Australia: How To Ride A Bumpy Disinflationary Path

Australia's growth outlook has cooled off, but the labour market remains too tight and the decline in inflation has been primarily due to base effects. We disagree with markets' expectations that we have seen the peak in RBA rates, and expect at least one more hike. This should help a recovery in the undervalued (in the short- and medium-term) Aussie dollar.

After two months of 'no-change', the market has decided that the Reserve Bank of Australia (RBA) has finished hiking rates. We disagree. There has been only a modest slowdown in the economy, and most of the decline in inflation so far owes to base effects which are turning less helpful, while the run-rate for month-on-month inflation remains much higher than is consistent with the RBA’s inflation target. We expect at least one more hike, possibly in September or maybe waiting for the quarterly inflation numbers which will be known by the November meeting, and quite possibly two. That would take the cash rate target to 4.35% with an upper risk of 4.6%.

If we are right that the US Fed has finished tightening, then this could see some outperformance of the AUD into year-end. AUD’s sensitivity to pro-cyclical trades and the shape of the yield curve, as well as its pronounced undervaluation, put it in a good position to potentially outpace other G10 peers in a multi-quarter USD decline.

The macro picture: Labour market remains tight

GDP growth in Australia has slowed every quarter since the third quarter of 2022, and looks set to deliver another weak quarter of growth in the second quarter of 2023. NowCasting estimates are pointing to only about a 0.2% quarter-on-quarter increase, and 1.5% year-on-year annual growth rate in the second quarter.

Australian GDP projections

ING, Refinitiv

This suggests that the RBA’s rate tightening is indeed working, on top of the external factors weighing on growth (weak China re-opening, US and EU slowdown).

But on many measures, the Australian economy remains robust, and this remains a concern when we dig into the inflation data and see that on some measures (admittedly not all) inflation is still running quite strong.

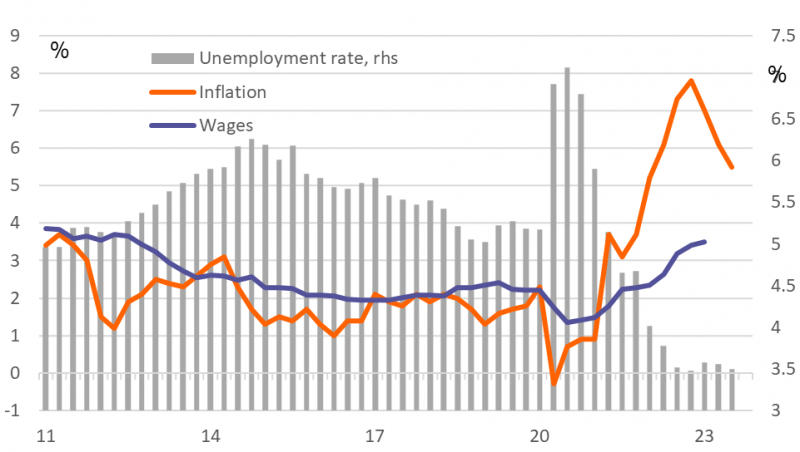

In particular, Australia’s labour market shows only limited signs of slowdown. At 3.5%, the unemployment rate is close to its all-time low of 3.4% in October last year. And almost all of the jobs that have been created over that time have been full-time jobs, with commensurately higher weekly earnings, benefits and security than part-time jobs. That means household spending power is being supported. The consequence of this is that wages growth, though only measured quarterly, and with long lags, remains, according to the RBA’s own anecdotes, on an upward path. And this will help keep service sector inflation higher than would ideally be the case.

