AUD/USD Price Analysis: Hurdled 200-DMA And Turned Bullish, Eyed 0.6600

Image Source: Pixabay

- The AUD/USD currency pair gained 0.34% on positive sentiment, defying the impact of the negative housing market report.

- The bias appeared to be neutral with an upside tilt. A breach of the 200-DMA at 0.6579 could target the 0.6600 and 0.6639 levels.

- Downside risks include the 200-DMA at 0.6579 and the Jan. 17 low of 0.6523 before testing the 0.6500 mark.

On Friday, the Australian dollar registered solid gains from the US dollar amidst an upbeat market mood following the release of an improvement in consumer sentiment and a negative housing market report. At the time of writing, the AUD/USD was seen exchanging hands at the 0.6373 mark, with gains of 0.34%.

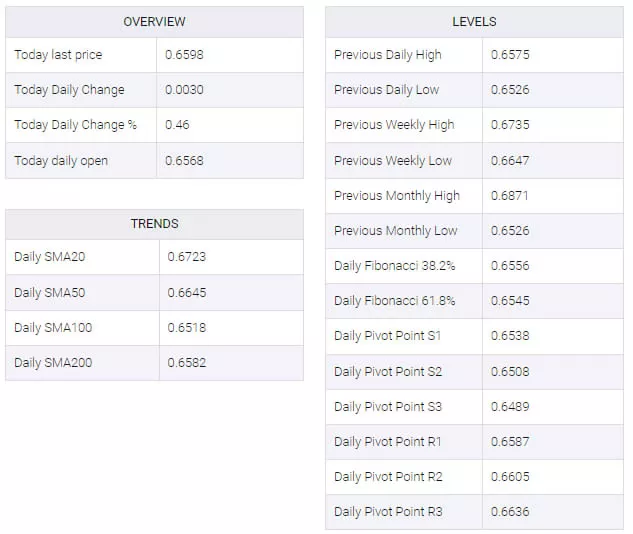

The daily chart portrays the pair with a neutral bias, though tilted to the upside, after breaking above the 200-day moving average (DMA) at 0.6579. Further upside can be seen at the 0.6600 level, followed by the 50-day moving average (DMA) at 0.6639. Once surpassed, the next stop would be the Jan. 12 cycle high at 0.6728.

For a bearish resumption, the AUD/USD currency pair's first line of support would be the 200-DMA at 0.6579, followed by the Jan. 17 daily low of 0.6523. A drop below that level could see sellers challenge the 0.6500 figure.

AUD/USD Price Action – Daily Chart

(Click on image to enlarge)

AUD/USD Technical Levels

More By This Author:

EUR/GBP Price Analysis: Bears Pause As Weak UK Retail Sales Lift The Pair

Oil Jumps With Ukraine Targeting Russian Oil Depots

Aud/usd Pares Losses And Returns To 0.6600 With US Dollar Strength Easing

Disclosure: Information on this article contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes ...

more