Australia: GDP Growth Firms Up In The Third Quarter

Image Source: Pexels

Not that big a surprise after recent trade numbers

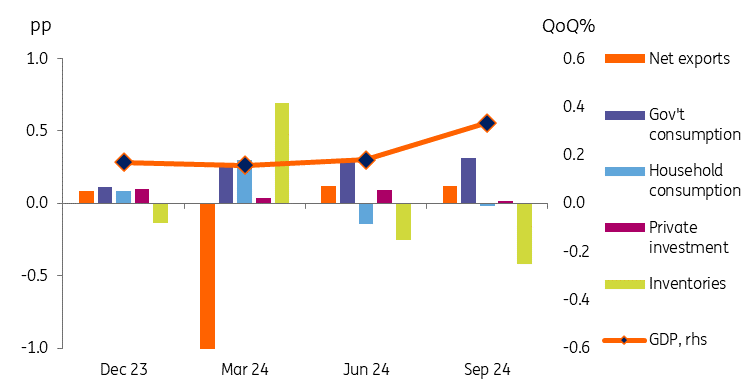

3Q24 GDP for Australia missed on the downside, coming in at 0.3% QoQ, well below the 0.5% figure that had been forecast. However, that consensus figure looked in doubt after yesterday's net export contribution figures were published. These showed a smaller contribution to GDP from net exports (+0.1pp). While this is sometimes offset elsewhere (usually inventories) in this case, it turned out to be fully reflected in the numbers.

Nonetheless, this still marks a firming of economic activity, and the question the Reserve Bank of Australia (RBA) and financial markets will be asking is whether this is enough to put off any thoughts of monetary easing in early 2025?

The answer to that question lies in the composition of this GDP release.

Private demand is nowhere to be seen

Household consumption is missing in action

What we can see from the breakdown of GDP by component, is that there is almost no private domestic demand. The only positive contributors to GDP in 2Q24 were net exports (and even these were weaker than expected as mentioned) and general government spending.

Household consumption contributed nothing to growth in 3Q24. It has not done so for two quarters now. Private investment also contributed nothing. Inventories were a drag. At least that may set the scene for some inventory rebuilding later on, though that's not a very optimistic viewpoint if that is all there is to look forward to.

Financial markets seem to agree, and the AUDUSD weakened to the low end of 64 cents after the release, while cash rate futures showed more chance of an RBA rate cut by April priced in following the release.

As for the RBA - nothing here to get excited about

As far as policy is concerned, there aren't too many takeaways from this. The GDP data is lagged and does not always tally with other high-frequency data like retail sales, or the labour market. These higher frequency releases are painting a rosier picture of growth than the GDP numbers.

There also isn't too much read-across from these numbers to the inflation outlook. Soft domestic demand would suggest price pressures abating, but the core inflation numbers remain quite sticky.

Taking all of this into account, we don't see any reason in these numbers to change our outlook for RBA policy, which is for the first rate cut in 1Q25, but with a decent chance that we will be pushing that forecast back later into 2025.

More By This Author:

South Korea: Outlook Rocked By Martial Law DeclarationRates Spark: Eyes On France

Food Prices Drive A Higher-than-Expected Rise In Turkish Inflation

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more