Australian Dollar Holds Ground Due To Cautious RBA's Policy Stance

Image Source: Unsplash

The Australian Dollar (AUD) remains steady against the US Dollar (USD) on Tuesday. The AUD/USD pair depreciates following the release of October's Westpac Consumer Confidence and September’s ANZ Job Advertisements. The pair also depreciates as the Greenback continues to receive support despite the increased likelihood of further Federal Reserve (Fed) rate cuts and the ongoing government shutdown.

Australia’s Westpac Consumer Confidence declined 3.5% month-over-month (MoM) to 92.1 in October, a sharper decline than the previous 3.1% fall, marking the fastest drop since April. ANZ Job Advertisements slipped 3.3% MoM in September, a much steeper drop than the previous decline of 0.3%.

The TD-MI Inflation Gauge data released on Monday suggested that inflation may come in hotter than anticipated in the third quarter, despite the Reserve Bank of Australia's (RBA) efforts to keep inflation within its 2–3% target range.

The RBA decided to keep its Official Cash Rate (OCR) unchanged at 3.6% at the September monetary policy meeting. The Australian central bank warned that inflation has proven more persistent than expected, especially in market services, while the labor market remains tight.

Traders will likely observe speeches from Reserve Bank of Australia (RBA) officials this week, which are expected to provide further insight into the central bank’s policy outlook following the latest inflation data.

Australian Dollar remains subdued as US Dollar extends gains despite market caution

- The US Dollar Index (DXY), which measures the value of the US Dollar against six major currencies, is extending its gains and trading around 98.10 at the time of writing.

- The CME FedWatch Tool suggests that markets are now pricing in a 94% chance of a Fed rate cut in October and an 84% possibility of another reduction in December.

- Kansas City Fed President Jeffrey Schmid delivered hawkish remarks on Monday, saying that the Fed must maintain its inflation credibility and stressed that inflation is too high. Schmid added that monetary policy is appropriately calibrated.

- United States (US) Senators failed to pass spending proposals to reopen the federal government for a fourth time, extending the ongoing shutdown into a new week. The closure has suspended key federal programs and delayed major economic reports, including September’s jobs data originally due Friday.

- The US ADP Employment Change report, released on Wednesday, showed that private sector payrolls declined by 32,000 in September, while annual pay growth was 4.5%. This figure followed the 3,000 decrease (revised from a 54,000 increase) reported in August and came in below the market expectation of 50,000.

- The latest Job Openings showed the labor market is slowing, yet vacancies rose from 7.21 million to 7.23 million in August. Meanwhile, the hiring rate edged down to 3.2%, the lowest level since June 2024, while layoffs remained at a low level.

- The White House announced that Australian Prime Minister Anthony Albanese and US President Donald Trump will hold their first in-person meeting in Washington, D.C. on October 20 to discuss the Aukus nuclear submarine pact.

- TD-MI Inflation Gauge showed a 0.4% increase month-over-month in September, rebounding from a 0.3% fall in the prior month. Meanwhile, the annual inflation gauge rose 3%, following the previous 2.8% increase.

Australian Dollar hovers around 0.6600 support near nine-day EMA

The AUD/USD pair is trading around 0.6610 on Tuesday. Technical analysis on the daily timeframe suggests that the pair is moving within the ascending channel, indicating a prevailing bullish bias. Additionally, the 14-day Relative Strength Index (RSI) is positioned above the 50 level, strengthening the bullish bias.

On the upside, the AUD/USD pair may explore the region around the 12-month high of 0.6707, recorded on September 17. A break above this level would support the pair to test the upper boundary of the ascending channel around 0.6790.

The initial support lies at the psychological level of 0.6600, aligned with the nine-day Exponential Moving Average (EMA) of 0.6602. Further declines would lead to the support at the 50-day EMA of 0.6563, aligned with the ascending channel’s lower boundary around 0.6560. A break below the channel would likely cause the emergence of a bearish bias and put downward pressure on the AUD/USD pair to navigate the area around the fourth-month low of 0.6414, recorded on August 21.

AUD/USD: Daily Chart

Australian Dollar Price Today

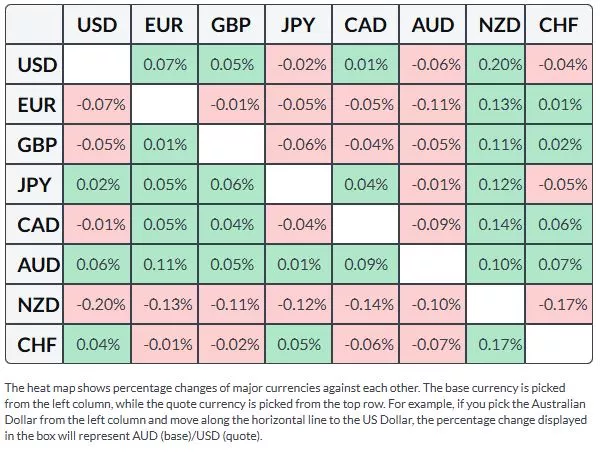

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the Euro.

More By This Author:

Australian Dollar Moves Little As US Dollar Remains Steady Ahead Of PMI DataAustralian Dollar Steadies Despite Disappointing Trade Balance Data

USD/CAD Price Forecast: Treads Water Above 1.3900 As Bullish Bias Prevails

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not ...

more