AUD/USD Weekly Forecast: Bears Takeover, Focus On US CPI

The AUD/USD pair had a bearish week as the dollar ended strong due to upbeat employment data. However, Aussie was on the front foot when the week started due to increased Fed rate cut expectations. Most of the reports this week indicated a slowdown in the US economy.

Business activity in the manufacturing sector fell, job vacancies dropped, and private firms employed fewer people in May.

However, the services sector remained robust despite high borrowing costs. In Australia, GDP data revealed a smaller-than-expected growth but had little impact on rate cut expectations. The primary catalyst came at the end of the week when the nonfarm payrolls showed stronger-than-expected performance in the labor market. This led to a rally in the dollar as rate-cut bets fell.

Next week’s key events for AUD/USD

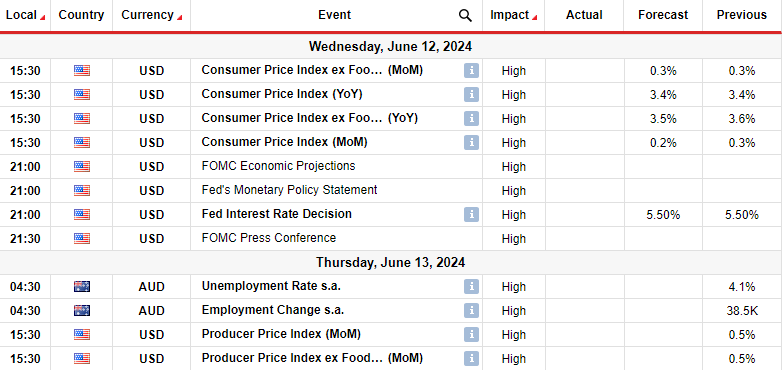

Next week, investors will focus on US inflation data and the FOMC policy meeting. Meanwhile, Australia will release its employment figures, impacting the outlook for RBA rate cuts. The last CPI report showed easing inflation in the US, which gave policymakers and traders confidence that the downtrend is intact.

However, it has been up and down since then, with some reports showing continued economic strength. Another downbeat report would boost expectations for Fed rate cuts in the US. However, if inflation remains stubborn, policymakers will maintain a hawkish tone at the FOMC meeting. This would mean a decline in rate-cut bets that would strengthen the dollar against the Aussie.

AUD/USD weekly technical forecast: Market turns bearish with price below 22-SMA

AUD/USD daily chart

On the technical side, the AUD/USD price has broken below the 22-SMA, confirming a bearish sentiment shift. This move comes after bulls retested and failed to break above the 0.6700 resistance level. Moreover, this sentiment shift can be seen in the RSI, which has crossed below 50 into bearish territory.

As a result, the price will likely retest the 0.6501 support level. If bears are ready to start a new downtrend, the decline will continue below the 0.6401 support level to make lower highs and lows.

More By This Author:

EUR/USD Price Analysis: Euro Firm Amid ECB’s Unclear Path

USD/CAD Forecast: Loonie Slips As BoC Rate Cut Looms

AUD/USD Price Analysis: Surges Despite Lackluster GDP Figures

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more