Asia Week Ahead: Regional Inflation Readings Plus Growth Figures From Korea

Inflation reports for Australia, Singapore and Japan will be the main focus of Asia's data calendar next week. Other key releases include Korea’s third-quarter GDP figures, where we could see a slight deceleration.

Australia CPI expected to remain unchanged

Australia’s September CPI release comes out a couple of weeks before the next Reserve Bank of Australia (RBA) rates meeting on 7 November. The good news is that we think there is a chance that the headline inflation rate could manage not to rise again in September. The bad news is that we think it may stay at 5.2% year-on-year, unchanged after it rose in August.

Is this enough to keep the RBA on hold? The last minutes suggested the RBA had quite a low tolerance for inflation to remain above their target, so “failure to make satisfactory progress” might be considered a sufficient condition for a further hike. The alternative is to wait one more month. While the base effects aren’t much better in October, then at least you wouldn’t be facing possible pressure to hike twice. If the RBA does hold rates unchanged at both meetings – which isn't our base case, as we think they will hike at one of them – then we see the chances of them hiking in the New Year (as the market is pricing in) as very low. Very high inflation spikes at the end of 2022 mean the inflation rate should be dropping sharply again as reported in early 2024.

Singapore inflation could tick higher

Inflation for September could inch higher after global energy prices increased due to developments related to OPEC supply. Meanwhile, anxiety over the US Federal Reserve keeping “rates higher for longer” also forced Asian currencies to wilt under the strength of the dollar, with headline inflation possibly creeping up to 4.1% YoY from 4% previously. Core inflation could still be on the downtrend, slipping to 3.2% YoY from 3.4%.

Japan inflation expected to ease

Tokyo’s CPI inflation is expected to slow mainly due to base effects. Headline inflation could come down to 2.6% YoY in October (vs 2.8% in September, 2.7% market consensus). However, a monthly comparison would show that the recent pick-up in global commodity prices and the weaker yen could add more upside pressure.

Singapore industrial production likely still in the red

Industrial production could post another month of contraction, tracking the struggles of the export sector. Industrial production could slide 7.3% YoY but still higher by 8% compared to the previous month. We should see an eventual improvement in the coming months should NODX improve, but as of now, we expect the industrial sector to be subdued.

Possible deceleration in Korea GDP growth

Korea’s third-quarter GDP is expected to decelerate to 0.4% quarter-on-quarter seasonally adjusted from the previous quarter’s 0.6%, with a continued drag from domestic demand. We believe investment contraction could persist, although private consumption is likely to improve, boosted by longer holidays than usual and various government programs. However, customs trade data suggests the positive net export contribution could be narrower than in the previous period. Lastly, both business and consumer surveys are likely to slide further with heightened financial stresses and geopolitical tensions, suggesting another weak growth for the current quarter.

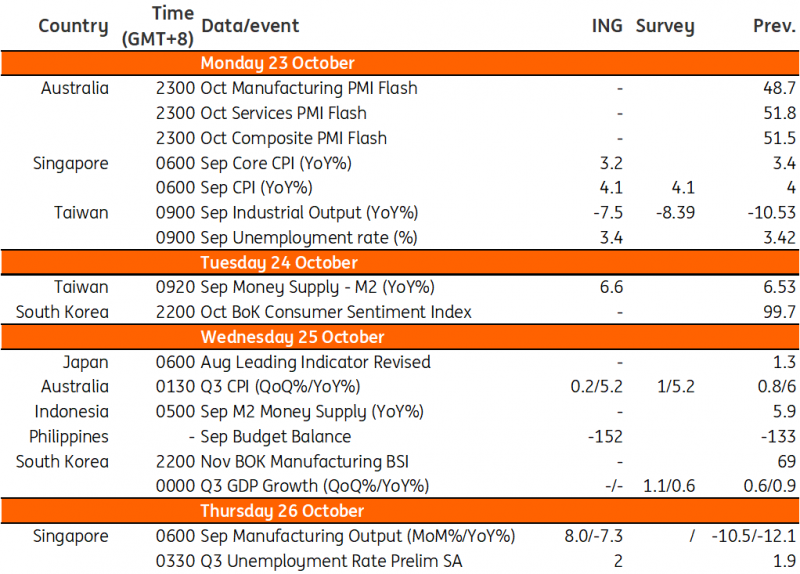

Key events in Asia next week

Refinitiv, ING

More By This Author:

Business Sentiment Darkens In France, Signaling A General Loss Of Economic DynamismLittle Change In Poland’s Employment Numbers But Wages Remain High

FX Daily: Defensive Positions Advised

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more