AUD/USD Weekly Forecast: Upbeat Data Supports RBA Rate Hike

The AUD/USD weekly forecast is bullish as some analysts believe the RBA will hike rates next week while the dollar struggles to post any gain.

Ups And Downs Of AUD/USD

Australian inflation decreased in February to its lowest level in eight months. The US released a mixed bag of data, with consumer confidence and pending home sales rising and GDP, jobless claims, and inflation falling.

While inflation cooled in February, it remained elevated enough to potentially enable the Federal Reserve to raise borrowing costs one more time this year. US consumer spending increased marginally in February.

In February, according to additional data, consumer confidence in the United States dropped for the first time in four months due to worries about an impending recession. This was even though the effect of the recent banking crisis was relatively mild.

The probability of a Fed rate rise of 25 basis points in May dropped to about 50%, with no increase equally likely.

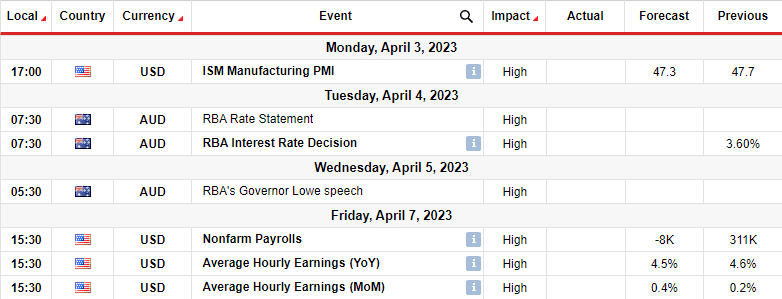

Next Week’s Key Events For AUD/USD

A strong labor force report, resilient business conditions, and strong expenditure on services are among the most recent data releases analysts at ANZ are pointing to as evidence that the RBA will increase rates in April.

Investors will also focus on the nonfarm payroll report showing whether the US labor market is cooling amid high borrowing costs.

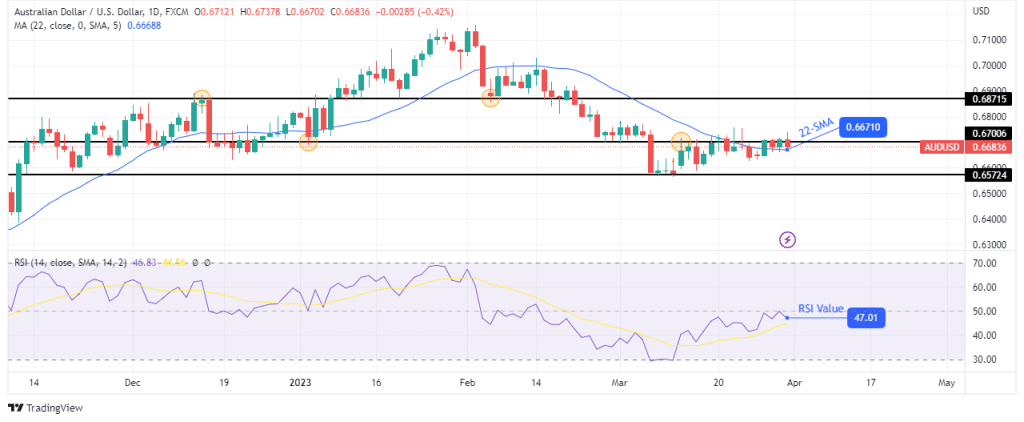

AUD/USD Weekly Technical Forecast: Bulls Struggling Around 0.6700 Resistance

The daily chart shows AUD/USD trading slightly above the 22-SMA while the RSI trades slightly below 50. The bulls are on the verge of taking control. However, they need a stronger candle above the 22-SMA to push the RSI above 50. They also need to break above the 0.6700 key resistance level.

If bulls can achieve all the above, the price will be free to climb to the next resistance level at 0.6871. This will then allow bulls to start making higher highs and lows for a bullish trend

However, if the 0.6700 holds firm as resistance, the price will likely break below the SMA and fall back to the 0.6572 support level. A break below this support would mean a continuation of the downtrend.

More By This Author:

AUD/USD Forecast: Australia’s Inflation Eases To 8-Month LowGBP/USD Price Analysis: Bailey Emphasizes On Coping Inflation

EUR/USD Weekly Forecast: ECB Defends Hikes Despite Instability