Australian Dollar Moves Little As Us Dollar Weakens Ahead Of ISM Services PMI

Image Source: Unsplash

The Australian Dollar (AUD) advances against the US Dollar (USD) on Wednesday after registering over 1% gains in the previous session. The AUD/USD pair holds ground after China's Services Purchasing Managers' Index (PMI) rose to 52.3 in January from 52.0 in December. This figure came in stronger than the expectations of 51.8. China is a key trading partner of Australia, so any changes in the Chinese economy could impact the AUD.

The AUD rose after the release of seasonally adjusted S&P Global Purchasing Managers’ Index (PMI) data, which showed Australia’s Composite PMI rising to 55.7 in January from 51.0 in December. The expansion was the strongest in 45 months. Meanwhile, Services PMI climbed to 56.3 from 51.1, marking its highest level since February 2022. The reading beat the flash estimate of 56.0 and remained above the 50.0 threshold, extending the run of expanding services activity to two years.

The Reserve Bank of Australia (RBA) raised the Official Cash Rate (OCR) by 25 basis points (bps) to 3.85% on Tuesday, citing stronger-than-expected growth and a sticky inflation outlook. As the tightening cycle begins, markets have lifted the probability of a May hike to 80% and now price in roughly 40 bps of further tightening over the rest of the year.

RBA Governor Michele Bullock said during the post-meeting press conference that inflation pressures remain too strong, warning it will take longer to return to target and is no longer acceptable. She stressed the board will stay data-dependent and avoid forward guidance.

US Dollar moves little after registering recent losses

- The US Dollar Index (DXY), which measures the value of the US Dollar against six major currencies, remains subdued for the second successive session and is trading near 97.40 at the time of writing. Markets will focus later in the day on the Institute for Supply Management’s (ISM) Services Purchasing Managers Index (PMI), which is expected to ease to 53.5 in January from 54.4 in December.

- The Bureau of Labor Statistics (BLS) will not publish the January employment report on Friday as scheduled because of the partial government shutdown that began last weekend. The shutdown ended late Tuesday after US President Donald Trump signed a funding deal negotiated with Senate Democrats, despite ongoing tensions over his immigration crackdown.

- Monday’s data showed an unexpected rebound in US factory activity, underscoring economic resilience, as the Institute for Supply Management's (ISM) Manufacturing Purchasing Managers' Index (PMI) rose to 52.6 from 47.9 in December, beating market expectations of 48.5.

- US President Donald Trump’s nomination of Kevin Warsh as the next Federal Reserve (Fed) Chair. Markets interpreted Warsh’s appointment as signaling a more disciplined and cautious approach to monetary easing.

- The US Dollar gained traction as risk sentiment improved after the US Senate reached an agreement to advance a government funding package, thereby averting a shutdown, according to Politico.

- US producer-side inflation firmed, moving further away from the Federal Reserve’s 2% target and reinforcing the central bank’s policy stance. US PPI inflation holds steady at 3.0% year-over-year (YoY) in December, unchanged from November and above expectations for a moderation to 2.7%. Core PPI, excluding food and energy, accelerated to 3.3% YoY from 3.0%, defying forecasts for a decline to 2.9% and highlighting persistent upstream price pressures.

- St. Louis Fed President Alberto Musalem said additional rate cuts are not warranted at this stage, characterizing the current 3.50%–3.75% policy rate range as broadly neutral. Similarly, Atlanta Fed President Raphael Bostic urged patience, arguing that monetary policy should remain modestly restrictive.

- Australia’s RBA Trimmed Mean inflation increased to 0.2% month-over-month (MoM) and 3.3% year-over-year (YoY). The monthly CPI rose 1.0% in December, up from 0% previously and above the 0.7% forecast.

- Australia’s export prices rose 3.2% quarter-on-quarter (QoQ) in Q4 2025, rebounding from a 0.9% fall in Q3 and marking the first increase in three quarters, as well as the strongest gain in a year. Meanwhile, import prices climbed 0.9%, beating expectations for a 0.2% decline and reversing a 0.4% drop in Q3.

- China's RatingDog Manufacturing Purchasing Managers' Index (PMI) rose to 50.3 in January from 50.1 in December. This figure came in line with the expectations. The latest reading indicated a slight expansion in factory activity, but the fastest growth since last October.

- Australia’s TD-MI Inflation Gauge rose 3.6% year-over-year (YoY) in January, up from 3.5% previously. The Monthly Inflation Gauge increased by 0.2%, slowing sharply from December’s two-year high of 1% and marking the weakest pace since August.

- ANZ Job Advertisements jumped 4.4% month-over-month (MoM) in December 2025, rebounding from a revised 0.8% decline and posting the first increase since July. The rise was also the strongest monthly gain since February 2022, signaling renewed momentum in hiring toward year-end.

Australian Dollar rebounds toward three-year highs near 0.7100

The AUD/USD pair is trading around 0.7030 on Wednesday. Daily chart analysis indicates that the pair remains within the ascending channel pattern, indicating a persistent bullish bias. The 14-day Relative Strength Index (RSI) is at 73.30; it typically signals bullish momentum, but stretching momentum.

The AUD/USD pair rebounded toward 0.7094, the highest level since February 2023, which was recorded on January 29. A break above this level would support the pair to test the upper ascending channel boundary around 0.7210. On the downside, the primary support lies at the nine-day Exponential Moving Average (EMA) of 0.6964, aligned with the lower boundary of the channel. Further declines would expose the 50-day EMA at 0.6759 support.

AUD/USD: Daily Chart

Australian Dollar Price Today

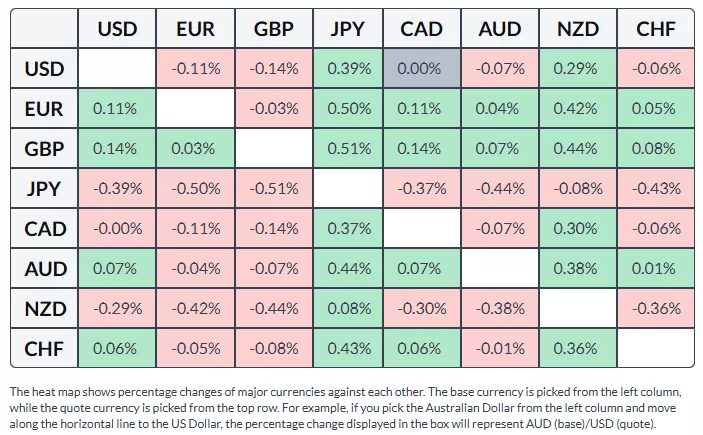

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the Japanese Yen.

More By This Author:

Australian Dollar Advances Ahead Of Rba Policy DecisionWTI Declines To Near $64.00 Despite Elevated Geopolitical Risks

Indian Rupee Receives As Traders Expect RBI Intervention