Australian Dollar Moves Little As US Dollar Remains Steady Ahead Of PMI Data

Image Source: Unsplash

The Australian Dollar (AUD) holds ground against the US Dollar (USD) on Friday after registering losses in the previous session. The AUD/USD pair remains steady following the release of S&P Global Purchasing Managers’ Index (PMI) data.

The S&P Global Australia Composite PMI fell to 52.4 in September from 55.5 in August, marking a full year of monthly growth but at the slowest pace since June. Meanwhile, the Services PMI declined to 52.4 from 55.8, signaling continued expansion in the services sector for the 20th straight month, though also at its weakest rate since June.

Australia’s Trade Surplus narrowed to 1,825 million month-over-month (MoM) in August, against 6,500 million expected and 7,310 million in the previous reading. Meanwhile, Exports fell by 7.8% MoM in August from 3.3% seen a month earlier as Gold exports declined after a run of strong months. Imports rose by 3.2% MoM in August, compared to a decline of 1.3% seen in July.

The Reserve Bank of Australia (RBA) said in its semi-annual Financial Stability Review (FSR) on Thursday that risks emerge from elevated asset prices and stress in sovereign debt markets. It noted that highly leveraged trades and the expansion of the non-bank sector are increasing market vulnerabilities. The RBA also warned that weakness in China’s property sector is weighing on banks and is likely to persist.

The RBA kept its Official Cash Rate (OCR) unchanged at 3.6% at the September monetary policy meeting. RBA Governor Michele Bullock said at a post-meeting press conference that components of the monthly CPI are a little higher than expected, and inflation is not running away.

Australian Dollar steadies as US Dollar extends gains

- The US Dollar Index (DXY), which measures the value of the US Dollar against six major currencies, is extending its gains for the second consecutive day and trading around 97.90 at the time of writing. The US ISM Services PMI and the final S&P Global Services PMI reports are due later in the day.

- The US federal government shut down on Wednesday after Congress failed to reach a funding deal, resulting in a deadlock. The September US Nonfarm Payrolls (NFP) report will not be released on Friday, as the Labor Department has paused virtually all activity.

- The US ADP Employment Change report, released on Wednesday, showed that private sector payrolls declined by 32,000 in September, while annual pay growth was 4.5%. This figure followed the 3,000 decrease (revised from a 54,000 increase) reported in August and came in below the market expectation of 50,000.

- The latest Job Openings showed the labor market is slowing, yet vacancies rose from 7.21 million to 7.23 million in August. Meanwhile, the hiring rate edged down to 3.2%, the lowest level since June 2024, while layoffs remained at a low level.

- The labor market weakness boosts bets on further Federal Reserve (Fed) rate cuts. The CME FedWatch Tool suggests that markets are now pricing in a 99% chance of a Fed rate cut in October and an 87% possibility of another reduction in December.

- Bloomberg reported on Wednesday that China’s state-run iron ore buyer, China Mineral Resources Group (CMRG), directed steelmakers to stop new purchases from Australian mining giant BHP. The news came as China entered its October 1–8 holiday period. However, the Australian Financial Review cited a Chinese commodity pricing firm, Mysteel, which disputed the report, saying it had “verified through relevant channels and confirmed that this rumour is not true.”

- China’s NBS Manufacturing PMI improved to 49.8 in September, following August’s 49.4. The reading came in above the market consensus of 49.6 in the reported month. The NBS Non-Manufacturing PMI inched lower to 50.0 in September, from August’s 50.3 figure and missed the expectations of 50.3.

- The White House announced that Australian Prime Minister Anthony Albanese and US President Donald Trump will hold their first in-person meeting in Washington, D.C. on October 20 to discuss the Aukus nuclear submarine pact.

- Australia’s AiG Industry Index rose 7.6 points to -13.2 in September, showing slight improvement but remaining in contraction. The S&P Global Manufacturing Purchasing Managers’ Index (PMI) fell to 51.4 in September from 53.0 in August, indicating that the sector continued to expand but at a slower pace.

Australian Dollar tests 0.6600 barrier after rebounding from nine-day EMA

The AUD/USD pair is trading around 0.6590 on Friday. Technical analysis on the daily chart shows that the pair remains within the ascending channel, indicating a prevailing bullish bias. Additionally, the 14-day Relative Strength Index (RSI) is positioned slightly above the 50 level, suggesting the bullish bias is active.

On the upside, the AUD/USD pair targets the psychological level of 0.6600. A break above this level may prompt the pair to explore the region around the 12-month high of 0.6707, recorded on September 17, followed by the upper boundary of the ascending channel around 0.6760.

The nine-day Exponential Moving Average (EMA) at 0.6595 is acting as immediate support, followed by the 50-day EMA at 0.6560 and the ascending channel’s lower boundary around 0.6550. Further declines below the channel would likely trigger the emergence of a bearish bias and put downward pressure on the AUD/USD pair, potentially navigating the region around the fourth-month low of 0.6414, recorded on August 21.

AUD/USD: Daily Chart

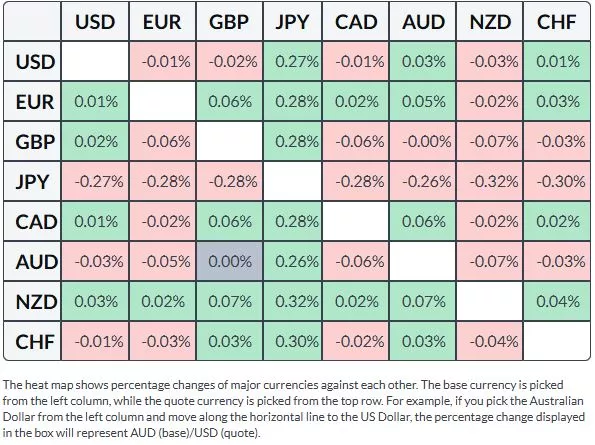

Australian Dollar Price Today

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the weakest against the New Zealand Dollar.

More By This Author:

Australian Dollar Steadies Despite Disappointing Trade Balance DataUSD/CAD Price Forecast: Treads Water Above 1.3900 As Bullish Bias Prevails

Australian Dollar Inches Higher As US Dollar Corrects Downwards

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not ...

more