AUD/JPY Price Analysis: Surged To Six-Day High Amid Risk-On Sentiment

Image Source: Unsplash

- The AUD/JPY currency pair rose late in Friday's trading session, supported by a risk-on sentiment that was fueled by Wall Street's advance.

- Buyers appeared to be in control as the pair surpassed the 97.00 level, seemingly aiming for a daily close above 98.00 for further gains.

- Despite the ascent, pullback risks persisted. Sellers may have targeted levels below the 97.00 mark for bearish momentum.

The AUD/JPY currency pair edged higher late in Friday’s trading session, sponsored by a risk-on impulse that was fueled by the advance in Wall Street. Safe-haven peers appeared to be pressured while US Treasury yields retraced, which was a tailwind for riskier assets. At the time of writing, the AUD/JPY currency pair had exchanged hands at around 97.79, printing a new six-day high.

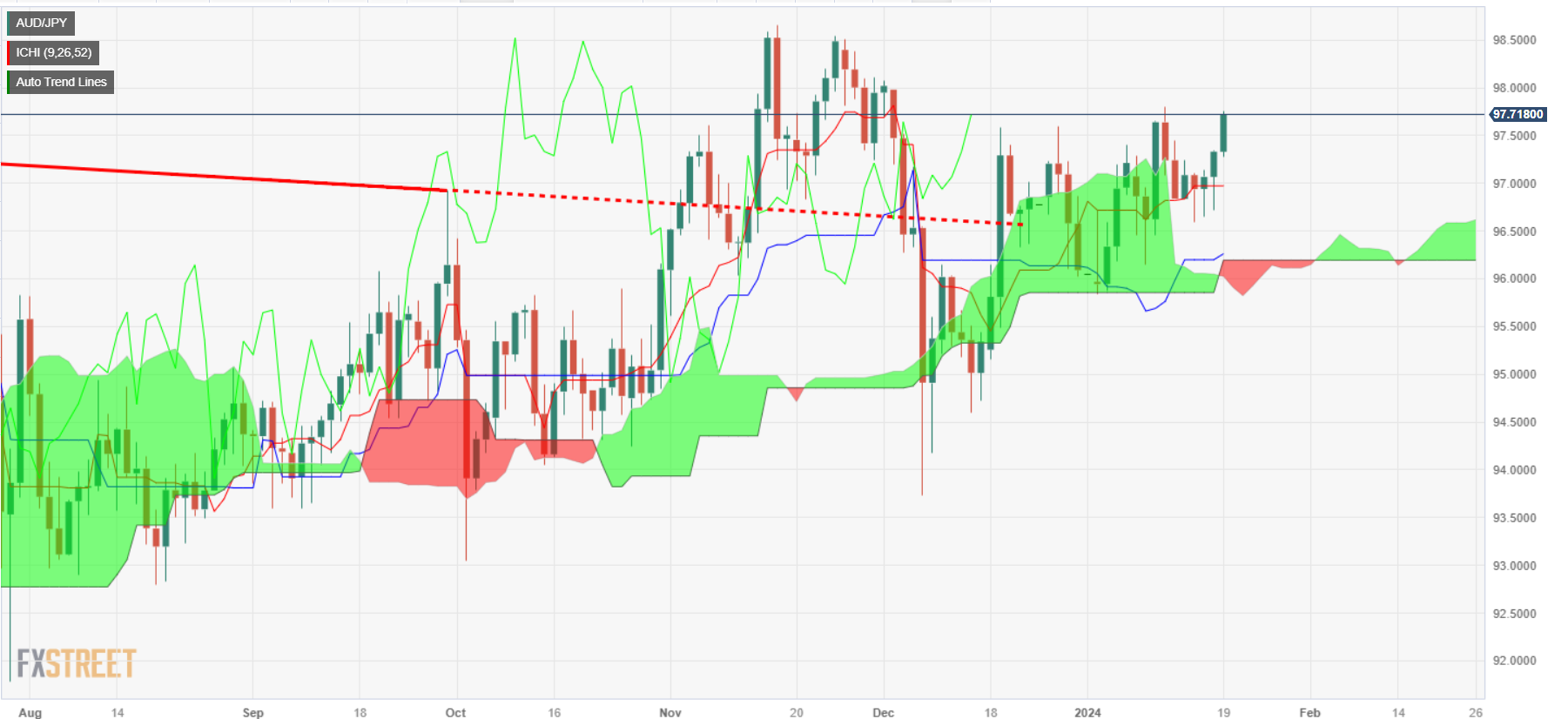

The pair began the week at around the lows, below the Tenkan-Sen formation, but the AUD/JPY exchange rate was already above the Ichimoku Cloud (Kumo), suggesting that buyers were in charge. Consequently, they reclaimed the 97.00 level and, on Friday, extended its gains.

Still, pullback risks remained, as buyers needed a daily close above the 98.00 figure to remain hopeful of testing last year’s high of 98.58. Once surpassed, the next stop would be the 99.00 figure.

For a bearish case, sellers would need to drive prices below the 97.00 mark, through the Tenkan Sen formation at the 96.97 level, and toward the Jan. 16 low of 96.58. A breach of the latter would expose the Kijun-Sen structure at the 96.18 figure, ahead of the Senkou Span B and A, each at the levels of 96.14 and 96.01, respectively.

AUD/JPY Price Action – Daily Chart

(Click on image to enlarge)

AUD/JPY Key Technical Levels

More By This Author:

AUD/USD Price Analysis: Hurdled 200-DMA And Turned Bullish, Eyed 0.6600EUR/GBP Price Analysis: Bears Pause As Weak UK Retail Sales Lift The Pair

Oil Jumps With Ukraine Targeting Russian Oil Depots

Disclosure: Information on this article contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes ...

more