Australian Dollar Gains As Westpac Leading Economic Index Rises In December

Image Source: Unsplash

The Australian Dollar gains ground against the US Dollar (USD) on Wednesday, extending its gains for the third successive session. The AUD/USD pair appreciates as the Greenback continues to lose ground amid rising United States (US)–Greenland concerns.

The Westpac–Melbourne Institute Leading Economic Index for Australia rose 0.1% month-on-month (MoM) in December 2025, after remaining unchanged in the prior month. At the same time, the six-month annualized growth rate increased to 0.42% from 0.20% in November, indicating that the economic recovery through 2025 is extending into early 2026.

The AUD also finds support as emerging upward price pressures strengthen expectations of tighter monetary policy from the Reserve Bank of Australia (RBA). The International Monetary Fund (IMF) has urged the RBA to remain cautious, highlighting that inflation has stayed above the Bank’s 2%–3% target band for a prolonged period, even though headline CPI eased more quickly than anticipated in November.

The People’s Bank of China (PBOC), China's central bank, announced on Tuesday that it would leave its Loan Prime Rates (LPRs) unchanged. The one-year and five-year LPRs were at 3.00% and 3.50%, respectively. It is essential to note that any changes in the Chinese economy could impact the Australian Dollar, as both countries are close trading partners.

US Dollar weakens as US–Greenland concerns aggravate

- The US Dollar Index (DXY), which measures the value of the US Dollar against six major currencies, is extending its losses and trading around 98.50 at the time of writing.

- US President Donald Trump said there is “no going back” on his ambitions regarding Greenland, alongside earlier threats to impose new 10% tariffs on eight European Union (EU) countries, fueling concerns over slower economic growth.

- The European Parliament plans to suspend approval of the US trade deal agreed in July, with the decision set to be announced on Wednesday in Strasbourg, France, signaling an escalation in US–Europe tensions.

- US labor market data has pushed back expectations for further Federal Reserve (Fed) rate cuts until June. Fed officials have signaled little urgency to ease policy further until there is clearer evidence that inflation is sustainably moving toward the 2% target. Morgan Stanley analysts revised their 2026 outlook, now forecasting one rate cut in June followed by another in September, compared with their previous expectation of cuts in January and April.

- Data from the National Bureau of Statistics showed on Monday that China’s Industrial Production rose 5.2% year-over-year YoY in December, accelerating from 4.8% in November, supported by resilient export-driven manufacturing activity. Meanwhile, Retail Sales rose 0.9% YoY, undershooting forecasts of 1.2% and November’s 1.3%.

- China’s Gross Domestic Product (GDP) rose 1.2% quarter-over-quarter in Q4 2025, accelerating from 1.1% in Q3 and exceeding the market consensus of 1.0%. On an annual basis, GDP grew 4.5% in Q4, easing from 4.8% in the previous quarter but coming in above expectations of a 4.4% reading.

- Australia’s TD-MI Inflation Gauge, released on Monday, rose to 3.5% year-over-year (YoY) in December, up from 3.2% previously. On a monthly basis, inflation surged 1.0% month-over-month (MoM) in December 2025, the fastest pace since December 2023 and a sharp acceleration from 0.3% in the prior two months.

- RBA policymakers acknowledged that inflation has eased significantly from its 2022 peak, though recent data suggests renewed upward momentum. Headline CPI slowed to 3.4% YoY in November, the lowest reading since August, but remains above the RBA’s 2–3% target band. Meanwhile, trimmed mean CPI edged down to 3.2% from October’s eight-month high of 3.3%.

- The RBA assessed that inflation risks have modestly tilted to the upside, while downside risks, particularly from global conditions, have diminished. Board members expect only one additional rate cut this year, with underlying inflation projected to remain above 3% in the near term before easing to around 2.6% by 2027.

Australian Dollar rises to near 0.6750 near 15-month highs

The AUD/USD pair is trading around 0.6740 on Wednesday. Daily chart analysis indicates that the pair is rising above the nine-day Exponential Moving Average (EMA), pointing to a bullish bias for the short term. Meanwhile, the 14-day Relative Strength Index (RSI), at 62.90, is reinforcing underlying upside momentum.

On the upside, the AUD/USD pair could target the 15-month high of 0.6766. The immediate support lies at the nine-day EMA of 0.6712. A daily close below the short-term average may bring the 50-day EMA at 0.6651 into focus as initial support. Deeper losses could then extend toward 0.6414, the lowest level since June 2025.

AUD/USD: Daily Chart

Australian Dollar Price Today

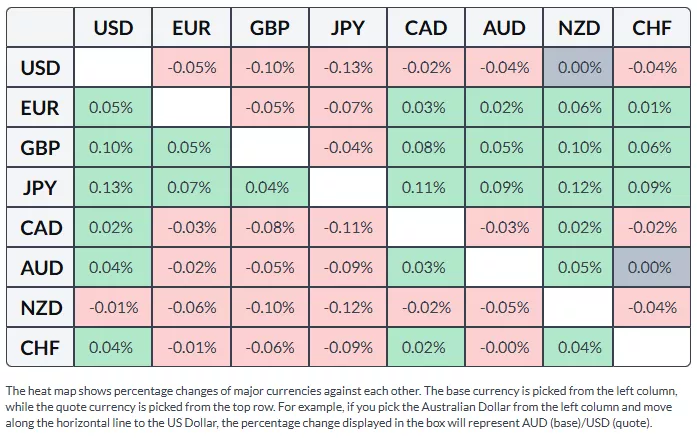

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the New Zealand Dollar.

More By This Author:

Dow Jones Futures Slump Due To US-Greenland Dispute, EU Trade RisksUS Dollar Index Holds Near 99.50 As Jobless Claims Bolster Fed Pause

Gold Retreats To Near $4,600 As Fed Rate Pause Expectations Grow