Wages, unemployment and inflation in Australia

ING, Refinitiv

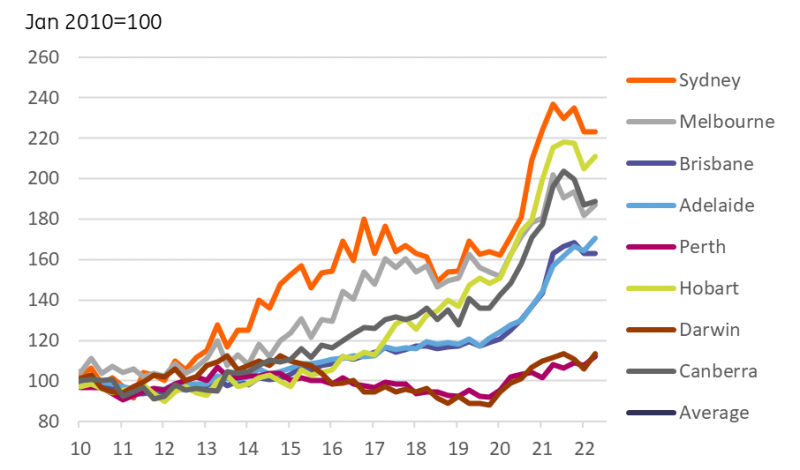

Housing concerns have eased

Into the mix of things that you wouldn’t normally expect to see after one of the biggest tightening cycles in history, is the fact that the residential housing market, known for its interest rate sensitivity, is not only holding up quite well, it is actually strengthening in some locations and real-time real estate sources suggest that this continued during the second quarter of this year and even on into early third quarter.

Residential house prices

ING, Macrobond

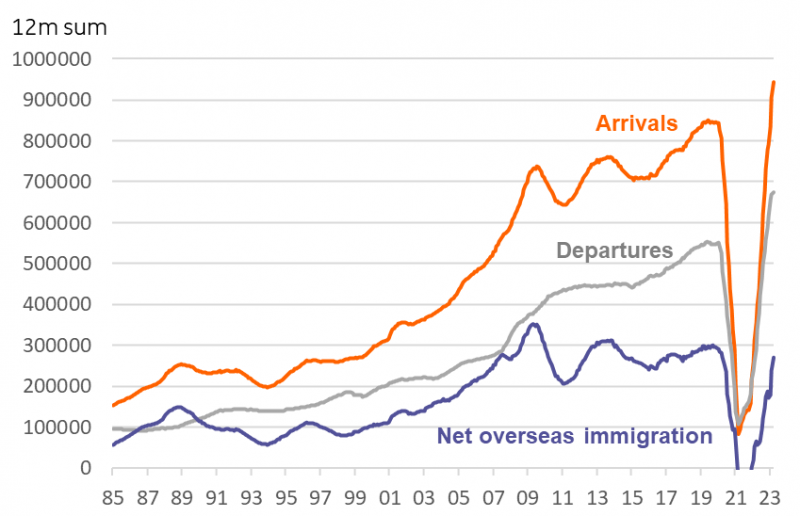

This is partly a factor of how ahead of the game many households got during the period of low interest rates, overpaying their mortgages, and accruing a buffer against times just like these. Many others have paid off mortgages entirely, though there are certainly some households for whom the current situation is creating genuine hardship. It is also a response to record high immigration rates which are putting upward pressure on house prices at a time when housing supply has been weak.

