Australian Dollar Grapples To Hold Position Despite Upbeat China Inflation

Image Source: Unsplash

- The Australian Dollar receives pressure despite higher-than-expected Chinese inflation data.

- China's CPI increased 0.5% YoY in July, against the expected 0.3% and previous 0.2% readings.

- CME FedWatch tool suggests 100% odds of a 25-basis point Fed rate cut in September.

The Australian Dollar (AUD) edges lower as the US Dollar (USD) advances further following the recent US Initial Jobless Claims, which eased in the previous week. However, the AUD/USD pair gained ground following the hawkish comments from Reserve Bank of Australia (RBA) Governor Michele Bullock on Thursday.

China's Consumer Price Index (CPI) rose 0.5% year-on-year in July, exceeding the expected 0.3% and previous 0.2% readings. Meanwhile, the monthly index also increased 0.5%, swinging from the previous decline of 0.2%. Any change in the Chinese economy could impact the Australian markets as both countries are close trade partners.

Governor Bullock highlighted the importance of remaining cautious regarding inflation risks and expressed readiness to raise rates if needed, noting that inflation might not fall back to the 2–3% target range until late 2025. Additionally, the Aussie Dollar saw gains following the RBA's assertive choice to keep the cash rate at 4.35% on Tuesday.

The upside of the US Dollar could be restrained as the US Federal Reserve (Fed) is widely anticipated to implement a rate cut in September. According to the CME FedWatch tool, markets are now fully pricing in a quarter-basis point interest rate cut by the Fed in September.

Daily Digest Market Movers: Australian Dollar grapples to extend gains due to hawkish RBA

- Westpac updated its RBA forecast, now predicting the first-rate cut will occur in February 2025, a shift from the previously anticipated November 2024. They also revised their terminal rate forecast to 3.35%, up from the previous 3.10%. The RBA is now viewed as more cautious, needing stronger evidence before considering rate cuts.

- On Thursday, Kansas City Fed President Jeffrey Schmid stated that reducing monetary policy could be "appropriate" if inflation remains low. Schmid noted that the current Fed policy is "not that restrictive" and that while the Fed is close to its 2% inflation goal, it has not yet fully achieved it, per Reuters.

- US Initial Jobless Claims dropped to 233,000 for the week ending August 2, coming in under the market expectation of 240,000. This decline follows an upwardly revised figure of 250,000 for the previous week, which was the highest in a year.

- China's Trade Balance showed a surplus of 84.65 billion for July, falling short of the 99.0 billion expected and 99.05 billion previously. Exports (YoY) came in at 7.0% vs. 9.7% expected and 8.6% previously. Meanwhile, Imports increased 7.2% YoY against 3.5% expected, swinging from a decline of 2.3% prior.

- The AiG Australian Industry Index showed a slight easing in contraction in July, improving to -20.7 from the previous -25.6 reading. Despite this improvement, the index has indicated contraction for the past twenty-seven months.

- On Wednesday, Treasurer Jim Chalmers contested the RBA's view that the economy remains too robust and that large government budgets are contributing to prolonged inflation, according to Macrobusiness.

- On Tuesday, RBA Governor Michele Bullock mentioned that the board had seriously considered increasing the cash rate from 4.35% to 4.6% due to ongoing concerns about excess demand in the economy. Additionally, RBA Chief Economist Sarah Hunter noted on Wednesday that the Australian economy is performing somewhat stronger than previously anticipated by the RBA.

Technical Analysis: Australian Dollar rises to near 0.6600

The Australian Dollar trades around 0.6590 on Friday. The daily chart analysis shows that the AUD/USD pair moves upward within an ascending channel, indicating a bullish bias. Meanwhile, the 14-day Relative Strength Index (RSI) is approaching the 50 level. A break above the 50 level could confirm the bullish bias.

In terms of support, the AUD/USD pair may find immediate support at throwback support of 0.6575 level. A break below this level could reinforce the bearish bias and exert pressure on the pair to test the lower boundary of the ascending channel around the 0.6520 level. Further support appears at the throwback support level of 0.6470.

On the upside, the pair could test the upper boundary of the ascending channel at the 0.6610 level. A breakthrough above this level could lead the AUD/USD pair to explore the region again around a six-month high of 0.6798.

AUD/USD: Daily Chart

Australian Dollar PRICE Today

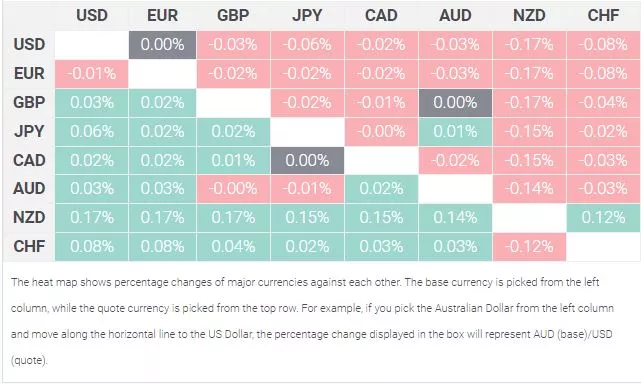

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the Euro.

More By This Author:

Silver Price Forecast: XAG/USD rises to near $27.00 due to rising odds of a Fed rate cutEUR/GBP Trades Above 0.8600, Holds Position Near Three-Month Highs

USD/CHF falls to near 0.8500 due to safe-haven flows, ISM Services PMI awaited

Disclosure: Information on this article contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes ...

more