Asia Week Ahead: Regional Inflation Numbers And A Bank Indonesia Decision

Image Source: Pixabay

A quieter data calendar in Asia next week will feature inflation numbers from both Japan and Singapore while Bank Indonesia meets to decide on policy rates. The People’s Bank of China will release its benchmark lending rates.

China Loan Prime Rates

The People’s Bank of China will release its benchmark lending rates, the five-year and one-year loan prime rate. We are expecting it to follow the medium-term lending facility (MLF) rate to stay put.

Activity data released in the past few months have shown modest improvement in China’s recovery, which together with concern about the weakness of the CNY, means that rate cuts will probably be avoided for now.

Taiwan’s export orders and industrial production

Taiwan will release its export orders and industrial production numbers next week. Global semiconductor demand is slowly picking up, and we expect the decline in orders to further moderate to -4.8% year-on-year.

Industrial production is likely to follow suit and grow by -6.4% YoY. Exports have grown for three consecutive months since June – but the numbers are still negative, which is largely due to base effects.

Bank Indonesia expected to pause

Bank Indonesia (BI) is expected to hold rates steady at 6% next week. A better-than-expected trade report coupled with the rebound of IDR suggests that there is little pressure on the central bank to hike rates, so they should remain unchanged in the central bank's upcoming meeting.

Japan Inflation

Next week, Japan’s October CPI inflation will be out. We expect headline inflation to reaccelerate to 3.3% YoY in October (vs 3.0% in September). Prices of fresh food and energy will be the main drivers, but prices of other services are also expected to rise, reflecting the accumulated input price upward pressure.

Core inflation (excluding fresh food and energy) will likely stay above the 4.0% level, which is likely to shift the Bank of Japan's policy stance more towards the neutral from the ultra-easing bias.

Singapore inflation edging higher

Singapore headline inflation could inch up slightly to 4.2% YoY from the previous month’s reading of 4.1%. Compared to the previous month, prices might actually dip slightly by 0.2% month-on-month. Meanwhile, core inflation – the preferred measure of the Monetary Authority of Singapore – could be steady at 3%.

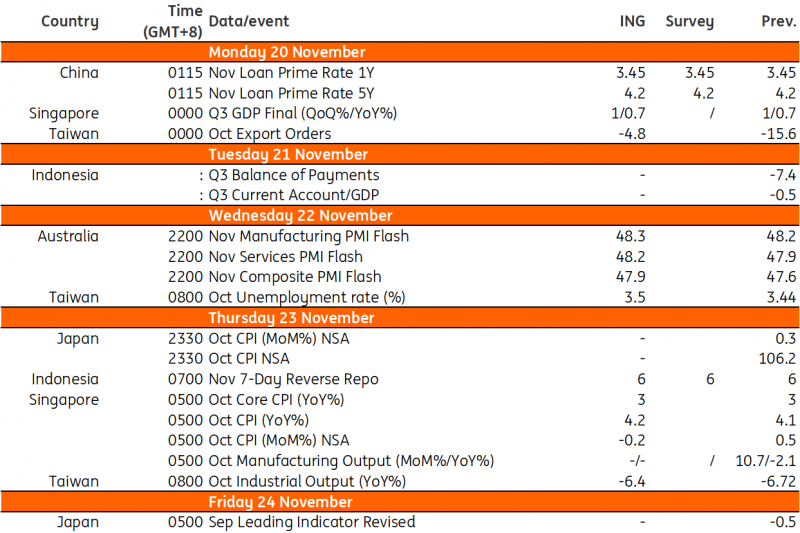

Key events in Asia next week

Image Source: Refinitiv, ING

More By This Author:

After Off-Cycle Move, Philippines Central Bank Keeps Rates UnchangedFX Daily: Government Shutdown Averted

Asia Morning Bites For Thursday, November 16

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more