AUD/USD Weekly Forecast: Upbeat Australia’s Inflation To Boost Aussie

The AUD/USD weekly forecast is bullish as investors wait to see if Australia’s inflation will push the RBA to be more aggressive.

Ups And Downs Of AUD/USD

The pair started the week on a bullish note after the Reserve Bank of Australia released its hawkish meeting minutes. The bullish trend was further supported by RBA Governor Philip Lowe’s speech, where he insisted on raising rates to curb inflation.

“For inflation to return to the 2%–3% target range, a more sustainable balance between demand and supply is needed. Higher interest rates will help achieve this,” Lowe said.

The central bank is also facing criticism over its inflation policy from the Australian government. The government is planning a review to look into the bank’s board structure, operations, and methods of communication with the public.

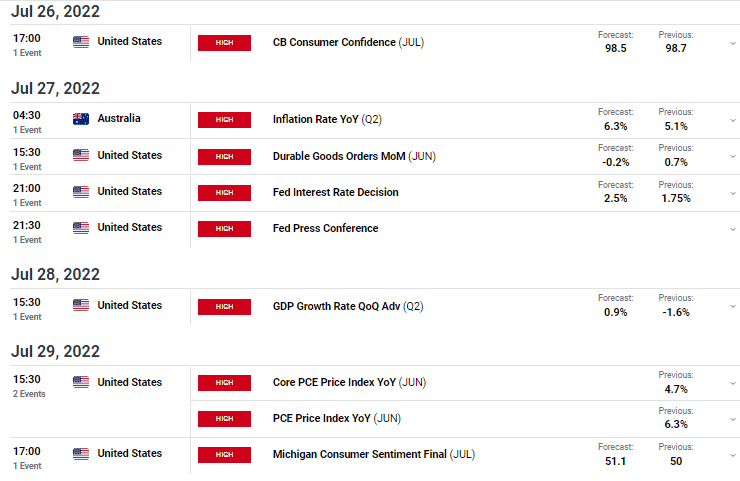

Next Week’s Key Events For AUD/USD

Investors expect a significant rise in Australia’s inflation when data is released next week. Inflation in the country has been on the rise, surprising the Reserve Bank of Australia. The bank had forecasted rates to stay at 0.1% to 2024, only to raise rates in May as inflation exceeded expectations.

For this reason, the Reserve Bank of Australia is facing criticism from the government. However, the bank insists it will keep hiking rates until inflation is controlled. Investors also expect a rate hike from the Federal Reserve.

US consumer confidence is expected to drop as economic activity slows down. However, investors expect Q2 GDP to grow from -1.6% to 0.9%.

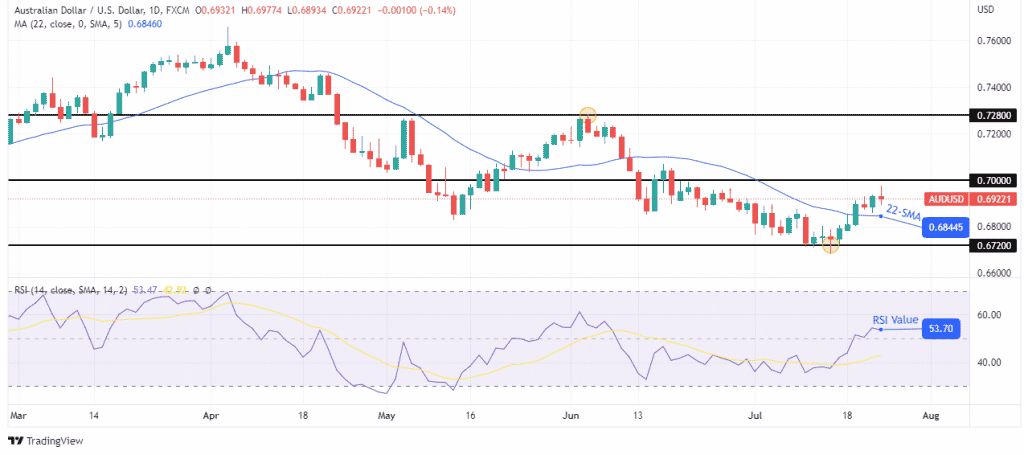

AUD/USD Weekly Technical Forecast: A Break Above 0.7 Will Confirm The Bullish Trend

Looking at the 4-hour chart, we see the price trading above the 22-SMA, showing bulls are in charge. RSI also favors bullish momentum as it trades above 50. The pair’s downtrend stopped at the 0.67200 level before the price went on to break above the SMA.

The price has come close to a critical psychological level at 0.7, which might pause or even stop the uptrend. There will be resistance at 0.7 and support at the 22-SMA. A break above 0.7 will confirm the bullish trend, while a break below the 22-SMA will resume the downtrend.

More By This Author:

GBP/USD Price Analysis: Upbeat Jobs Report Boosts Pound

AUD/USD Outlook: Aussie Recovers Ahead Of RBA Meeting Minutes

EUR/USD Weekly Forecast: Markets Priced In ECB’s 25bps Rate Hike

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more