Australian Dollar Gains Ground As US Dollar Struggles Amid Concerns Over Fed Independence

Image Source: Unsplash

- The Australian Dollar extends its winning streak for the fifth consecutive day.

- President Trump may announce his preferred candidate to lead the Federal Reserve next year.

- The US Dollar depreciated due to risk-on sentiment following a fragile US-brokered Israel-Iran ceasefire.

The Australian Dollar (AUD) inches higher on Friday, extending its winning streak for the fifth successive session. The AUD/USD pair remains stronger as the US Dollar (USD) struggles due to renewed concerns over the US Federal Reserve’s (Fed) independence.

US President Donald Trump could weaken Fed Chair Jerome Powell’s authority by announcing his preferred candidate to lead the central bank next year. Trump said that he has a list of potential Powell successors down to “three or four people,” without naming the finalists.

The US Dollar also faced challenges amid improving risk appetite, driven by a fragile US-brokered Israel-Iran ceasefire. Traders will likely focus on the developments surrounding US-Iran talks and Middle East conflicts.

US President Donald Trump noted that the United States (US) and Iran would hold a meeting next week but questioned the need for a diplomatic solution on Iran's nuclear program, citing the damage that American bombing had done to key sites, per Bloomberg.

Australian Dollar advances as US Dollar loses ground due to risk-on mood

- The US Dollar Index (DXY), which measures the value of the US Dollar against six major currencies, is trading at around 97.40 at the time of writing. Traders await the US May Personal Consumption Expenditures (PCE) Price Index data later on Friday.

- US President Donald Trump may announce a successor for Federal Reserve (Fed) Chair Jerome Powell by September or October. Trump might consider former Fed Governor Kevin Warsh and National Economic Council Director Kevin Hassett, according to the Wall Street Journal.

- Chicago Fed President Austan Goolsbee said on Thursday that the political waves are not a factor in decision-making, nor would the naming of a shadow chair, per CNBC.

- Fed Chair Jerome Powell noted on Wednesday that Trump's tariff policies may cause a one-time price hike, but they could also lead to more persistent inflation. The Fed should be careful in considering further rate cuts.

- Fed’s Powell highlighted during his testimony before the Congressional Budget Committee on Tuesday, strengthening his case for delaying rate cuts, likely until sometime in the fourth quarter. Powell added, “When the time is right, expect rate cuts to continue.” He also said that data suggests that at least some of the tariffs will hit consumers and will start to see more tariff inflation starting in June.

- Minneapolis Fed President Neel Kashkari reaffirmed the Fed's wait-and-see stance on potential tariff impacts on inflation and the broader economy in general before making any hard decisions on moving interest rates.

- Kansas City Fed President Jeff Schmid said early Wednesday that the central bank should wait to see how uncertainty surrounding tariffs and other policies impacts the economy before adjusting interest rates. Schmid added that the resilience of the economy gives us the time to observe how prices and the economy develop, per Bloomberg.

- A US intelligence report indicated that US strikes on Iranian nuclear sites have set back Tehran's program by only a matter of months, per Reuters. Additionally, Iranian Foreign Minister Abbas Araghchi said that the country's nuclear program continues, per the local news agency Al Arabiya.

- China’s state planner, the National Development and Reform Commission (NDRC), said on Thursday that they are “confident in minimizing uncertainty and negative impact of external shocks.” They also noted that “With policy implementation and introduction, we are confident and capable of minimizing the adverse impacts from external shock.”

- China’s Premier Li Qiang made some encouraging comments on the economic outlook in his appearance on Thursday. Li said that the domestic economy shows strong resilience and development potential. China’s economic data shows stability in Q2, he added.

- Australian Bureau of Statistics (ABS) reported vacancies rose by 2.9% in the three months to May, partly recovering from a 4.3% decline in the previous quarter ended February. Australia’s labor demand remained resilient despite a soft economy as job vacancies rebounded in the May quarter, driven by openings in the construction and professional sectors. However, job openings stood at 339,400 in May, down 2.8% from a year earlier, the smallest annual decline in the past two years.

Australian Dollar hovers around 0.6550 support near seven-month highs

AUD/USD is trading around 0.6550 on Friday. The daily technical analysis indicates a persistent bullish bias as the pair remains within the ascending channel pattern. The 14-day Relative Strength Index (RSI) is positioned above the 50 mark. Additionally, the pair rises above the nine-day Exponential Moving Average (EMA), indicating that short-term price momentum is stronger.

On the upside, the AUD/USD pair is testing the seven-month high of 0.6552, which was recorded on June 16, followed by the upper boundary of the ascending channel around 0.6570.

The nine-day EMA at 0.6511 is poised to act as primary support. A break below this level would weaken the short-term price momentum and put downward pressure on the AUD/USD pair to test the lower boundary of the ascending channel around 0.6450, aligned with the 50-day EMA at 0.6447.

AUD/USD: Daily Chart

Australian Dollar PRICE Today

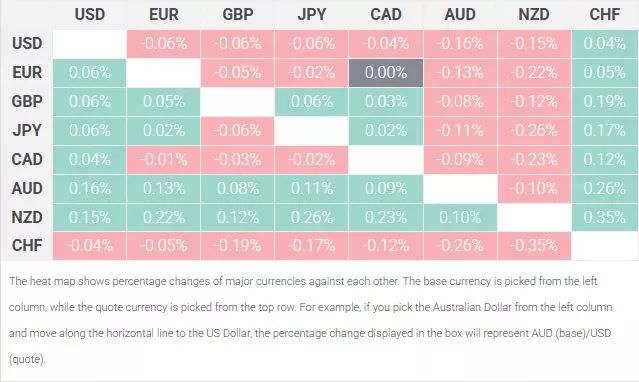

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the Swiss Franc.

More By This Author:

EUR/JPY Price Forecast: Moves Below 168.00 Toward Nine-Day EMA SupportAustralian Dollar Holds Gains As US Dollar Remains Weaker, Q1 GDP Annualized Eyed

Australian Dollar Advances As Middle East Ceasefire Improves Market Sentiment

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not ...

more