AUD/USD Price Forecast: Turns Sideways Around 0.6660 As Rally Hits Pause

Image Source: Unsplash

The AUD/USD pair turns sideways as the three-week rally hits a pause after posting a fresh three-month high at 0.6686 on Wednesday. During Friday’s early European trading hours, the Aussie pair trades calmly near 0.6660.

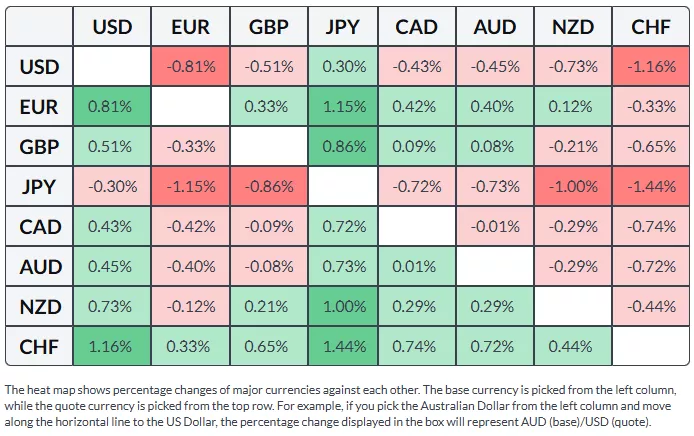

Australian Dollar Price This week

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies this week. Australian Dollar was the strongest against the Japanese Yen.

The pair struggles to extend its advance after the release of the unexpectedly weak Australian labor market data for November. The data released on Thursday showed that the economy shed 21.3K jobs in November, while it was expected to have added 20K fresh workers, raising concerns over the labor market strength.

Meanwhile, investors shift their focus to the United States (US) Nonfarm Payrolls (NFP) data for November, which will be released on Tuesday.

Investors will pay close attention to the US NFP data as its impact on market expectations for the Federal Reserve’s (Fed) monetary policy outlook is expected to be high. In the last three monetary policy meetings, the Fed has lowered interest rates by 100 basis points (bps) to 3.50%-3.75%, citing downside risks to employment.

As of writing, the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, trades with caution near its seven-week low of 98.13 posted on Thursday.

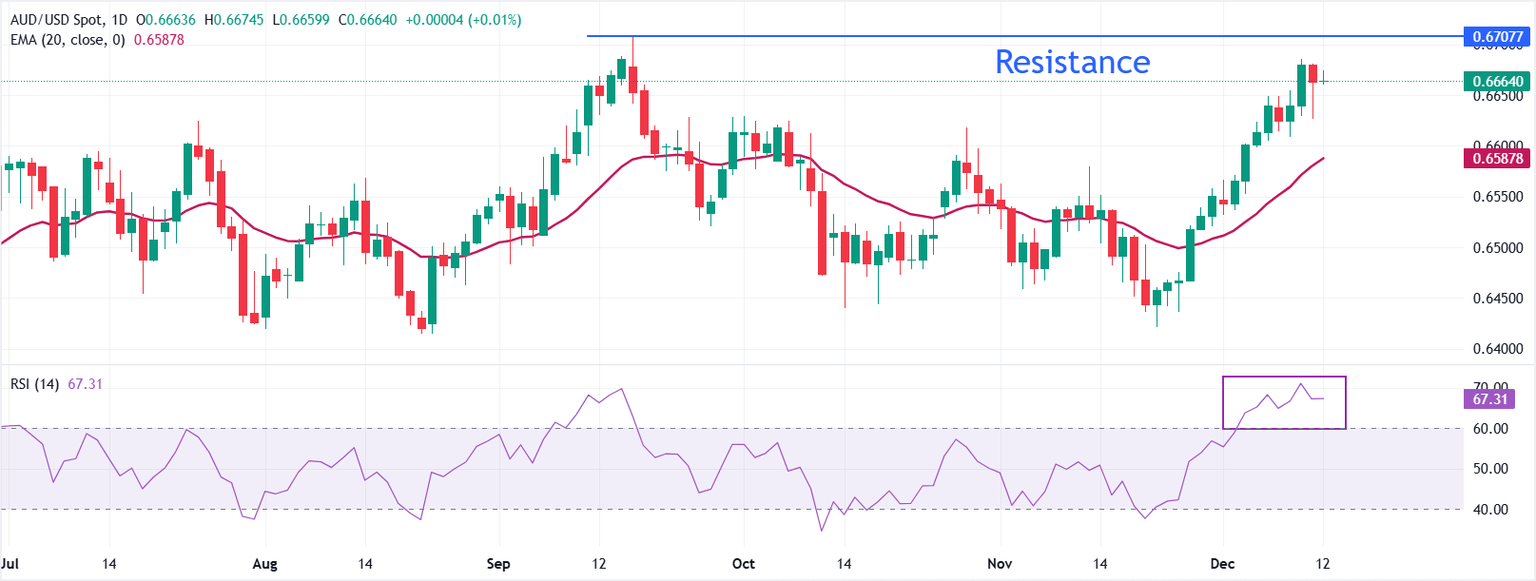

AUD/USD technical analysis

AUD/USD trades stably near 0.6660 in the early European session on Friday. The pair holds above a rising 20-Exponential Moving Average (EMA), now at 0.6588, which supports the bullish bias. The 20-day EMA has been ascending for several sessions and continues to guide the trend higher.

The 14-day Relative Strength Index (RSI) at 67 (bullish, near overbought) confirms firm momentum while edging toward a stretch where gains could slow.

With momentum elevated, bulls retain control, though the proximity to overbought conditions could temper follow-through and encourage consolidation. A pullback would be expected to find demand on approaches to the rising average, while a close below it would open room for a broader corrective phase towards the November 14 high of 0.6551; otherwise, the broader bias would remain upward as long as price action respects the trend proxy. Looking up, the advance could extend towards the September 17 high of 0.6707.

More By This Author:

Pound Sterling Holds Onto Fed-Related Gains Against US DollarXAG/USD Corrects From All-Time Highs To Near $62, Outlook Remains Firm

Pound Sterling Trades Higher Ahead Of BoE Bailey’s Speech, Fed Monetary Policy

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not ...

more