Australian Dollar Gains As CPI Beats Forecasts, Fed Rate Cut Bets Grow

Image Source: Unsplash

The Australian Dollar (AUD) advances against the US Dollar (USD) on Wednesday, extending its gains for the fourth successive session. The AUD/USD pair holds ground after the Australian Bureau of Statistics (ABS) released the first “complete” monthly Consumer Price Index (CPI), which climbed by 3.8% year-over-year (YoY) in October. The reading surpassed the market consensus of a 3.6% rise and a 3.5% increase prior.

The AUD could gain ground as the first monthly CPI increased the cautious sentiment surrounding the Reserve Bank of Australia (RBA) policy outlook. The RBA is expected to maintain the Official Cash Rate (OCR) at 3.6% in December as inflation remains above the RBA’s 2–3% target range. RBA officials noted that the unemployment rate has risen slightly, but the job market remains healthy and is expected to continue doing so.

Minutes from the RBA’s November meeting indicated the central bank may keep rates unchanged for an extended period. The ASX 30-Day Interbank Cash Rate Futures indicate that, as of November 25, the December 2025 contract was trading at 96.41, implying a 6% probability of a rate cut to 3.35% from 3.60% at the upcoming RBA Board meeting.

US Dollar struggles as recent data increase Fed rate cut bets

- The US Dollar Index (DXY), which measures the value of the US Dollar against six major currencies, is holding ground after registering modest losses in the previous session and trading around 99.80 at the time of writing. The Greenback faced challenges amid rising expectations of a Fed rate cut in December, driven by soft US data.

- The CME FedWatch Tool suggests that markets are now pricing in a more than 84% chance that the Fed will cut its benchmark overnight borrowing rate by 25 basis points (bps) at its December meeting, up from the 50% probability that markets priced a week ago.

- The US Producer Price Index (PPI) remained steady at 2.7% year-over-year in September, matching expectations and August’s reading and suggesting that inflationary pressures have stabilized. Core PPI eased to 2.6% from 2.9%, undershooting forecasts of 2.7%.

- The US Retail Sales rose by 0.2% month-over-month (MoM) in September, slowing from the 0.6% increase seen in August, indicating more cautious consumer spending. Separately, the Conference Board reported a sharp deterioration in household sentiment, with Consumer Confidence sliding 6.8 points to 88.7 in November from 95.5 in October.

- Fed Governor Christopher Waller told Fox Business on Monday that his main concern is the weakening labour market, adding that inflation is “not a big problem” given the recent softness in employment. He also said the September payrolls figure will likely be revised lower and warned that concentrated hiring is “not a good sign,” indicating his support for a near-term rate cut.

- New York Fed President John Williams said on Friday that policymakers could still cut rates in the “near-term,” a remark that lifted market odds for a December move. Moreover, Fed Governor Stephen Miran said that Nonfarm Payrolls data support a December rate cut, adding that if his vote were decisive, he “would vote for a 25-bps cut.”

- The preliminary reading of Australia's S&P Global Manufacturing Purchasing Managers Index (PMI) came in at 51.6 in November, versus 49.7 prior. Meanwhile, Services PMI rose to 52.7 in November from the previous reading of 52.5, while the Composite PMI increased to 52.6 in November versus 52.1 prior.

- The Reserve Bank of Australia published the Minutes of its November monetary policy meeting last week, indicating that board members signalled a more balanced policy stance, adding that it could keep the cash rate unchanged for longer if incoming data proves stronger than expected.

- RBA Assistant Governor Sarah Hunter noted last week that “sustained above-trend growth could fuel inflationary pressures.” Hunter noted that monthly inflation data can be volatile and that the central bank won’t react to a single month of figures. She added that the RBA is closely assessing labour-market conditions to gauge supply capacity and is examining how the effects of monetary policy may be changing over time.

Australian Dollar could target 0.6500 after decisively breaking above nine-day EMA

The AUD/USD pair is trading around 0.6480 on Wednesday. The daily chart analysis shows the pair holding within a rectangular consolidation zone, signaling a neutral bias. The pair continues to trade below the nine-day Exponential Moving Average (EMA), highlighting subdued short-term upward momentum.

The AUD/USD pair finds immediate support at the lower boundary of the rectangle around 0.6420, followed by the five-month low of 0.6414, set on August 21.

On the upside, the pair hovers around the nine-day EMA at 0.6479. A successful break above this moving average would support the AUD/USD pair to test the psychological level of 0.6500. Further advances would lead the pair to reach the rectangle’s upper boundary near 0.6630.

AUD/USD: Daily Chart

Australian Dollar Price Today

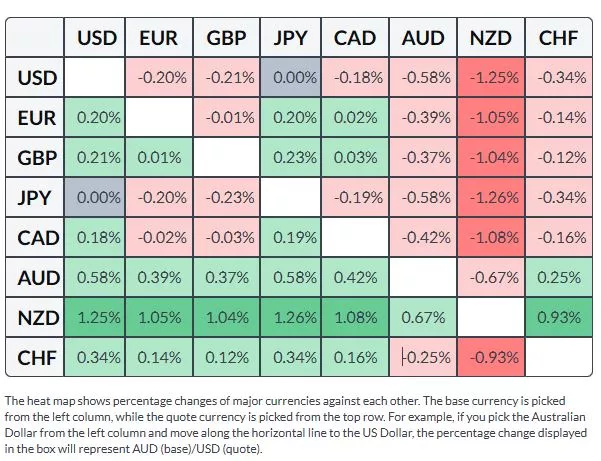

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the Japanese Yen.

More By This Author:

EUR/USD Rises To Near 1.1600 As US Data Boost Fed Rate Cut Bets

EUR/JPY Price Forecast: Tests 180.50 Support Near Nine-Day EMA

USD/CAD Price Forecast: Hovers Around 1.4100 As Bullish Bias Persists

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not ...

more