Australian Dollar Edges Higher Amid Dovish Tone Surrounding Fed Policy

Image Source: Unsplash

- Australian Dollar may further appreciate as the US Dollar could struggle due to dovish Fed speak.

- The AUD found support as stronger inflation figures tempered market expectations for a near-term RBA rate cut.

- Fed Governor Christopher Waller supports an interest-rate cut in the September meeting.

The Australian Dollar (AUD) moves little against the US Dollar (USD) on Friday, following three days of gains. However, the AUD/USD may further appreciate as the US Dollar (USD) could struggle amid renewed dovish sentiment surrounding the Federal Reserve (Fed) policy outlook.

The AUD also received support from stronger-than-expected inflation data, which has lowered the likelihood of a Reserve Bank of Australia (RBA) rate cut. Australia’s Monthly Consumer Price Index rose 2.8% year-over-year in July, beating both the previous 1.9% increase and the 2.3% forecast.

The Minutes from the Reserve Bank of Australia’s August policy meeting indicated that board members expect further reductions in the cash rate will likely be required over the coming year. The Minutes also highlighted that the timing and pace of any cuts would depend on incoming economic data and the outlook for global risks.

Australian Dollar steadies as US Dollar edges higher ahead of PCE inflation data

- The US Dollar Index (DXY), which measures the value of the US Dollar against six major currencies, is remaining steady and trading around 97.90 at the time of writing. The Greenback received support as the United States (US) economy grew in the second quarter. US Gross Domestic Product (GDP) Annualized climbed 3.3% in Q2, a faster pace than the initially estimated 3.1% increase and 3.0% prior.

- Traders await the July Personal Consumption Expenditures (PCE) Price Index due on Friday, the last key inflation release before the Federal Reserve’s September meeting. Headline PCE is forecast to rise 2.6% year-over-year in July, while core PCE is expected to increase 2.9% over the same period.

- Fed Governor Christopher Waller said on Thursday that he would support an interest-rate cut in the September meeting and further reductions over the next three to six months to prevent the labor market from collapsing, per Reuters.

- US President Donald Trump announced on Tuesday that he was removing Fed Governor Lisa Cook from her position on the Fed's board of directors. The dismissal of Fed Governor Cook could increase the likelihood of heavy interest rate cuts, given Trump’s ongoing pressure on the central bank to reduce borrowing costs.

- President Trump threatened "subsequent additional tariffs" and export restrictions on advanced technology and semiconductors in retaliation for digital services taxes that hit American technology companies, per Bloomberg.

- Fed Chair Jerome Powell said at the Jackson Hole symposium on Friday that risks to the job market were rising, but also noted inflation remained a threat and that a decision wasn't set in stone. Powell also stated that the Fed still believes it may not need to tighten policy solely based on uncertain estimates that employment may be beyond its maximum sustainable level.

- China’s chipmakers are seeking to triple the country’s total output of artificial intelligence processors next year, the Financial Times reported on Thursday. Traders are already cautious following US President Donald Trump’s warning of imposing a 200% tariff on Chinese goods if Beijing refuses to supply magnets to the United States (US), per Reuters. It is worth noting that any change in the Chinese economy could influence AUD as China and Australia are close trading partners.

- Australia’s Private Capital Expenditure rose 0.2% in the second quarter, from the previous decline of 0.1% but fell short of the expected 0.7% increase.

Australian Dollar targets 0.6550 barrier near monthly highs

AUD/USD is trading around 0.6540 on Friday. The technical analysis of the daily chart indicates that the pair is positioned slightly above the ascending trendline, suggesting a prevailing bullish bias. Additionally, the pair is trading above the nine-day Exponential Moving Average (EMA), indicating short-term price momentum is stronger.

On the upside, the AUD/USD pair could target the monthly high at 0.6568, reached on August 14, followed by the nine-month high of 0.6625, which was recorded on July 24.

The AUD/USD pair may find initial support at the nine-day EMA of 0.6502 and the 50-day EMA at 0.6498, followed by the ascending trendline around 0.6490. A break below this crucial support zone would cause the emergence of the bearish bias and prompt the pair to test the two-month low of 0.6414, recorded on August 21.

AUD/USD: Daily Chart

Australian Dollar Price Today

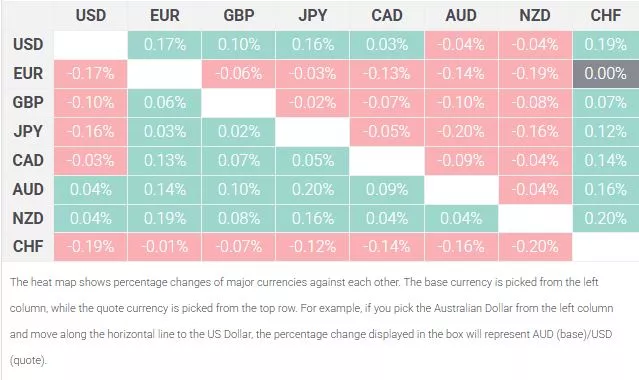

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the Japanese Yen.

More By This Author:

US Dollar Index Price Forecast: Tests 98.00 Support After Breaking Below Nine-Day EMADow Jones Futures Steady As Nvidia Earnings, AI Stocks Drive Focus

Australian Dollar Moves Sideways As US Dollar Steadies Ahead Of Powell’s Speech

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not ...

more