Permanent and long-term migration

ING, Macrobond

High risks of inflation bumps

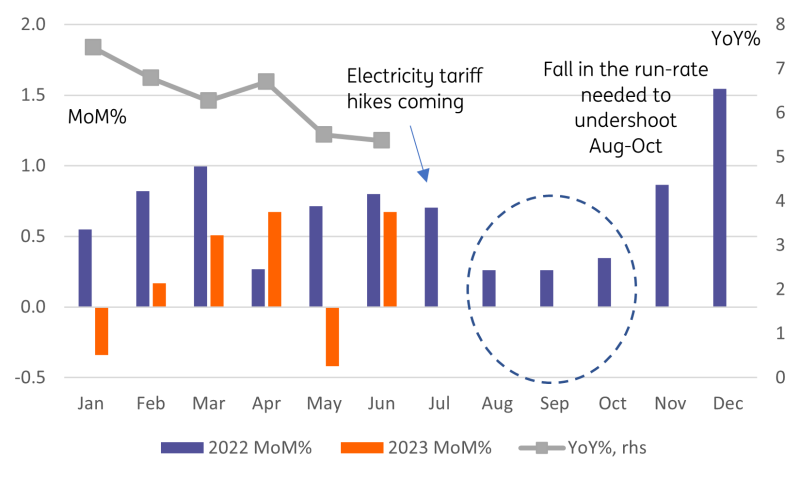

When it comes to the inflation story itself, and how this may develop and feed through into future RBA policy, the monthly data tell the most coherent story. This data shows how very high month-on-month rates of growth in the first six months of last year are one of the main reasons why the annual inflation rate has dropped. All that has needed to happen each month is that the CPI index rises less than it did last year, and the inflation rate automatically drops. That is basically how year-on-year inflation works.

Australia's CPI outlook

ING, Macrobond

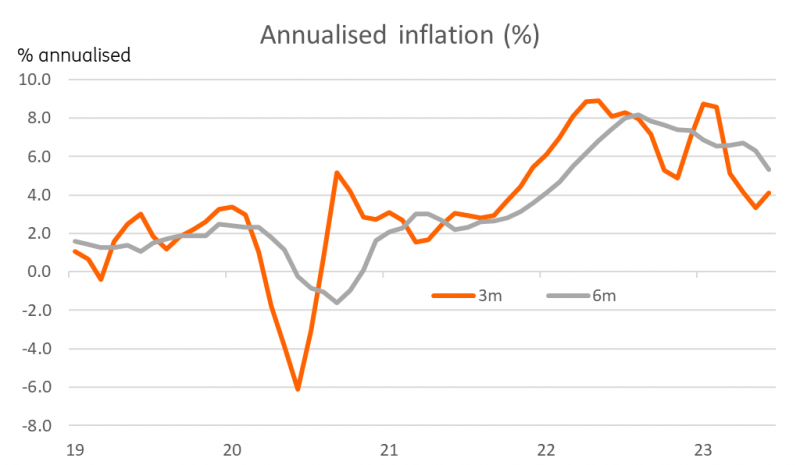

But the month-on-month increases in the CPI index this year have still been quite fast. Looked at from the perspective of the annualised rates of 3m and 6m inflation (what we refer to as the 'run-rate'), which is less influenced by what happened 12 months ago, and tells us more about what inflation is doing right now, it is clear that the inflation run-rate has not dropped very much.

Moreover, unless it does so, and soon, given the much less favourable series of base comparisons from August to October, there is a very good chance that the annual inflation rate will begin to move higher again, not lower during third/fourth quarter 2023. Even the July print, where the last high base comparison should make progress possible, we have large electricity tariff hikes to incorporate, so the bad news may come even earlier.

Australia's inflation

ING, Macrobond

Markets are underestimating risks of more RBA tightening

Put that all together, and we are not convinced by market pricing that shows only about a 20% chance of a further hike in rates in this cycle.

Incoming Governor, Michele Bullock will preside over her first RBA rate meeting in October. But outgoing Governor, Philip Lowe may choose to deliver his final hike at the September meeting as a welcome gift to her, leaving her only to decide whether she needs to follow this up with another, and we would imagine by then, final hike if the inflation data fails to make further progress.

We do get much more helpful base comparisons again in November and December, but these rely on the seasonal problems hitting agriculture and energy in Australia last year not being repeated. That seems like a fair call, but certainly not a risk-free one when one considers all the things that can go wrong: bushfires, floods, geopolitical interruptions to supply chains. So despite taking a more hawkish than consensus view on rates, we would argue that the risks to our forecasts remain skewed more on the upside.

AUD: Ample room for a recovery

The Australian dollar has been the worst-performing G10 currency in the past month, as it faced a combination of external headwinds coming from another round of Chinese growth repricing and the recent risk-off environment, as the two holds by the RBA cooling off domestic rate expectations.

