AUD/NZD Tumbles To Near 1.1430 As RBNZ Cuts OCR By 25 BPS To 2.25%, As Expected

Image Source: Unsplash

The AUD/NZD pair slides vertically to near 1.1430 during the Asian trading session on Wednesday. The pair faces intense selling pressure as the Reserve Bank of New Zealand (RBNZ) has cut its Official Cash Rate (OCR) by 25 basis points (bps) to 2.25%.

This is the third time in a row when the RBNZ has reduced its interest rates. The New Zealand (NZ) central bank was expected to cut its OCR by quarter-to-a-percent as employment conditions and economic growth have been consistently deteriorating.

In the third quarter of the year, the NZ Unemployment Rate rose to 5.3%, the highest since the same quarter of 2020. And, the Gross Domestic Product (GDP) was contracted by 0.9% in the second quarter.

On the other hand, the Australian Dollar (AUD) has been outperforming its peers as the Aussie’s Consumer Price Index (CPI) data for October has come in higher than projected. Earlier in the day, the Australian Bureau of Statistics (ABS) reported that inflationary pressures rose to 3.8% on an annualized basis. Economists expected the CPI data to come in higher at 3.6% from 3.5% in September.

Australian Dollar Price Today

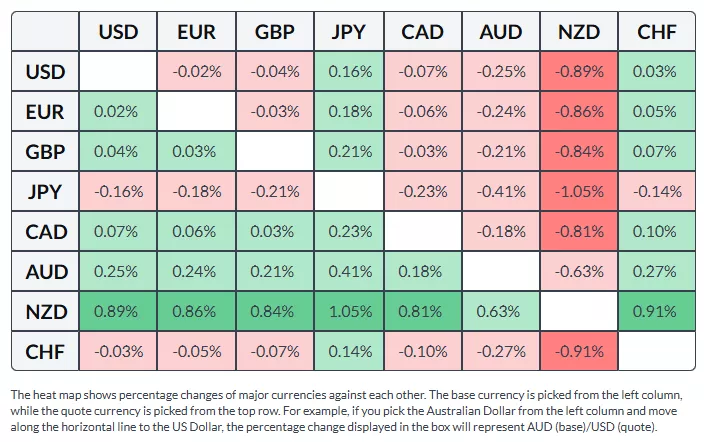

The table below shows the percentage change of the Australian Dollar (AUD) against the listed major currencies today. The Australian Dollar was the strongest against the Japanese Yen.

The scenario of price pressures accelerating is likely to undermine expectations of any interest rate cut by the Reserve Bank of Australia (RBA) in the near term. Earlier this month, the RBA kept its OCR steady at 3.6%, citing upside inflation risks.

More By This Author:

Pound Sterling Drops After Weak UK Retail Sales, PMI dataXAG/USD Revisits Weekly Low Near $49.50 As Fed Rate Hold Bets Remain Firm

Pound Sterling Rebounds Despite Accelerating BoE Dovish Bets