Australian Dollar Moves Little Ahead Of Looming CPI Data

Image Source: Unsplash

The Australian Dollar (AUD) remains flat against the US Dollar (USD) on Tuesday following two days of gains. Traders adopt caution ahead of the looming November Consumer Price Index (CPI) release due on Wednesday.

The AUD could find support following a recent survey of leading economists cited by the Australian Financial Review, which suggests the Reserve Bank of Australia (RBA) may not be done tightening this cycle. The poll indicates inflation is expected to remain stubbornly elevated over the coming year, fueling expectations of at least two additional rate hikes.

China’s RatingDog Services Purchasing Managers’ Index (PMI), released on Monday, declined to 52.0 in December from 52.1 in November. RatingDog reported last week that Manufacturing PMI climbed to 50.1 in December from 49.9 in November. It is important to note that any change in the Chinese economy could impact the AUD as China and Australia are close trading partners.

US Dollar declines amid Fed rate cut bets

- The US Dollar Index (DXY), which measures the value of the US Dollar against six major currencies, is extending its losses and trading around 98.30 at the time of writing.

- CNN reported over the weekend that the US President Donald Trump administration launched a “large-scale strike against Venezuela” and detained President Maduro to face charges, without congressional approval. Trump said the US would administer Venezuela until a safe, orderly, and judicious transition is achieved.

- The Guardian reported on Monday that President Trump warned Washington could launch a new military intervention if Venezuela’s interim president, Delcy Rodríguez, fails to meet US demands. He also made remarks about Colombia’s leadership, floated the idea of “Operation Colombia,” criticized Mexico for not getting its act together, and suggested Cuba appeared close to collapse.

- Traders expect two additional Federal Reserve rate cuts in 2026. Markets are bracing for US President Donald Trump to nominate a new Fed chair to replace Jerome Powell when his term ends in May, a move that could tilt monetary policy toward lower interest rates.

- Federal Open Market Committee (FOMC) December Meeting Minutes suggested last week that most participants judged that it would likely be appropriate to stand on further rate cuts if inflation declined over time. Meanwhile, some Fed officials said it might be best to leave rates unchanged for a while after the committee made three rate reductions this year to support the weakening labor market.

- China’s official Manufacturing Purchasing Managers' Index (PMI), which rose to 50.1 in December, compared to 49.2 in the previous reading. The reading came in above the market consensus of 49.2 in the reported month. The NBS Non-Manufacturing PMI climbed to 50.2 in December versus November’s 49.5 figure. The market forecast was for a 49.8 print.

- The RBA December Meeting Minutes indicated that policymakers stand ready to tighten policy if inflation fails to ease as expected, placing increased focus on the Q4 CPI report due January 28. Analysts note that a stronger-than-expected Q4 core inflation reading could trigger a rate hike at the RBA’s February 3 meeting.

- Australia’s headline inflation rose to 3.8% in October 2025 from 3.6% in September, remaining above the RBA’s 2–3% target range. As a result, markets are increasingly pricing in a rate hike as early as February 2026, with both the Commonwealth Bank of Australia and National Australia Bank projecting a rise to 3.85% at the RBA’s first policy meeting of the year. Consumer Inflation Expectations rose to 4.7% in December from November’s three-month low of 4.5%.

Australian Dollar eyes 15-month highs after breaking above 0.6700

AUD/USD is trading around 0.6720 on Tuesday. The technical analysis of the daily chart indicates that the pair rebounds from the lower boundary of the ascending channel pattern, suggesting the strengthening bullish bias. The 14-day Relative Strength Index (RSI) at 65.64 suggests bullish momentum, with room for further upside toward overbought conditions.

The AUD/USD pair could test the immediate barrier at 0.6727, the highest level since October 2024, reached on December 29. Further gains could allow the pair to approach the upper boundary of the ascending channel near 0.6820.

On the downside, the AUD/USD pair may find the initial support at the nine-day Exponential Moving Average (EMA) of 0.6693, aligned with the lower ascending channel boundary. A break below the channel could expose the AUD/USD pair to the area around the six-month low near 0.6414, recorded on August 21.

AUD/USD: Daily Chart

Australian Dollar Price Today

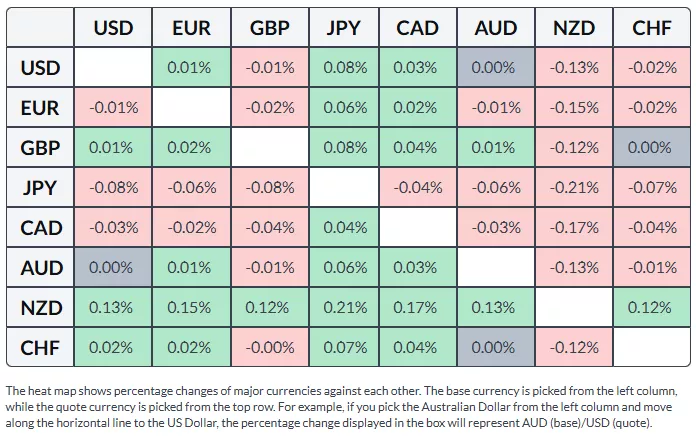

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the Japanese Yen.

More By This Author:

AUD/USD Rises To Near 0.6700 As RBA Rate Hike Bets EmergeGBP/JPY Steadies Near 211.00 As Japan’s Fiscal Policy Weighs On Yen

Australian Dollar Remains Steady Following China's NBS PMI

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not ...

more