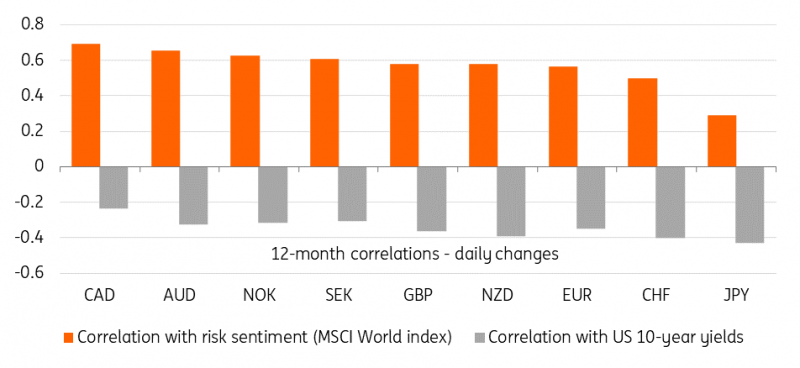

Much of the outlook for an ultra-sensitive currency to global risk sentiment like AUD remains strictly tied to external developments. As shown below, AUD/USD is the second most sensitive USD-cross in G10 to swings in global equity-related risk sentiment, while its correlation with US back-end rates is not higher than other cyclical currencies like NZD, EUR and GBP.

G10 correlations with risk sentiment and US yields

ING, Refinitiv

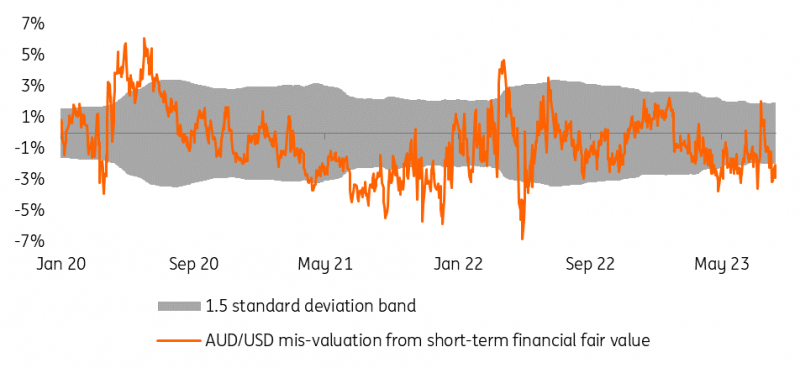

The recent rally in global equities (MSCI World up 7% in the past six months) clearly hasn’t been reflected in AUD price action. Our short-term fair value model – where MSCI World index performance is a variable – has been displaying an obvious tendency in AUD/USD to overshoot on the undervaluation side, which likely reflects the risk premium related to China’s re-rating of growth expectations. The persistence of that risk premium suggests that the Chinese growth disappointment factor is now largely priced into AUD, which could ultimately limit the scope for further downside. Incidentally, we estimate that AUD/USD remains around 18% undervalued in the medium term, according to our real BEER model mis-valuation results.

AUD/USD displaying persistent undervaluation

ING

As highlighted above, we think the domestic picture will also improve for AUD, as the RBA may well have to hike again despite market’s flat rate expectations. The monetary policy story could potentially come through as a positive factor at a time (September, for example) when USD resilience hasn’t abated yet, meaning an RBA-driven bullish pocket for AUD could initially be mostly mirrored in relative strength against other pro-cyclical currencies rather than on AUD/USD. Still, in line with our bearish USD call for later in the year, we expect AUD/USD to rebound back to the June and July 0.69 peaks before year-end, and then find more support above 0.70 in the first half of 2024.

More By This Author:

To Hike Or To Hold? Three Scenarios For The Bank Of England’s Next Steps

The Commodities Feed: Disappointing China Trade Data Weighs On Sentiment

Rates Spark: Action At Both Ends Of The Curve

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more