Australian Dollar Holds Gains A US Dollar Loses Ground Ahead Of CPI Inflation Report

Image Source: Unsplash

- The Australian Dollar appreciates as Australia is preparing for renewed trade negotiations with the European Union.

- China’s Consumer Price Index declined 0.1% YoY in March, following a 0.7% drop in February.

- President Trump announced a 90-day pause on new tariffs for most US trade partners, reducing them to 10%.

The Australian Dollar (AUD) regained its ground against the US Dollar (USD) on Thursday following the news that Australia is gearing up for renewed trade negotiations with the European Union (EU). The EU decided to revisit the stalled talks. During a one-hour video meeting on Wednesday evening, EU Trade Commissioner Maros Sefcovic suggested setting a new timeline to restart discussions with his Australian counterpart, Don Farrell. The previous round of extensive negotiations broke down two years ago due to disagreements over agricultural access to the EU’s 450 million consumers.

The AUD/USD pair weakened after US President Donald Trump escalated trade tensions with China by raising tariffs on Chinese imports to 125%, prompting concern due to Australia’s close trade ties with China.

China is increasing tariffs on all US imports to 84% and has added six American firms—such as defense and aerospace companies Shield AI and Sierra Nevada—to its trade blacklist. It also imposed export controls on a dozen US companies, including American Photonics and BRINC Drones.

China’s Consumer Price Index (CPI) fell 0.1% year-over-year in March, following a 0.7% decline in February and missing the forecasted 0.1% rise. The monthly CPI inflation fell by 0.4%, worse than February’s 0.2% decline and market expectations. Meanwhile, the Producer Price Index (PPI) dropped 2.5% annually in March, deeper than the 2.2% fall in February and the projected 2.3% decline.

Australia’s economic outlook remains fragile, with business and consumer confidence lagging. The weak data has strengthened expectations of a more dovish Reserve Bank of Australia (RBA), with markets now pricing in up to 100 basis points in rate cuts this year—beginning in May, with further reductions expected in July and August.

Australian Dollar may face headwinds ahead of US CPI data

- The US Dollar Index (DXY), which tracks the USD against a basket of six major currencies, is trading lower near 102.60 at the time of writing. Attention now turns to the US Consumer Price Index (CPI) inflation report, due later on Thursday.

- On Wednesday, President Trump announced a 90-day pause on new tariffs for most US trade partners, lowering them to 10% to allow room for ongoing negotiations. “The 90-day pause is an encouraging sign that negotiations with most countries have been productive,” said Mark Hackett of Nationwide. “It also injects some much-needed stability into a market rattled by uncertainty.”

- The Federal Open Market Committee (FOMC) Meeting Minutes suggested that policymakers nearly unanimously agree that the US economy faces the dual risk of rising inflation and slowing growth, warning of “difficult tradeoffs” ahead for the Federal Reserve.

- Fed officials continue to downplay the immediate impact of escalating trade tensions, maintaining that policy decisions will remain data-driven. Market participants are now pricing in just a 40% chance of a rate cut at next month’s Fed meeting, according to the CME FedWatch tool.

- Adding to the global trade landscape, The Wall Street Journal reported that China held discussions with European Union trade chief Maros Sefcovic, expressing its willingness to deepen trade, investment, and industrial cooperation with the EU.

- In Australia, consumer sentiment weakened notably, with the Westpac Consumer Confidence Index falling 6% in April after a 4% gain in March—the first decline since January.

- Australia’s business sentiment also softened as the NAB Business Confidence Index slipped to -3 in March from a revised -2, its lowest reading since November. Business conditions remained relatively steady but slightly below average, improving modestly from 3 to 4.

Australian Dollar pulls back from nine-day EMA near 0.6150

The AUD/USD pair is trading near 0.6140 on Thursday, with technical indicators on the daily chart pointing to a sustained bearish bias, as the pair has retreated from the nine-day Exponential Moving Average (EMA). Additionally, the 14-day Relative Strength Index (RSI) sits below 50, suggesting the reinforcement of the bearish bias.

Immediate support is seen at the 0.5914—marking the lowest level since March 2020, followed by the psychological level of 0.5900.

On the upside, initial resistance lies at the nine-day EMA around 0.6147, followed by the 50-day EMA at 0.6261. A stronger recovery could be seen in the pair, testing the four-month high at 0.6408.

AUD/USD: Daily Chart

Australian Dollar PRICE Today

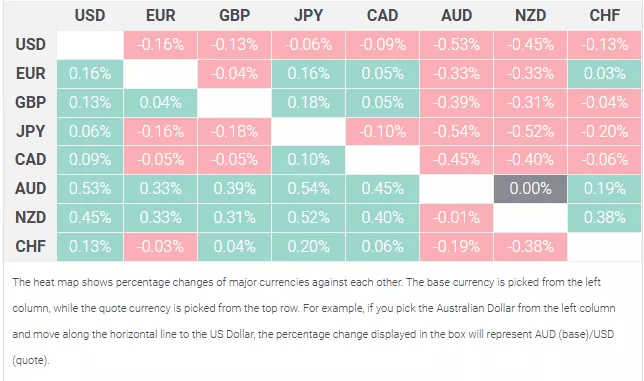

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the US Dollar.

More By This Author:

EUR/GBP Climbs Toward 0.8600 Amid Growing Hopes Of Easing Trade TensionsSilver Price Forecast: XAG/USD Pulls Back From Five-Month High Near $34.50

USD/CAD Remains Subdued Near 1.4250 Despite Concerns Over Impending US Auto Tariffs

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not ...

more