Australian Dollar Moves Little Due To Thin Holiday Trading

Image Source: Unsplash

The Australian Dollar (AUD) inches higher against the US Dollar (USD), rebounding toward the 14-month high of 0.6727 on Tuesday. The AUD finds support amid growing expectations of interest rate hikes from the Reserve Bank of Australia (RBA). Volumes are expected to be thin due to the New Year's holiday in Australia.

The Reserve Bank of Australia’s (RBA) December Meeting Minutes signaled growing uncertainty among board members about whether monetary policy remains sufficiently restrictive. The policymakers indicated it stands ready to tighten policy if inflation fails to ease as expected, placing increased focus on the Q4 CPI report due January 28. Analysts note that a stronger-than-expected Q4 core inflation reading could trigger a rate hike at the RBA’s February 3 meeting.

The AUD/USD pair could rise as the US Dollar (USD) could face challenges amid ongoing expectations of two more rate cuts by the Federal Reserve (Fed) in 2026. Traders are likely to focus on the Federal Open Market Committee (FOMC) December Meeting Minutes due later in the day.

US Dollar holds ground despite Fed rate cut bets

- The US Dollar Index (DXY), which measures the value of the US Dollar against six major currencies, is gaining ground and trading around 98.00 at the time of writing.

- The Fed lowered the interest rates by 25 basis points (bps) at the December meeting, bringing the target range to 3.50%–3.75%. The Fed delivered a cumulative 75 bps of rate cuts in 2025 amid a cooling labor market and still-elevated inflation.

- The CME FedWatch tool shows an 83.9% probability of rates being held at the Fed’s January meeting, up from 80.1% a week earlier. Meanwhile, the likelihood of a 25-basis-point rate cut has fallen to 16.1% from 19.9% a week ago.

- US Initial Jobless Claims declined to 214K from 224K in the prior week, beating the 223K market forecast. Meanwhile, Continuing Jobless Claims rose to 1.923 million from 1.885 million, while the four-week average of Initial Claims edged lower to 216.75K from 217.5K.

- The US Bureau of Economic Analysis (BEA) released delayed data showing that preliminary US Gross Domestic Product (GDP) Annualized expanded 4.3% in the July–September period. The reading exceeded market expectations of a 3.3% increase and surpassed the 3.8% growth recorded in the previous quarter.

- Bloomberg reported Sunday that China’s Ministry of Finance plans to expand targeted investment in priority sectors, including advanced manufacturing, technological innovation, and human capital development. The announcement followed a year-end meeting outlining next year’s fiscal policy priorities. Any impact on China’s economy could affect the AUD, given Australia’s close trade ties with China.

- Australia’s headline inflation rose to 3.8% in October 2025 from 3.6% in September, remaining above the RBA’s 2–3% target range. As a result, markets are increasingly pricing in a rate hike as early as February 2026, with both the Commonwealth Bank of Australia and National Australia Bank projecting a rise to 3.85% at the RBA’s first policy meeting of the year.

- Australia’s Consumer Inflation Expectations rose to 4.7% in December from November’s three-month low of 4.5%, supporting the Reserve Bank of Australia’s (RBA) hawkish stance.

Australian Dollar tests 0.6700 barrier after rebounding from nine-day EMA

AUD/USD is trading around 0.6690 on Tuesday. The technical analysis of the daily chart indicates that the pair remains within the ascending channel pattern, suggesting a persistent bullish bias. The pair holds above a rising nine-day Exponential Moving Average (EMA), preserving the short-term uptrend. The average continues to advance, keeping a bullish bias in place. The 14-day Relative Strength Index (RSI) at 64.22 signals strong momentum.

After rebounding from a nine-day EMA support, the AUD/USD pair is testing the immediate resistance at the psychological level of 0.6700, followed by the 0.6727, the highest level since October 2024, reached on December 29. The daily tone stays positive above the moving average, which could support the pair to break above the latter and explore the region around the upper boundary of the ascending channel at 0.6840.

On the downside, a break below the nine-day EMA at 0.6681, followed by the lower ascending channel boundary around 0.6670, would open the doors for the AUD/USD pair to navigate the region around the six-month low near 0.6414, marked on August 21.

AUD/USD: Daily Chart

Australian Dollar Price Today

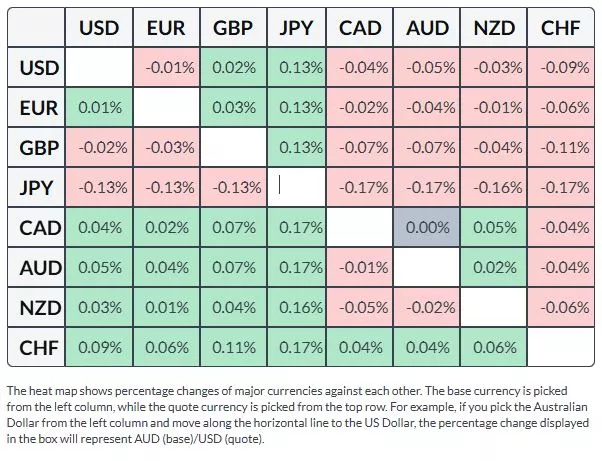

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the Japanese Yen.

More By This Author:

Dow Jones Futures Steady As Traders Await US Q3 GDP ReleaseAustralian Dollar Loses As US Dollar Advances Before Michigan Sentiment Index

Australian Dollar Gains As US Dollar Remains Steady On Fed Policy Outlook

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not ...

more