AUD/USD Weekly Forecast: Investors Expect 25bps Hike By RBA

The AUD/USD weekly forecast is slightly bullish as investors expect a rate hike from the Reserve Bank of Australia.

Ups And Downs Of AUD/USD

Due to rising interest rates and soaring inflation, Australia’s economy grew at the slowest pace in a year last quarter. All indications point to further slowing ahead.

Consumer confidence in the United States surprisingly went down in February. However, people were more optimistic about the labor market.

The number of Americans submitting new applications for unemployment benefits dropped once more last week, indicating continued resilience in the labor market. This escalated concerns in the financial market that the Fed would keep raising interest rates for longer.

Economic data issued on Friday revealed steady demand for services in the US. Purchasing managers’ indices from S&P Global and the Institute for Supply Management show that the sector’s activity is still expanding. The manufacturing sector activity also went up.

These releases contributed to the pair’s bullish week.

Next Week’s Key Events For AUD/USD

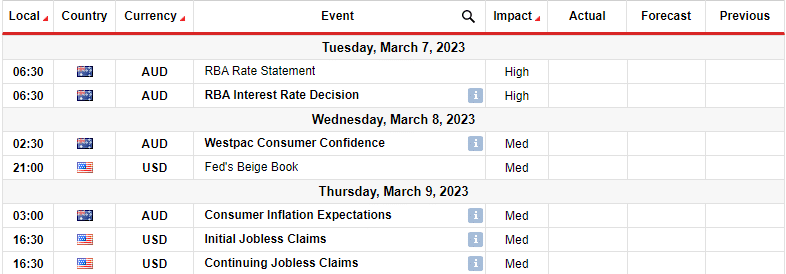

All focus next week will be on the RBA meeting. According to a Reuters poll, the Reserve Bank of Australia will raise interest rates by another 25 basis points to 3.60% on Tuesday, then another 25 basis points the next quarter before taking a break until next year. This will raise the peak rate higher than previously anticipated. Investors will also pay attention to employment data from the US.

AUD/USD Weekly Technical Forecast: Bearish Trend Likely Continue In The Coming Week

The daily chart shows AUD/USD in a downtrend, shown by the price, which trades below the 22-SMA, and the RSI, which trades below the 50-mark. Bears took over when the price broke below the 22-SMA, retested, and made a lower low.

Bears have currently paused at the 0.6702 support. The price has traded in a tight range and might allow bulls to make a deeper pullback to retest the 22-SMA and the 0.6851 resistance level.

The price will then likely respect the 22-SMA as resistance and bounce lower. Bears will be looking to break below 0.6702 and make a new low. The next strong support level is at 0.6606.

More By This Author:

GBP/USD Weekly Forecast: Dollar To Gain Amid Upbeat DataEUR/USD Weekly Forecast: US Inflation Rises By Most In 6 Months

USD/CAD Weekly Forecast: US Inflation Remains Stubbornly High