Australia: Strong Labor Report Complicates Reserve Bank (RBA) Rate Decision

Image Source: Pexels

August labor report

Keeping up its reputation for being an unforecastable piece of data, Australia's August labor report surprised strongly on the upside. A total of 64,900 new jobs were created in August. And although almost all of these were part-time jobs (62,100), such jobs have a habit of becoming full-time in the months ahead, which will also imply higher wages, greater job security, and better benefits - all things that usually go hand in hand with consumer confidence and stronger consumer spending.

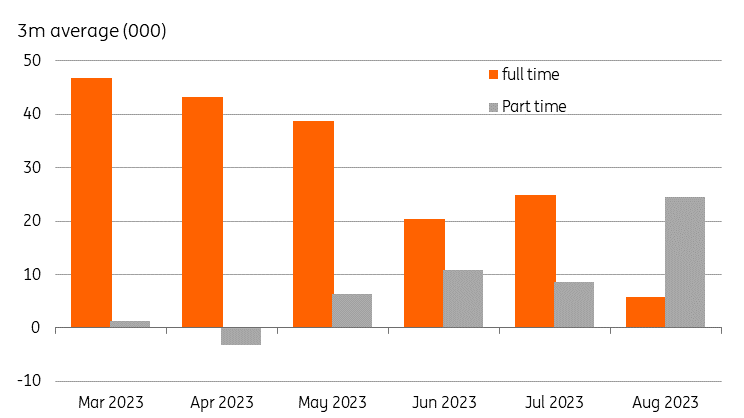

The chart below shows the evolution of Australian employment smoothed over three months. What is evident is that although full-time employment had been slowing, the ongoing rise in part-time jobs might presage a renewed pick up in full-time jobs in the months ahead.

This would be a problem because the Reserve Bank of Australia (RBA) has been trying to cool the economy enough to bring inflation down. It has certainly made some good progress this year, getting the headline monthly inflation rate down to 4.9% in July, and the wage growth figures have also been surprisingly well-behaved. But just like the US, where inflation is now rising again at a headline level, Australian inflation has used up all the helpful base effects from last year, and the going will be a lot harder in the months ahead until we get to the November data when it should start to improve again.

Australian employment change (3mma)

Australia Employment - CEIC, ING

Rates peaked or not?

We have been wrestling with our RBA rate call, coming very close this month to chopping out our forecast for one final rate hike before the end of this year - possibly at the November meeting. We are glad now that we didn't remove this because the data flow on the activity side seems to be holding up better than would be consistent with further decent progress towards the RBA's inflation target.

Presentationally, it also might be useful for the new RBA Governor, Michelle Bullock, to stamp her authority on markets and establish a reputation for not taking risks with inflation. This would be better done early in her tenure before minds start to get made up, on the assumption that central banks still follow the implications of the seminal Barro and Gordon research.

So for now, the final 25bp cash rate hike to 4.35% remains part of our forecast. We will need to see further solid progress on inflation reduction, as well as some more concrete signs of slowing activity and domestic demand before we ditch it.

More By This Author:

Asia Morning Bites - Thursday, September 09

Poland’s Current Account Still In Surplus

Lingering US Inflation Fears Leave A Final Rate Hike On The Table

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more