Australian Dollar Outlook: Hard Fight Ahead Against FOMC-Charged US Dollar

AUSTRALIAN DOLLAR FORECAST: NEUTRAL

The Australian Dollar was battered by the US Dollar last week following the Federal Open Market Committee’s (FOMC) policy decision where the central bank signaled a potential path to tightening policy. Investors dove into the Greenback headfirst on the announcement as rate traders sold off their bond positions, causing front-end yields to rise.

While bond markets stabilized since then, with a concurrent flattening of the curve, USD strength remained unhampered, keeping pressure on its majors peers. The hawkish Fed signal culled inflation bets, which negatively affected commodity prices as well. The result saw a multi-front attack on the Aussie-Dollar, given its exchange rate is also exposed to commodity prices.

Moreover, regarding commodities, the Australian economy faces negative headwinds from China. The economic powerhouse is Australia’s largest trading partner, which leaves it particularly vulnerable to policy moves from Beijing. A recent order to release metals from state reserves has added additional weight to prices, with copper taking the brunt of the hit. Moreover, China has also ordered firms to curb exposure and limit leverage in metal markets.

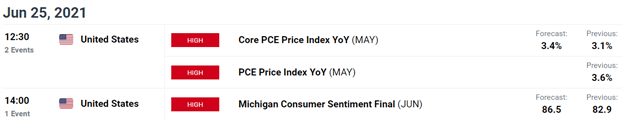

Overall, the Australian Dollar’s direction is likely to remain dependent on the market’s reaction to the change in Fed policy in the short term. If traders continue to bid up the US currency, the aforementioned risks may continue to weigh on foreign currencies like the Aussie Dollar. That said, next week’s US PCE print should be closely watched. Analysts expected core prices to rise at a 3.4% clip, up from 3.1%. If the figure comes in above 3.4%, it may drive more bets into USD.

DAILYFX ECONOMIC CALENDAR

Disclaimer: See the full disclosure for DailyFX here.