Asia Week Ahead: Tokyo Inflation Takes Center Stage

Image Source: Unsplash

Tokyo inflation data may be the data point to watch in the coming week, as it could meaningfully influence the timing of the Bank of Japan’s next move. We also have Korean GDP data, Taiwan export orders and Singapore industrial production to look at. China will be relatively quiet following the recent data dump.

Japan: Tokyo CPI is the one to watch for BoJ timing clues

Flash PMIs and Tokyo CPI will be released in the coming week. Of these, the Tokyo consumer inflation release is the key data point to watch. We expect headline inflation to stay at 2.2% year-on-year but with a sharp rise in the monthly comparison. This release will be very important to gauge the Bank of Japan's rate hike timing. The manufacturing PMI is expected to improve further as temporary production disruption is ebbing, but the service PMI is likely to edge down while staying well above the neutral level.

South Korea: Consumer and business surveys

South Korea will release consumer and business surveys and third-quarter GDP data for this year. We expect GDP to rebound modestly (0.4% quarter-on-quarter seasonally adjusted) from the previous quarter’s contraction of -0.2%. Construction and consumption should weigh on overall growth, but the contraction should be smaller than in the previous quarter. Exports are likely to remain the main driver of growth. We think survey data will soften on the back of heightened uncertainty around the US economy.

Singapore: Inflation falling but core rates to remain sticky

Headline inflation in September should fall further in Singapore as lower gasoline prices weigh on the index. We expect the CPI index to rise by just 0.2% month-on-month, resulting in the first sub-2.0% inflation reading since March 2021. The core inflation rate is likely to be stickier. Tight labour markets and robust wage growth should keep service prices high and leave the core inflation rate roughly unchanged at 2.7% YoY.

Industrial production should follow the recent soft NODX numbers, and we expect the annual rate of growth to decline to 3.0% YoY, down from 6.7% in August following a 1% decline from the previous month.

Taiwan: Export orders and industrial production data

Taiwan publishes its export orders data on Monday afternoon. We expect export orders growth to remain stable from last month’s 9.1% YoY, forecasting a modest uptick to 10.9% YoY. Industrial production data is also set for release on Wednesday, where a very favourable base effect has led to YoY growth in the low to mid-teens since April. We look for growth to moderate slightly in September to 12.6% YoY from 13.4% YoY.

China: Quiet after data dump week

The week ahead is quiet for China in terms of data releases after the data dump this week. The loan prime rate will be announced on Monday but there should be no surprises, with a 20bp cut expected to match the cut to the 7-day reverse repo rate made in September.

The MLF decision is expected on Friday, and there should be no further change this month after a 30bp cut last month. Data aside, it is worth monitoring if there are potential further government ministry briefings or a potential announcement of the timing for the National People’s Congress meeting in the week ahead, as stimulus rollout remains a major theme for markets.

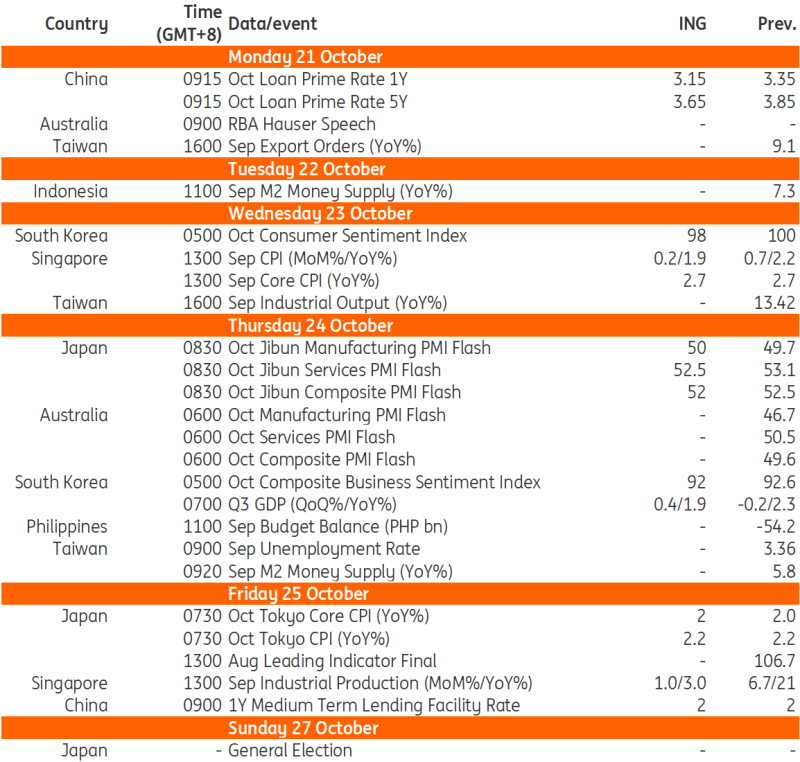

Key events in Asia next week

Source: Refinitiv, ING

More By This Author:

FX Daily: Dollar Momentum Continues To Build

Rates Spark: Markets Now Contemplating A 50bp December ECB Cut

Asia Morning Bites For Friday, Oct 18

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more