AUD/USD Weekly Forecast: The 0.7400 Level Should Be Tested Next Week

Image Source: Unsplash

- The Reserve Bank of Australia reduced bond purchasing to $4 billion.

- The measure will be held until February 2022.

- The Aussie will recover in the long run, and it should go to 0.7400 this week.

The Australian dollar closed the week at 0.73546 after falling mainly on Tuesday, when the Reserve Bank of Australia announced that it will maintain its plan to taper by lowering the bonds purchasing to 4 billion every week from the previous 5 billion. However, it also announced that it will keep this policy until February 2022. The AUD/USD weekly forecast remains bullish, and focus will remain on fundamental events from the Australian economy.

On Friday, traders were hoping they could recover some of the losses of the week. The news about the call between US President and Chinese Prime Minister Xi Jinping, and the fast rate of vaccination progress in Australia, which is expected to surpass the US in the share of the vaccinated population, were helping bulls.

However, the strong numbers of the Price Producer Index generated speculation about the expected inflation rate and fear about the actions that the Fed could take to reduce its stimulus sooner.

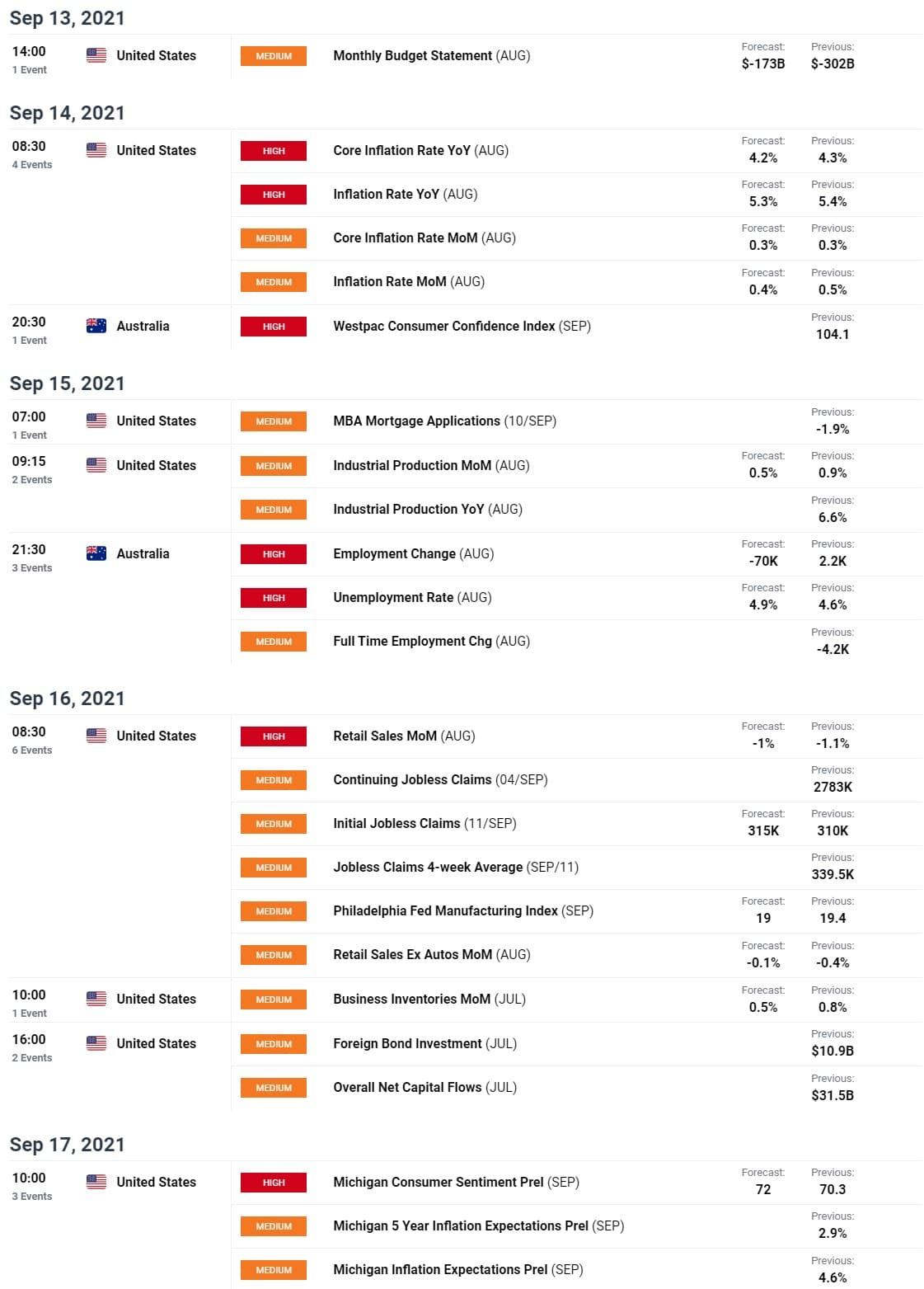

Upcoming Events

On the economic calendar, the focus will be on inflation and employment. On Tuesday, the US will release its inflation data for August. The market expects a 5.3% rate of inflation and a 4.2% of Core inflation.

Australia will publish the employment change and unemployment rate data for August on Wednesday. For the unemployment rate, Australia forecasts a reading of 4.9% in contrast to July's 4.6% reading.

AUD/USD Weekly Forecast – Daily Chart

AUD/USD Technical Analysis: 0.7400 is the Psychological Level to Surpass

The pair struggles to go beyond the 0.7400 level. Once over that level, it will have to go to 0.7600. Right now, the price is above the 20-days SMA and below the 100-days SMA. The RSI seems to be strong in the middle, close to 50%.

If the price goes down, the resistance levels will be at 0.7300 and the 200-week EMA. Beyond that, there is the 0.71 level, an area from which the price has bounced repeatedly.

AUD/USD Forecast for Next Week

It seems like the Aussie will go north, although the momentum is not very strong. The price will try to surpass 0.7400. However, it could easily go the other way. If the economic growth slows down, investors will run to protect their capital on the US dollar. Nevertheless, in the long run, the price seems to be heading to 0.8000.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more