Australian Dollar Extends Gains Due To The Hawkish Sentiment Surrounding RBA

Image Source: Unsplash

- The Australian Dollar gains ground due to the hawkish sentiment surrounding the RBA.

- Australia's Consumer Inflation Expectations for July posted a reading of 4.3%, slightly lower than June’s 4.4% reading.

- The US Dollar declines due to the lower Treasury yields ahead of Consumer Price Index data for June.

The Australian Dollar (AUD) holds gains on Thursday after the release of soft Consumer Inflation Expectations for July by the Melbourne Institute, which presents consumer expectations for inflation over the next 12 months.

The AUD/USD pair receives support from increasing expectations that the Reserve Bank of Australia (RBA) may delay the global rate-cutting cycle or possibly raise interest rates again. Recent data showed a decline in Australian consumer confidence in July, contrasted by a surge in business sentiment, reaching a 17-month high in June.

The US Dollar (USD) loses ground, potentially influenced by the lower US Treasury yields. Traders are looking to the upcoming US Consumer Price Index (CPI) data for June, due on Thursday, for further insights into the Federal Reserve’s (Fed) monetary policy stance.

Market forecasts generally predict that the annualized US core CPI for the year ending in June will remain steady at 3.4%. Meanwhile, headline CPI inflation is expected to increase to 0.1% month-over-month in June, compared to the previous flat reading of 0.0%.

Daily Digest Market Movers: Australian Dollar improves due to hawkish sentiment surrounding the RBA

- Australia's Consumer Inflation Expectations for July came in at 4.3%, slightly lower than the previous reading of 4.4%.

- Federal Reserve Board Governor Lisa Cook stated on Wednesday, "My baseline forecast...is that inflation will continue to move toward target over time, without much further rise in unemployment," according to Reuters.

- On Wednesday, Fed Chair Jerome Powell emphasized the need to closely monitor the labor market, noting that it has significantly deteriorated. Additionally, Powell expressed confidence in the downward movement of inflation.

- Consumer Price Index (CPI) in China, a close trade partner of Australia, rose at an annual rate of 0.2% in June, down from a 0.3% rise in May. The market had forecasted a 0.4% increase for the period. Monthly, Chinese CPI inflation declined by 0.2% in June, compared to a 0.1% decline in May, which came in below the expected decline of 0.1%.

- On Tuesday, Fed Chair Jerome Powell answered questions before the Senate Banking Committee on the first day of his Congressional testimony. Powell stated, "More good data would strengthen our confidence in inflation." He emphasized that a "policy rate cut is inappropriate until the Fed gains greater confidence that inflation is headed sustainably toward 2%." He also noted that "first-quarter data did not support the greater confidence in the inflation path that the Fed needs to cut rates."

- On Tuesday, Australia's Westpac Consumer Confidence dropped by 1.1% in July, reversing the 1.7% increase seen in June. This marks the fifth decline in 2024, driven by ongoing worries about high inflation, elevated interest rates, and a sluggish economy.

Technical Analysis: Australian Dollar maintains position around 0.6750

The Australian Dollar trades around 0.6750 on Thursday. The Analysis of the daily chart shows that the AUD/USD pair consolidates within an ascending channel, indicating a bullish bias. Additionally, the 14-day Relative Strength Index (RSI) remains above the 50 level, confirming the bullish momentum.

The AUD/USD pair may test the upper boundary of the ascending channel at approximately 0.6785. If it breaks through this level, the pair could target the psychological level of 0.6800.

On the downside, the AUD/USD pair may find support around the lower boundary of the ascending channel at 0.6675, with additional support near the 50-day Exponential Moving Average (EMA) at 0.6646. A break below this level could push the pair toward the throwback support around 0.6590.

AUD/USD: Daily Chart

AUSTRALIAN DOLLAR PRICE TODAY

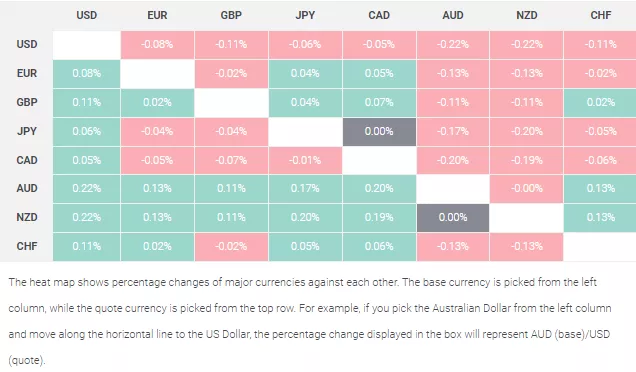

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the US Dollar.

More By This Author:

USD/CAD Holds Ground Around 1.3650 Due To Lower Oil Prices, Hawkish FedEUR/JPY Price Analysis: Holds Position Around 174.50 With An Overbought Condition

WTI Depreciates To Near $81.50, Saudi Expects To Rebound Oil Exports To China

Disclosure: Information on this article contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes ...

more