Australian Dollar Edges Higher Following Key Economic Data

Image Source: Unsplash

- The Australian Dollar appreciates after the domestic economic data release on Tuesday.

- Australia's Westpac Consumer Confidence increased by 2.8% in August, reversing the 1.1% decline observed in July.

- The pressure on US Dollar is alleviated due to diminished odds of a 50-basis point rate cut by the Fed.

The Australian Dollar (AUD) extends its gains against the US Dollar (USD) following key domestic economic data released on Tuesday. The AUD/USD pair may appreciate due to the hawkish sentiment surrounding the Reserve Bank of Australia (RBA).

Australia's Westpac Consumer Confidence rose by 2.8% in August, swinging from a 1.1% fall in July. Meanwhile, the Wage Price Index remained steady with a 0.8% rise in the second quarter, slightly below the market expectation of a 0.9% increase.

The AUD/USD pair receives support as the US Dollar (USD) faces challenges from expectations for a potential interest rate cut by the Federal Reserve (Fed) in September. However, this pressure might be alleviated due to reduced chances of a 50-basis point rate cut at the Fed's September meeting.

Traders will likely focus on US producer inflation data set to be released on Tuesday and consumer inflation figures on Wednesday. Traders are looking for confirmation that price growth remains stable.

Daily Digest Market Movers: Australian Dollar advances due to a hawkish mood surrounding the RBA

- On Monday, Reserve Bank of Australia (RBA) Deputy Governor Andrew Hauser attributed persistent inflation to weaker supply and a tight labor market. Hauser also noted that economic forecasts are surrounded by significant uncertainty.

- The upside of the risk-sensitive AUD could be restrained due to safe-haven flows amid increased geopolitical tensions in the Middle East. On Sunday, Defense Minister Yoav Gallant informed US Defense Secretary Lloyd Austin that Iran's military activities indicate preparations for a significant strike on Israel, as reported by Axios writer Barak Ravid.

- On Sunday, Federal Reserve Governor Michelle Bowman stated that she continues to see upside risks for inflation and ongoing strength in the labor market. This suggests that the Fed may not be prepared to cut rates at their next meeting in September, according to Bloomberg.

- China's Consumer Price Index (CPI) rose 0.5% year-on-year in July, exceeding the expected 0.3% and previous 0.2% readings. Meanwhile, the monthly index also increased 0.5%, swinging from the previous decline of 0.2%.

- Westpac updated its RBA forecast, now predicting the first rate cut will occur in February 2025, a shift from the previously anticipated November 2024. They also revised their terminal rate forecast to 3.35%, up from the previous 3.10%. The RBA is now viewed as more cautious, needing stronger evidence before considering rate cuts.

- On Thursday, Kansas City Fed President Jeffrey Schmid stated that reducing monetary policy could be "appropriate" if inflation remains low. Schmid noted that the current Fed policy is "not that restrictive" and that while the Fed is close to its 2% inflation goal, it has not yet fully achieved it, per Reuters.

- Last week, Treasurer Jim Chalmers contested the RBA's view that the economy remains too robust and that large government budgets are contributing to prolonged inflation, according to Macrobusiness.

- Last week, RBA Governor Michele Bullock expressed that the Australian central bank will not hesitate to raise rates again to combat inflation if needed. Those comments came just days after the RBA held rates steady at 4.35% for the sixth straight meeting.

Technical Analysis: Australian Dollar hovers around 0.6600 with testing a throwback support

The Australian Dollar trades around 0.6590 on Tuesday. The daily chart analysis shows that the AUD/USD pair steadies within an ascending channel, suggesting a bullish bias. However, the 14-day Relative Strength Index (RSI) consolidates below the 50 mark. A rise above this threshold could signal an increase in bullish momentum.

On the upside, the AUD/USD pair might test the upper boundary of the ascending channel at the 0.6660 level. A breakout above this level could push the pair toward its six-month high of 0.6798, reached on July 11.

In terms of support, the AUD/USD pair is testing immediate support at the throwback level of 0.6575. A drop below this level could strengthen a bearish bias, potentially driving the pair toward the lower boundary of the ascending channel near 0.6560, followed by the throwback level of 0.6470.

AUD/USD: Daily Chart

Australian Dollar PRICE Today

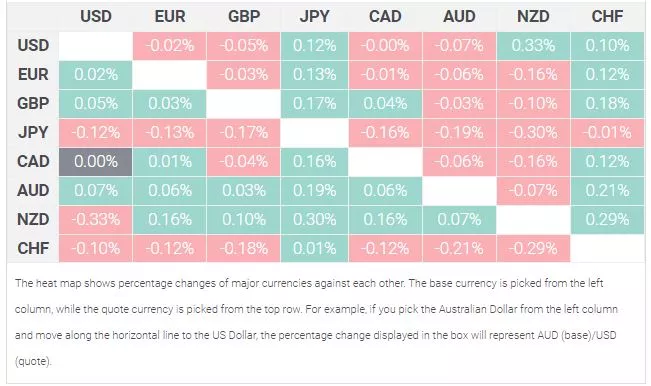

The table below shows the percentage change of the Australian Dollar (AUD) against listed major currencies today. The Australian Dollar was the strongest against the Swiss Franc.

More By This Author:

US Dollar Index Price Forecast: Remains Above 103.00 With Expecting A Trend ReversalAustralian Dollar Grapples To Hold Position Despite Upbeat China Inflation

Silver Price Forecast: XAG/USD rises to near $27.00 due to rising odds of a Fed rate cut

Disclosure: Information on this article contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes ...

more