Australian Dollar Extends Losses Due To Risk Aversion After Stronger US PMI

Image Source: Unsplash

- The Australian Dollar continues to lose ground after the release of higher-than-expected US PMI data.

- Australian equities faced pressure due to the lower commodity prices amid hawkish sentiment surrounding the Fed.

- US Dollar gained ground after FOMC Minutes suggested a lack of progress on inflation.

The Australian Dollar (AUD) continues its losing streak for the fourth successive session on Friday, possibly driven by risk aversion. The AUD/USD pair experiences downside as the US Dollar (USD) advances on hawkish sentiment surrounding the Federal Reserve (Fed) of maintaining higher policy rates for an extended period.

The Australian Dollar came under pressure as the Consumer Inflation Expectation of future inflation over the next 12 months fell to 4.1% in May from 4.6% in April, marking the lowest level since October 2021. This has increased the risk of inflation remaining above the target for an extended period. The latest Reserve Bank of Australia (RBA) meeting minutes showed that the policymakers agreed that it was challenging to either rule in or rule out future changes in the cash rate.

The US Dollar (USD) extends its gains as higher-than-expected Purchasing Managers Index (PMI) data from the United States (US), was released on Thursday. The data raised concerns that interest rates will remain elevated for much more time, sending Treasury yields higher. Additionally, the latest Federal Open Market Committee (FOMC) Minutes showed that Fed policymakers expressed concerns about the lack of progress on inflation, which was more persistent than expected at the start of 2024.

Daily Digest Market Movers: Australian Dollar extends losses due to risk aversion

- The ASX 200 Index has rebounded, trading around 7,740 on Friday. However, Australian equities faced pressure amid lower commodity prices as stronger-than-expected US PMI data raised concerns that the Federal Reserve might maintain higher interest rates for a longer period.

- The S&P Global US Composite PMI surged to 54.4 in May, up from April's 51.3. The index marked the highest level since April 2022 and exceeded market expectations of 51.1. The Service PMI rose to 54.8, indicating the biggest output growth in a year, while the Manufacturing PMI increased to 50.9.

- According to the CME FedWatch Tool, the probability of the Federal Reserve implementing a 25 basis-point rate cut in September has decreased to 46.6% from 49.4% a day earlier.

- The preliminary data showed on Thursday that Australian private sector activity remained expansionary for the fourth straight month in May. The preliminary Judo Bank Composite Purchasing Managers Index (PMI) decreased to 52.6 in May from April’s reading of 53.0, indicating a slight moderation in growth.

- The Judo Bank Australia Services PMI was 53.1 in May, down from April’s reading of 53.6. This marks the fourth consecutive month of expansion, albeit at a slower yet still solid pace. The Manufacturing PMI remained unchanged at 49.6 in May, indicating that manufacturing conditions continued to deteriorate for the fourth consecutive month.

- Reuters cited Chinese state media reports on Thursday, which indicated that China has deployed numerous fighter jets and conducted simulated strikes in the Taiwan Strait and around groups of Taiwan-controlled islands. Any geopolitical tension in the region may impact the Australian market as China and Australia are both close trade partners.

Technical Analysis: Australian Dollar hovers around the psychological level of 0.6600

The Australian Dollar trades around 0.6600 on Friday. Analysis of the daily chart indicates a weakening bullish bias as the AUD/USD pair has breached the lower boundary of a rising wedge. Additionally, the 14-day Relative Strength Index (RSI) is positioned at the 50 level. A further decline in this momentum indicator could confirm a bearish bias.

The major support level at 0.6550 is significant. A continued decline may increase pressure on the AUD/USD pair, potentially driving it toward the throwback support region at 0.6470.

On the upside, the nine-day Exponential Moving Average (EMA) at 0.6630, near the lower boundary of the rising wedge, could pose immediate resistance. A breakthrough above this level could reinforce the prevailing bullish bias for the AUD/USD pair, potentially leading it to reach the major level of 0.6650.

AUD/USD: Daily Chart

Australian Dollar price today

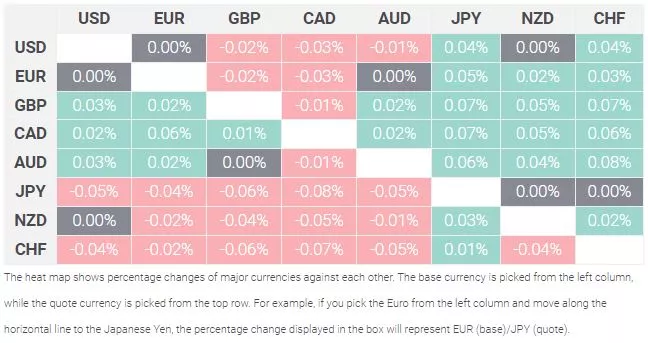

The table below shows the percentage change of the Australian Dollar (AUD) against listed major currencies today. The Australian Dollar was the weakest against the Canadian Dollar.

More By This Author:

EUR/USD Remains Above 1.0800 Ahead Of Eurozone PMISilver Price Forecast: XAG/USD Falls To Near $31.50 Amid Hawkish Fedspeak

NZD/USD Rises Toward 0.6150 After The RBNZ Decides To Keep OCR Unchanged

Disclosure: Information on this article contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes ...

more