AUD/USD Weekly Forecast: Bearish Amid Strong US NFP And ISM

The AUD/USD weekly forecast is bearish as the US dollar rises after the economy showed resilience amid rising interest rates.

Ups And Downs Of AUD/USD

Last week there was a lot of important news from the US and Australia. Australian retail sales fell by the most in more than two years in December as consumer spending was finally slowed by sky-high inflation and rising borrowing costs.

From the US, there was the FOMC meeting, jobs data, and PMI data. After a year of larger rate increases, the US central bank reduced the rate increase to a quarter percentage point and ignored the vast list of factors, such as pandemics and war, that were pushing up prices.

January saw a strong acceleration in job creation in the United States, with nonfarm payrolls rising by 517,000, much exceeding the expectation of 185,000. The unemployment rate was at 3.4%, a more than 53-1/2-year low.

The US services industry’s activity experienced a significant resurgence in January, another indication of the economy’s health.

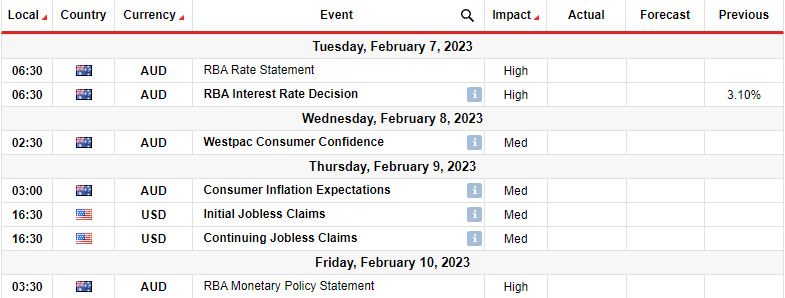

Next Week’s Key Events For AUD/USD

Investors will focus on the RBA meeting next week. As it struggles with an unexpected rise in inflation, the Reserve Bank of Australia will announce its fourth consecutive quarter-point interest rate increase on Tuesday and is likely to follow that up with a fifth in March.

AUD/USD Weekly Technical Forecast: Bears Confirm Takeover Below The 0.70 Key Level

The daily chart shows AUD/USD trading below the 22-SMA after the price broke below the 0.7001 key psychological level with a strong candle. The RSI has also crossed below the 50-level, shifting sentiment from bullish to bearish.

Bulls failed to push beyond the 0.7150 level, at which point bears took over. This takeover could be the beginning of a bearish trend. However, the price needs to start making lower lows and lower highs to confirm the reversal. This would mean retesting the 0.6805 and the 0.6603 support levels.

A new bearish trend would also see the price staying below the 22-SMA and the RSI below 50. A break back above the SMA would mean consolidation or a continuation of the bullish trend.

More By This Author:

USD/JPY Outlook: Tokyo’s Consumer Inflation Climbs To 42-Yr HighGBP/USD Weekly Forecast: Will BoE’s Hike Outshine The Fed’s?

AUD/USD Weekly Forecast: Australia’s Inflation to Rise in Q4