from 62% probability that markets priced a week ago.

- Federal Reserve Vice Chair Philip Jefferson noted Monday that risks to the labor market now outweigh upside risks to inflation, while stressing that the Fed should proceed “slowly” with any additional rate reductions.

- Fed Governor Christopher Waller said that the US central bank should cut the interest rates when policymakers meet in December. Waller added that he’s grown concerned over the labor market and the sharp slowdown in hiring.

- Kansas City Fed President Jeffrey Schmid said on Friday that monetary policy should “lean against demand growth,” adding that current Fed policy is “modestly restrictive,” which he believes is appropriate.

- National Economic Council Director Kevin Hassett cautioned that some October data may “never materialize,” as several agencies were unable to gather information during the shutdown. Initial private-sector reports suggest a cooling labor market and wavering consumer confidence, with persistent concerns about inflation.

- Automatic Data Processing (ADP) released the US Employment Change on Tuesday, showing an average weekly job loss of 11,250 in the four weeks to October 25. Weaker-than-expected private US labor data increased the likelihood of the Federal Reserve (Fed) policy easing. Challenger, Gray & Christmas announced that US employers slashed 153,074 jobs in October, up from the 55,597 cuts announced in October 2024.

- Reuters reported on Sunday that US Treasury Secretary Scott Bessent said a rare earths agreement between the United States (US) and China will “hopefully” be finalized by Thanksgiving. He added that he is confident China will uphold its commitments following the recent meeting in Korea between the two leaders, President Trump and President Xi Jinping.

- RBA Deputy Governor Andrew Hauser said last week, “Our best estimate is that monetary policy remains restrictive, though the committee continues to debate this.” Hauser added that if the policy is no longer mildly restrictive, it would have significant implications for future decisions.

- The Australian Bureau of Statistics (ABS) released the Unemployment Rate on Thursday, which declined to 4.3% in October from 4.5% in September, against the market expectations of 4.4%. Meanwhile, the Employment Change arrived at 42.2K in the same month from 12.8K (revised from 14.9K) prior, sharply exceeding the market forecast of 20K.

- Australia’s Full-Time Employment rose by 55.3K in October, from a rise of 6.5K in the previous reading (revised from 8.7K). Participation Rate steadied at 67%, while the Part-Time Employment decreased by 13.1K in October, versus an increase of 6.3K prior.

Australian Dollar moves below 0.6500 near lower rectangle boundary

The AUD/USD pair is trading around 0.6490 on Tuesday. The analysis of the daily chart shows the pair consolidating within a rectangular range, reflecting sideways movement. The price moves below the nine-day Exponential Moving Average (EMA), suggesting that momentum is weakening.

On the downside, the primary support lies at the lower boundary of the rectangle around 0.6470, followed by the five-month low of 0.6414, which was recorded on August 21.

The AUD/USD pair may test the primary barrier at the nine-day EMA of 0.6514. A break above this level would improve the short-term price momentum and lead the pair to reach the rectangle’s upper boundary near 0.6630.

AUD/USD: Daily Chart

Australian Dollar Price Today

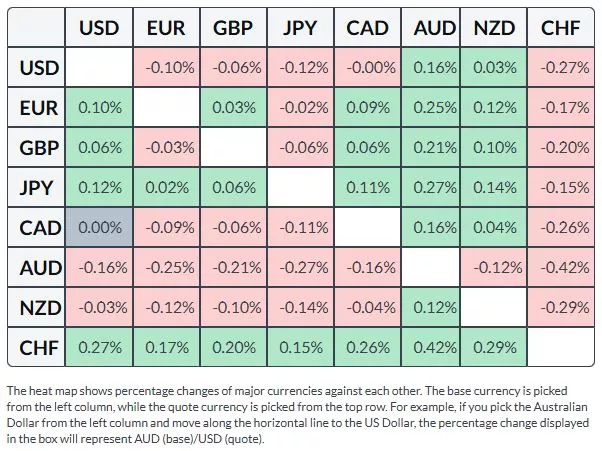

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the weakest against the Swiss Franc.

More By This Author:

XAG/USD Gains Above 52.50 Due To Rising US Data UncertaintyAustralian Dollar Extends Losses Despite Cautious RBA Tone

Australian Dollar Struggles As US Dollar Gains Ahead Of Michigan Consumer Sentiment Data

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not ...

more