Australian Dollar Holds Losses After Building Permits Data

Image Source: Pixabay

- The Australian Dollar loses ground due to increased risk aversion on Tuesday.

- Australia's Building Permits declined by 6.5% MoM in June, swinging from a 5.7% increase in May.

- The US Dollar could lose ground due to increased odds of a Fed rate cut in September.

The Australian Dollar (AUD) edges lower against the US Dollar (USD) following the release of Building Permits data on Tuesday. Australia's Consumer Price Index (CPI) data will be released on Wednesday, offering potential insights into the future direction of the Reserve Bank of Australia’s (RBA) monetary policy. Analysts anticipate a slight re-acceleration in Australia’s headline inflation for the second quarter, with the core rate likely remaining steady.

This inflation report will be pivotal in determining whether the RBA will opt for a rate hike at its policy meeting next week. However, economists have cautioned that an additional increase in interest rates could jeopardize Australia’s economic recovery.

The AUD/USD pair may limit its downside as the US Dollar could face challenges due to heightened expectations of the Federal Reserve’s (Fed) interest rate cut in September. Additionally, signs of cooling inflation and easing labor market conditions in the United States have fueled expectations of three rate cuts by the Fed this year. The Fed's Interest Rate Decision will be a focal point on Wednesday.

Daily Digest Market Movers: Australian Dollar declines due to risk-off mood

- Australia's Building Permits (MoM) fell by 6.5% in June, exceeding market expectations of a 3.0% decline. This follows a 5.7% increase in May. On a year-over-year basis, Building Permits declined by 3.7%, compared to the previous year's decline of 8.5%.

- National Australia Bank (NAB) anticipates that the Reserve Bank of Australia's (RBA) cash rate will remain stable at 4.35% until May 2025, according to a recent NAB Economics outlook. Looking ahead, the NAB Economics team predicts a decline to 3.6% by December 2025, with further decreases expected in 2026.

- In a media release on Monday, the Australian Prudential Regulation Authority (APRA) warned that arrears rates are increasing slowly. Following their latest quarterly assessment of domestic and international economic conditions, APRA announced that they will keep macroprudential policy settings on hold. These comments reflect their ongoing evaluation of both domestic and global economic environments.

- On Friday, the US Personal Consumption Expenditures (PCE) Price Index rose by 2.5% year-over-year in June, down slightly from 2.6% in May, meeting market expectations. On a monthly basis, the PCE Price Index increased by 0.1% after being unchanged in May.

- The US Core PCE inflation, which excludes volatile food and energy prices, also climbed to 2.6% in June, consistent with May's increase and above the forecast of 2.5%. The core PCE Price Index rose by 0.2% month-over-month in June, compared to 0.1% in May.

- Bank of America suggests that robust economic growth in the United States enables the Federal Open Market Committee (FOMC) to "afford to wait" before implementing any adjustments. The BofA notes that the economy "remains strong" and expects the Fed to begin rate cuts in December.

Technical Analysis: Australian Dollar hovers around 0.6550

The Australian Dollar trades around 0.6550 on Tuesday. The daily chart analysis shows that the AUD/USD pair treks the path of a downtrend line. The 14-day Relative Strength Index (RSI) is hovering at the oversold 30 level, indicating that the currency pair may be poised for a potential upward correction soon.

The AUD/USD pair could find immediate support around the key level of 0.6540. A break below this level could exert pressure on the pair to navigate the region around the throwback support at the 0.6470 level.

On the upside, key resistance is at the nine-day Exponential Moving Average (EMA) at 0.6595. A break above this level could lead the AUD/USD pair to test the psychological level of 0.6690, with a potential aim for a six-month high of 0.6798.

AUD/USD: Daily Chart

AUSTRALIAN DOLLAR PRICE TODAY

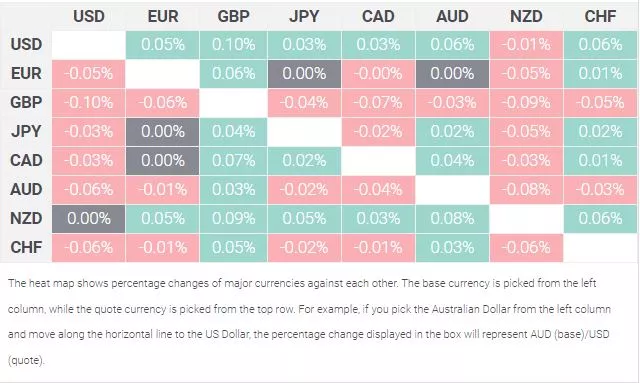

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the British Pound.

More By This Author:

USD/CAD Holds Losses Around 1.3800 After Retreating From Eight-Month Highs

WTI Hovers Around $78.00, Steadies Ahead Of US PCE Inflation

Japanese Yen Comes Under Pressure Following Tokyo CPI

Disclosure: Information on this article contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes ...

more