Australian Dollar Advances As China’s Manufacturing PMI Remains In Expansion Territory

Image Source: Unsplash

- The Australian Dollar receives support after the release of China's Caixin Manufacturing PMI on Thursday.

- China's manufacturing output in December continued to expand, marking its 14th consecutive month in growth territory.

- The US Dollar Index bounced back to multi-year highs due to the Federal Reserve's hawkish policy shift.

The Australian Dollar (AUD) gains ground against the US Dollar (USD) after the Caixin Manufacturing Purchasing Managers’ Index (PMI) from China was released on Thursday. As close trade partners, any fluctuations in China's economy tend to impact Australian markets.

China's Caixin Manufacturing PMI unexpectedly dropped to 50.5 in December, down from 51.5 in November. The market had anticipated a reading of 51.7 for the month. Wang Zhe, an economist at Caixin Insight Group, commented, “Supply and demand expanded. Manufacturers’ output and demand continued to grow as the market improved. The gauge for output remained in expansionary territory for the 14th consecutive month, while total new orders increased for the third straight month.”

The Reserve Bank of Australia’s (RBA) policymakers had grown more confident about inflation, though risks persisted. The board emphasized the need for monetary policy to remain "sufficiently restrictive" until there was greater certainty about inflation.

Australian Dollar appreciates despite a stronger US Dollar amid Fed’s hawkish policy shift

- The US Dollar Index (DXY), which tracks the value of the US Dollar against six major currencies, has rebounded to multi-year highs, trading around 108.50 at the time of writing. This surge is attributed to the US Federal Reserve's (Fed) hawkish policy shift.

- The Federal Reserve may adopt a more cautious outlook regarding further rate cuts in 2025, signaling a shift in its monetary policy stance. This change reflects uncertainties surrounding potential policy adjustments in light of the anticipated economic strategies of the incoming Trump administration.

- Escalating geopolitical tensions in the Middle East and the ongoing Russia-Ukraine war are likely to support the USD, a traditional safe-haven currency, in the near term. Analysts at Action Economics observed, “The greenback has been boosted by rising growth concerns elsewhere against the backdrop of geopolitical risk.”

- Traders are cautious regarding President-elect Trump’s economic policies, fearing that tariffs could increase the cost of living. These concerns were compounded by the Federal Open Market Committee’s (FOMC) recent projections, which indicated fewer rate cuts in 2025, reflecting caution amid persistent inflationary pressures.

- China's official Manufacturing PMI slipped to 50.1 in December, down from 50.3 in the previous reading and below market expectations of 50.3. Meanwhile, the NBS Non-Manufacturing PMI improved significantly, rising to 52.2 in December from November's 50.0 and beating estimates of 50.2.

- The RBA board noted that if future data aligns with or falls below forecasts, it would bolster confidence in inflation and make it appropriate to start easing policy restrictions. However, stronger-than-expected data could require maintaining restrictive policies for a longer period.

- Reserve Bank of Australia Governor Michele Bullock highlighted the continued strength of the labor market as a key reason the RBA has been slower than other nations to commence its monetary easing cycle.

Australian Dollar rises above 0.6200, next barrier appears at nine-day EMA

The AUD/USD pair trades near 0.6210 on Thursday, maintaining a bearish outlook on the daily chart as it trades within a descending channel pattern. The 14-day Relative Strength Index (RSI) has rebounded above 30, hinting at the possibility of a near-term upward correction.

Immediate resistance lies at the nine-day Exponential Moving Average (EMA) at 0.6225, with the next obstacle at the 14-day EMA at 0.6251. A key resistance level is the descending channel’s upper boundary, around the psychological mark of 0.6300.

On the downside, the AUD/USD pair could navigate the support region near the lower boundary of the descending channel, around 0.6040.

AUD/USD: Daily Chart

Australian Dollar PRICE Today

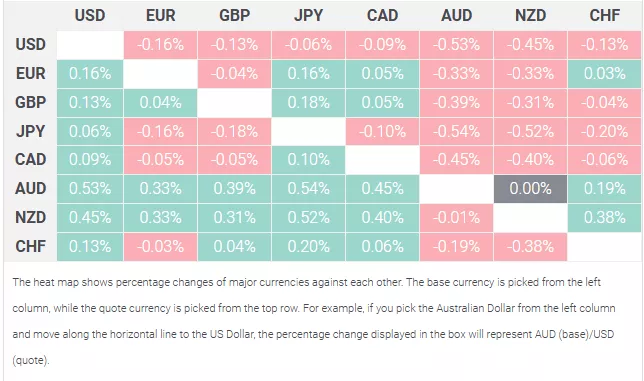

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the Japanese Yen.

More By This Author:

EUR/USD Price Analysis: Immediate Resistance Appears At Nine-Day EMA Above 1.0400Gold Prices Remains Unchanged As Markets Wind Down Ahead Of The New Year Holiday

GBP/USD Holds Gains Near 1.2600 Due To Thin Trading Ahead Of The New Year Holiday

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not ...

more