Australian Dollar Advances Ahead Of Rba Policy Decision

Image Source: Unsplash

The Australian Dollar (AUD) gains ground against the US Dollar (USD) on Tuesday ahead of the interest rate decision by the Reserve Bank of Australia (RBA) due later in the day. Policymakers are expected to remain cautious, with underlying inflation still above target and labor market conditions relatively tight, reinforcing a restrictive and data-dependent policy stance.

The AUD/USD pair holds ground despite the seasonally adjusted Building Permits in Australia falling sharply by 14.9% month-over-month to a four-month low of 15,542 units in December 2025, unwinding a downwardly revised 13.1% increase recorded in the previous month.

Australia’s Consumer Price Index (CPI) rose 3.8% YoY in December, accelerating from 3.4% previously. With headline inflation remaining above the RBA’s 2–3% target, recent PMI and employment data reinforce the case for a tighter monetary policy stance.

US Dollar declines after recent modest gains

- The US Dollar Index (DXY), which measures the value of the US Dollar against six major currencies, is edging lower after four days of gains and trading near 97.50 at the time of writing.

- US President Donald Trump’s nomination of Kevin Warsh as the next Federal Reserve (Fed) Chair. Markets interpreted Warsh’s appointment as signaling a more disciplined and cautious approach to monetary easing.

- The US Dollar gained traction as risk sentiment improved after the US Senate reached an agreement to advance a government funding package, thereby averting a shutdown, according to Politico.

- US producer-side inflation firmed, moving further away from the Federal Reserve’s 2% target and reinforcing the central bank’s policy stance. US PPI inflation holds steady at 3.0% year-over-year (YoY) in December, unchanged from November and above expectations for a moderation to 2.7%. Core PPI, excluding food and energy, accelerated to 3.3% YoY from 3.0%, defying forecasts for a decline to 2.9% and highlighting persistent upstream price pressures.

- St. Louis Fed President Alberto Musalem said additional rate cuts are not warranted at this stage, characterizing the current 3.50%–3.75% policy rate range as broadly neutral. Similarly, Atlanta Fed President Raphael Bostic urged patience, arguing that monetary policy should remain modestly restrictive.

- Australia’s RBA Trimmed Mean inflation increased to 0.2% month-over-month (MoM) and 3.3% year-over-year (YoY). The monthly CPI rose 1.0% in December, up from 0% previously and above the 0.7% forecast.

- Australia’s export prices rose 3.2% quarter-on-quarter (QoQ) in Q4 2025, rebounding from a 0.9% fall in Q3 and marking the first increase in three quarters, as well as the strongest gain in a year. Meanwhile, import prices climbed 0.9%, beating expectations for a 0.2% decline and reversing a 0.4% drop in Q3.

- China's RatingDog Manufacturing Purchasing Managers' Index (PMI) data, which rose to 50.3 in January from 50.1 in December. This figure came in line with the expectations. The latest reading indicated a slight expansion in factory activity, but the fastest growth since last October.

- Australia’s TD-MI Inflation Gauge rose 3.6% year-over-year (YoY) in January, up from 3.5% previously. The Monthly Inflation Gauge increased by 0.2%, slowing sharply from December’s two-year high of 1% and marking the weakest pace since August.

- ANZ Job Advertisements jumped 4.4% month-over-month (MoM) in December 2025, rebounding from a revised 0.8% decline and posting the first increase since July. The rise was also the strongest monthly gain since February 2022, signaling renewed momentum in hiring toward year-end.

Australian Dollar rebounds from nine-day EMA

The AUD/USD pair is trading around 0.6970 on Tuesday. Daily chart analysis indicates that the pair is remaining above the nine-day Exponential Moving Average (EMA), indicating a persistent bullish bias. The 14-day Relative Strength Index (RSI) is at 70; it typically signals bullish momentum, but stretching momentum.

The AUD/USD pair could rebound toward 0.7094, the highest level since February 2023, which was recorded on January 29. On the downside, the primary support lies at the nine-day Exponential Moving Average (EMA) of 0.6937, followed by the 50-day EMA of 0.6746.

AUD/USD: Daily Chart

Australian Dollar Price Today

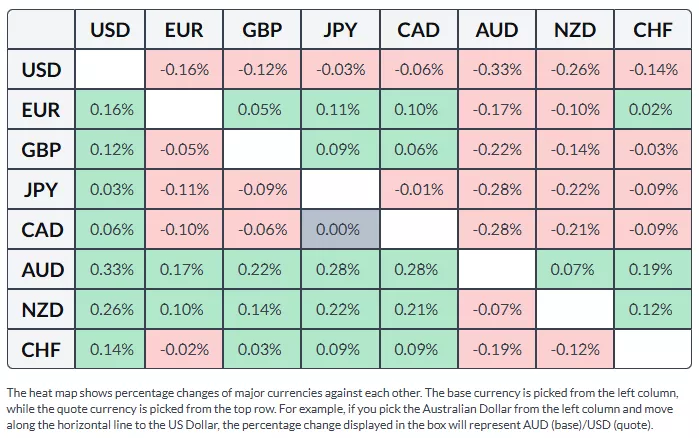

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the US Dollar.

More By This Author:

WTI Declines To Near $64.00 Despite Elevated Geopolitical RisksIndian Rupee Receives As Traders Expect RBI Intervention

AUD/USD Rises To Near 0.7050 As RBA Rate Hike Bets Increase